What Makes Investors the Victim of the Feud Between Binance and FTX?

Disclaimer: The text below is an advertorial article that is not part of Cryptonews.com editorial content.

The feud between FTX and Binance, two top crypto exchanges, has captured the crypto spotlight. Since CoinDesk published an article titled Divisions in Sam Bankman-Fried’s Crypto Empire Blur on His Trading Titan Alameda’s Balance Sheet, FTT holders and FTX investors have spent the past few days in fear. Meanwhile, everyone in the crypto community is asking if FTX will be the next Luna or Three Arrows Capital.

What happened to FTX?

According to the CoinDesk report, the balance sheet of Alameda Research, a crypto trading company owned by FTX founder SBF, contains a large amount of FTT and SOL, the former of which is the native token of FTX, while Solana is a key investment project of SBF. In other words, most of Alameda’s holdings are assets closely related to SBF. When the primary net assets of a company are issued by another company set up by the former’s founder, the actual worth of its assets becomes questionable. After all, it sounds like the founder is just trying to get something for nothing by manipulating the market.

Since the report came out, many crypto investors worry that Alameda might become insolvent, just like Three Arrows Capital and Celsius did, thereby slashing the FTT price and jeopardizing their assets stored at FTX.

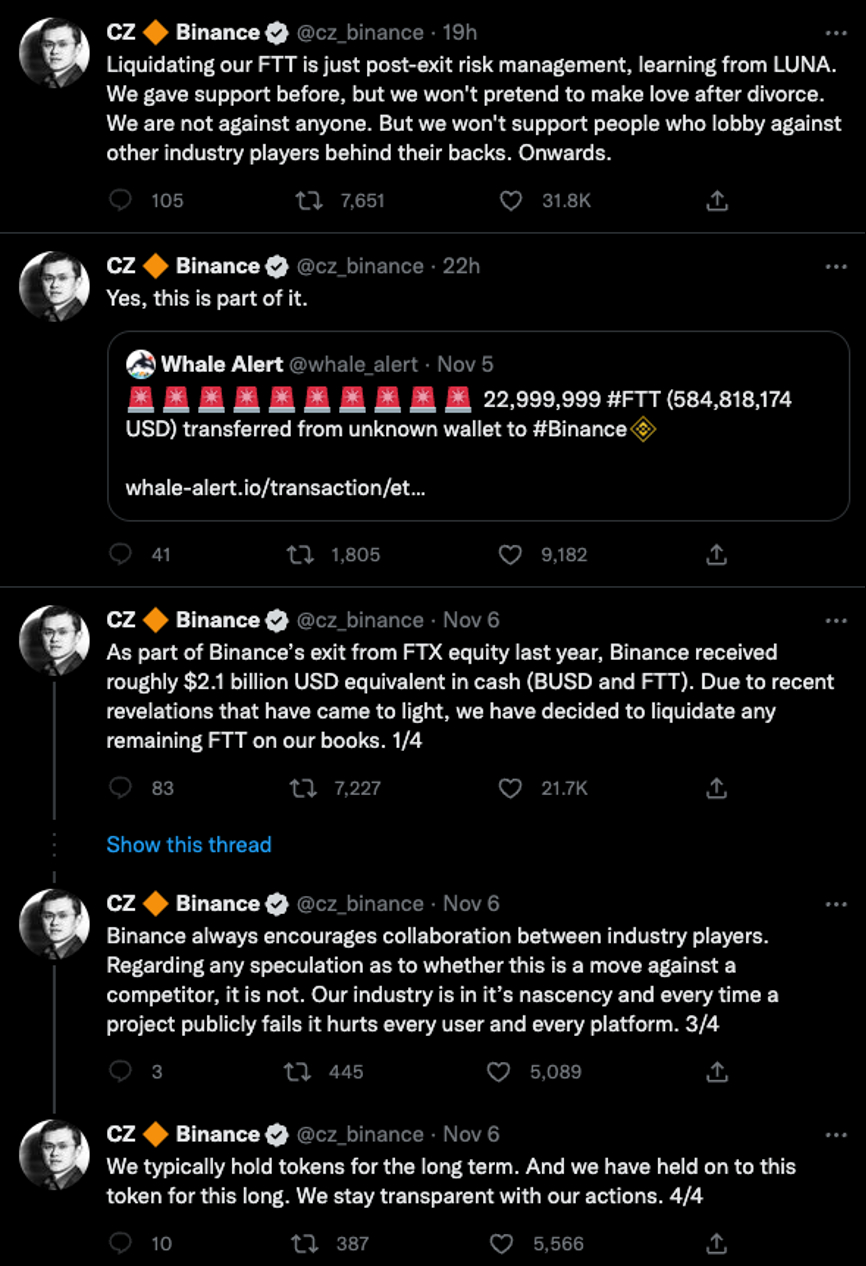

Adding fuel to the fire, Binance founder CZ posted a series of tweets targeting FTT, saying that Binance decided to liquidate the remaining FTT on its books that the exchange received as part of Binance’s exit from FTX equity last year due to recent revelations. Liquidating FTT is a way to mitigate risks that Binance learned from the LUNA meltdown, he added.

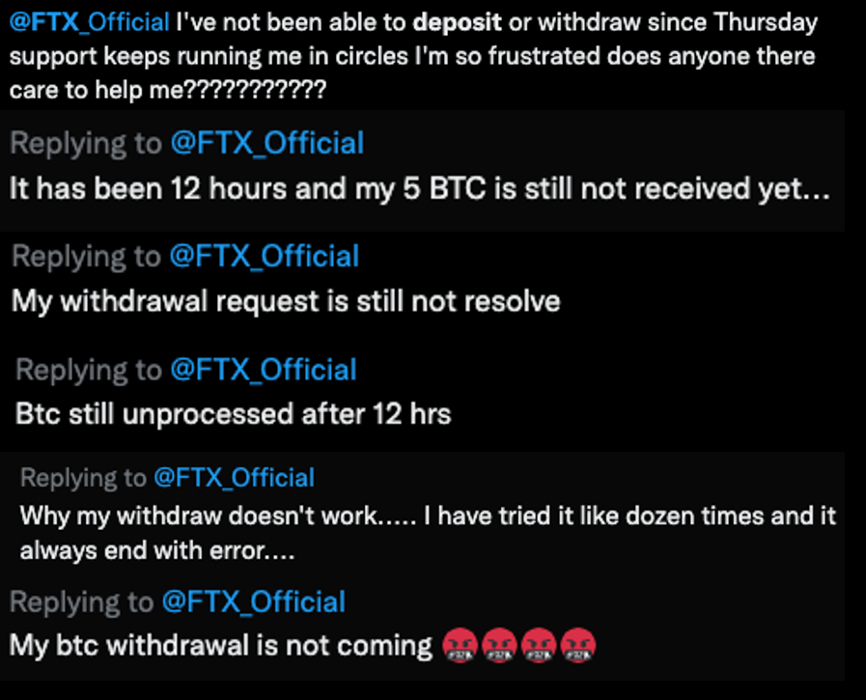

Binance has a massive FTT holding that is worth hundreds of millions of dollars. When it decides to dump its FTT holding, the market will become volatile. Additionally, the LUNA meltdown mentioned by CZ made FTX users panic even more. To mitigate possible risks, FTX users started to withdraw their cryptos. Meanwhile, many of them tweeted that their withdrawals failed to arrive as scheduled. It seems that no one in the crypto market still trusts FTX.

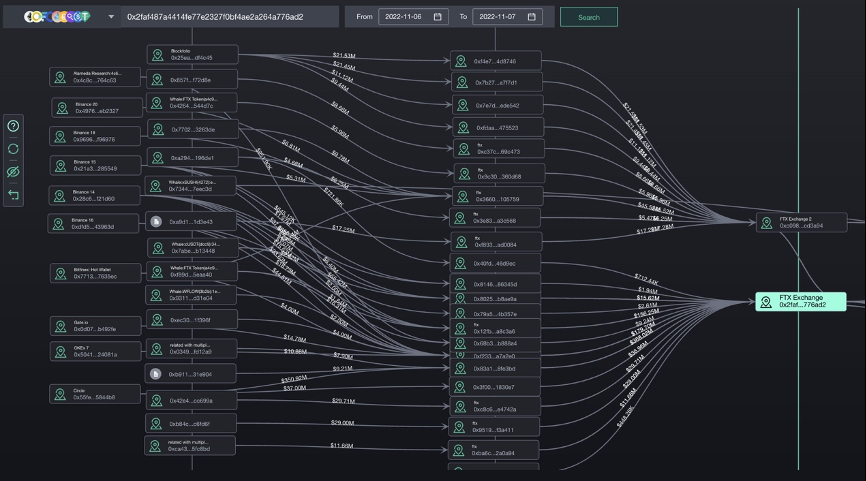

At the same time, according to on-chain statistics, FTX is transferring funds from other platforms to hot wallets, trying to solve the withdrawal problem.

What led to the withdrawal crisis?

Although both SBF and FTX kept tweeting that they’ve got enough funds to cover users’ holdings, the series of incidents triggered a crisis of trust. From delayed crypto withdrawals through insufficient asset holding in official hot wallets to transferring funds from other platforms, users are led to believe that FTX must have used their assets to earn profits on other platforms.

Some users still believe that the crisis is simply caused by the run on FTX due to the Twitter feud started by CZ. Despite that, in reality, if FTX did not misuse users’ assets and managed to promptly respond to each withdrawal request, the crisis of trust wouldn’t break out in the first place.

Throughout the crypto history, many exchanges went bust due to delayed withdrawals. Just recently, such incidents happened on Poolin. The mining pool claimed the delay was caused by liquidity problems but ultimately had to issue IOU (I-Owe-You) tokens with uncertain due dates, which is a lousy tactic that’s self-deceiving. In addition to Poolin, crypto trading platform Hoo also suspended its withdrawal function due to cash flow problems and launched a similar debt-to-token conversion plan. Both platforms failed to respond to withdrawal requests because they had used users’ assets for making investments, and the losses they suffered due to the LUNA meltdown meant that neither platform could fill in the gap, resulting in delayed/suspended withdrawals.

Apart from Poolin and Hoo, many other crypto companies, including Three Arrows Capital, Celsius, and BlockFi, went under because they diverted the assets of their users and investors to other purposes. Once extreme market volatility hits, such companies will face liquidation and dump their assets, and when they find that the gap is too large to fill, the only victims will be investors who struggle to withdraw their cryptos.

Are liquidity issues really justified in the crypto industry?

People biased against crypto often criticize the industry for scandals like liquidity crises, although such incidents are common in traditional finance, say, the bankruptcy of Lehman Brothers in 2008. Yet the fact that something happens does not mean it is justified. In the crypto space, liquidity crises would never happen if platforms didn’t misuse the asset of their users, and such crises could have been solved in an open, transparent manner. People foraying into the crypto space are all spitting on the deceit and the lack of transparency in traditional finance, but the crypto industry also suffers from the same issue in the form of liquidity crises.

Fortunately, not all crypto practitioners have put behind their original motivations. For example, CoinEx, a crypto exchange committed to eliminating the restraints of traditional finance, still sticks to respecting its users. Aiming to stay open and transparent, the exchange never misuses users’ assets and promises to process all withdrawals in time, safeguarding the bottom line of crypto trading platforms.

Although platforms might not worry about the speed of deposits and withdrawals, for investors, each second matters to crypto trading. This year, when Binance’s OP went live, it took users more than 12 hours to receive their deposits. As a result, many of them missed out on the best timing and had to watch the price drop. On CoinEx, by contrast, users can quickly deposit and withdraw their cryptos, thus having their rights and interests safeguarded all the time.

Crypto remains a nascent industry, and many problems await solutions. That said, platforms that misused users’ assets and created high leverage have all been punished and phased out. History tells us that any effort to get away with cheating users will eventually go in vain, and good money will drive out bad. Only responsible platforms like CoinEx that acts in the best interest of retail investors will gain a large user base.