Why DeFi Matters: Making Financial Services More Accessible

Disclaimer: The text below is a press release that was not written by Cryptonews.com.

Earlier this year, a new “hot” word appeared, and the crypto space has witnessed an incredible hype around DeFi projects, which has drawn a lot of attention to decentralized finance and brought in a lot of new users. This situation allowed the crypto community to discover the benefits of Defi, but also its drawbacks and limitations.

In this article, we will review in detail why decentralized finance will revolutionize the world of finance as we know it, what are its advantages, limitations and the solutions that can help the Defi space to overcome these obstacles. But before that, let’s find out what exactly decentralized finance is.

What Is DeFi?

“DeFi” stands for Decentralized Finance, it’s a niche that gathers all financial dApps (decentralized applications) that are built on top of existing blockchains. In contrast to what one might think, the concept is not new. Indeed, some projects like Fusion have been working on providing decentralized finance applications and services for a few years now, long before the appearance of the word “DeFi”.

The DeFi space aims to create an ecosystem that gathers multiple decentralized networks and open-source applications that offer various financial services and products. Through the use of blockchain’s smart contracts, it offers cheaper, less complex, and more secure financial services.

DeFi vs Traditional Finance: Why is Defi the Future of Global Finance?

DeFi is still in its early days, a lot of the services that are currently available aren’t as secure and decentralized as we expect them to be. However, there are already some quality products that are truly decentralized such as Anyswap and Uniswap. They can provide us an overview of the opportunities that DeFi brings to the table, and why it will be way more accessible than traditional finance.

Currently, more than $11 Billion in assets are locked up in DeFi, and it is increasingly growing everyday with the release of new DeFi services and products. Also, more institutional investors and traditional finance actors are trying to catch the decentralization train in its early days bringing more money and attention to DeFi. To better understand all this hype around decentralized finance, you’ll find below the main reasons why DeFi will change the global finance as we know it:

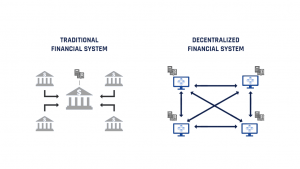

- No Intermediaries: Traditional finance relies on intermediaries such as banks and courts. On the other hand, DeFi applications do not require any intermediaries or third party intervention. Users are the bank here, and they remain in control of their assets, while smart contracts replace courts and resolve any potential disputes. This decentralization removes the limits applied by legacy finance, since Defi services and protocols are borderless and do not require KYC from their customers.

- More accessible: Another major advantage of DeFi is that it is more accessible. The traditional financial system cannot be easily accessed by people from low income regions all over the world, a lot of them are unbanked and have no access to any financial service. However, decentralized finance is cheaper and accessible anytime and anywhere, as long as the user has internet access.

- More secure: Decentralized finance services are built on top of blockchains. This means that data is recorded on the blockchain and spread across a large number of nodes, this makes it very complicated for any individual or group to attack and harm the system, in contrast to the majority of traditional financial services that have single points of failure, therefore being more vulnerable.

- Open-source and permissionless: DeFi ecosystem is open-source and permissionless, which accelerates the development of the ecosystem, since dApps and products can work together on improving the services they provide. Decentralized applications can integrate any new feature introduced by another dApp without having to ask permission.

For all these reasons, decentralized finance will continue to attract more actors whether they are individual users or businesses, and have more real-world use cases and applications. However, the truth must be told, we are not there yet! Indeed, the DeFi space is currently facing many challenges, and it needs maturation to overcome these limitations and reach its true mission.

DeFi Use Cases

DeFi can potentially offer any service or product that legacy finance offers. You name it, DeFi can create it and make it fully decentralized and easily accessible. This is the main reason behind the huge excitement among the crypto community, users have realized that they are the pioneers of something that could change our world forever.

Here are the main use cases of DeFi:

- Lending & Borrowing: Decentralized applications that offer lending and borrowing services are among the most popular DeFi tools. Using public blockchains for this kind of dApps offers many advantages compared to traditional services, these advantages include the ability to use digital assets as collaterals, P2P lending, lower counterparty risk, cheaper and faster transactions, easy access, etc.

- Decentralized Exchanges (DEX) and Swap Protocols: These innovative tools allow users to exchange their assets without needing any centralized intermediary to hold their assets. There are many examples of successful products in the market such as Uniswap which has a daily volume that competes with centralized exchanges, and Anyswap which is the first ever cross-chain decentralized exchange.

- Insurance: There are many products that contribute to remove the involvement of intermediaries, and help mitigate risk and distribute it between different participants. This DeFi version of insurance can be applied to personal wallets, pools and even lending and staking smart contracts. This feature reduces costs in a significant way compared to traditional insurance agencies.

Now, let’s take a closer look at the challenges and limitations that DeFi is facing and that must be resolved in order to be potentially adopted at a global scale.

Challenges and Limitations of Current DeFi Ecosystem

1. New and Experimental

Despite the large number of services and products available currently, the DeFi space is still new, immature and risky. The industry is not yet secure enough to attract large companies and businesses. For example, Ren protocol is a project that is widely trusted by the crypto community, despite the fact that it is holding around $300 million in RenBtc in a centralized wallet.

Whereas at the same time, there are other quality projects that deserve more attention. The best example would be Anyswap, a swap protocol built on Fusion blockchain that supports decentralized Bitcoin storage, it allows users to send wrapped bitcoins back and forth between Fusion, Binance Smart chain and Ethereum blockchains, while all other wrapped bitcoins on the market can only be locked on Ethereum network.

Another interesting example is Yield farming. The concept consists of locking digital assets in different protocols such as compound, generating very attractive and high interests. This scheme remains experimental and highly risky, especially if “whales” get involved in such DeFi protocols.

2. Scalability and Interoperability

The majority of DeFi products and services are built on Ethereum blockchain. This blockchain supports the use of smart contracts and it is the most used and adopted blockchain by the crypto community. However, Ethereum is facing some serious congestion and scalability issues making it impossible for the DeFi space to scale and be used at a larger scale. The more the network is used, the higher network fees are, and transactions take longer to process. It is clearly inevitable that decentralized finance must involve more convenient blockchains such as Fusion in order to be usable at a larger scale.

How Will DeFi Overcome These Limitations? Fusion Blockchain as The Ultimate Solution

In order to scale and to be able to compete with legacy finance, the DeFi industry must overcome the limitations and issues mentioned above. Ethereum needs the support of other blockchains to create an interoperable network where every blockchain can participate and contribute to the development of the ecosystem through its specific features.

Fusion blockchain aims to create an ecosystem where all isolated blockchains can interoperate with each other, and allow this big DeFi ecosystem to communicate with traditional financial tools.

Similarly to Ethereum, Fusion is a smart-contracts platform where developers can build various dApps and DeFi products. What sets Fusion apart is that it offers features that are specific to decentralized finance, such as the DCRM technology, the time-lock function, and many other DeFi-oriented features.

The DCRM technology is a trustless and decentralized interoperability protocol created by Fusion foundation with the help of some of the best cryptographers in the world. It allows the integration of any blockchain to Fusion’s ecosystem. By using DCRM, assets can move from a blockchain to another in a fully decentralized way. In contrast to the current situation where the majority of DeFi assets are locked in Ethereum, DCRM will open the door to lock assets in different blockchains, thereby decentralizing the DeFi industry from Ethereum, and allowing users to benefit from the advantages offered by other blockchains.

To better understand what this technology is offering, imagine using all DeFi services and products while avoiding Ethereum scalability and high fees issues by using a more scalable blockchain like Fusion with thousands times lower network fees. This is all possible thanks to DCRM that combines the benefits of different blockchains.

The time-lock function is another major DeFi technology introduced by Fusion. This function is based around the “time value of an asset”, the ownership of this asset can be split into defined periods. The concept of time-lock can be used for any financial transaction that involves time such as loans, derivatives, leasing, lending, mortgages, etc.

In addition to DCRM and time-lock functions, many other DeFi-friendly features are supported by Fusion such as quantum swaps and USAN support (short addresses similar to bank addresses).

To allow users to benefit from all these DeFi features, Fusion launched two innovative platforms:

WeDeFi is a user-friendly universal wallet that is available on Android and iOS. Users can store and manage their assets while remaining in full control of their funds. WeDeFi offers a no-loss lottery and a borrowing program that leverages Fusion’s time-lock function.

Anyswap:

nyswap is another project built on top of Fusion blockchain. It is the first ever decentralized cross-chain swap protocol, it supports automated pricing and liquidity systems. Anyswap leverages Fusion’s DCRM technology to allow users to swap between coins and tokens from different blockchains, such as ANY (Anyswap’s governance token), FSN, BTC, ETH, ERC-20 tokens and many other coins. Also, Anyswap launched its version on Binance Smart Chain, with future plans on launching another version on Ethereum. Users will therefore be able to move assets between the three blockchains and carry out on-chain transactions.

As you can see below, Anyswap offers one of the highest interest rates in the whole crypto market combining trading fees and ANY token rewards:

These two platforms (WeDeFi and Anyswap) are excellent examples of how the DeFi space should be. Fusion intends to expand to other blockchains by using its unique DeFi features. The main objective here is to let different blockchains communicate with each other and exchange data and assets in a fully decentralized, trustless, and permissionless way.

Final Thoughts

As you can see, Fusion is a blockchain that deeply understands the vision of the decentralized finance industry which relies on the cooperation between different DeFi projects in order to create a decentralized and user-friendly financial ecosystem. Fusion’s purpose is not to replace Ethereum or any other project, but to help DeFi actors to connect together and share each other’s features and benefits.

DeFi will soon or later have more real-world impact and use cases and it will capture a more important portion of traditional finance value. However, before we get there, the industry needs more proven and reliable products in order to incentivize traditional actors to immigrate into DeFi. Also, blockchains need to work together and combine their features and characteristics in order to create a scalable ecosystem that could compete with current centralized systems. Fusion has already positioned itself to be the project that could potentially lead DeFi into its true mission and overcome DeFi scalability and interoperability issues.

{no_ads}

Disclaimer: The text above is an advertorial article that is not part of Cryptonews.com editorial content.