US Edging Ahead of China and Europe in this Crypto Sector

While the United States might be losing ground to China in the blockchain technology race, and has slightly fewer players in the security token ecosystem than Europe, the world’s largest economy still dominates in a several security token-related areas, per the findings of a new study.

Switzerland-based security token platform BlockState says it has cooperated with the Frankfurt School Blockchain Center think tank on a report entitled “The Global Digital Securities Ecosystem: A comprehensive study of the market.”

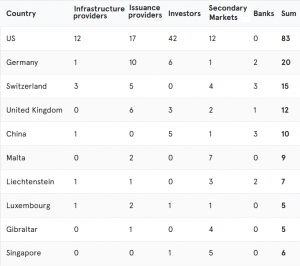

Per the report’s authors, the global security token ecosystem (213 players were identified in total) now has two centers of gravity – one in Europe, and one in the United States.

But Europe has a slight edge, with 88 industries in the sector. Although the United States has slightly fewer industry players (83), it has substantially more investors in the ecosystem (61%).

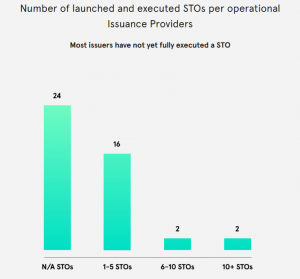

Also, the U.S. leads in the security token offering (STO) category, based on volume raised, number of STOs and number of issuance providers. Europe is closing in but still has a long way to catch up, according to the researchers. As reported, the Bank of Lithuania sees an increased interest in STOs and estimates that this new form of raising capital will become more popular.

Top 10 countries by players in the security token ecosystem

__

From an investment standpoint, the report claims that 71% of companies investing in securities token-related companies are “traditional” investors, a fact that signifies “a big interest and some validation from the ‘old’ economy in the new technology.”

The authors also note that the market “is still highly fragmented,” adding that only five of 69 investors have more than one security token related company in their portfolio.

Technology-wise, while the STO ecosystem has long relied on Ethereum, now the market is diversifying with new players emerging, particularly to offer private blockchain solutions, according to the researchers.

“Infrastructure providers predominantly choose modified versions of Proof-of-Stake as their verification algorithm, leaving the most commonly employed Proof-of-Work algorithm behind,” they added.

Perhaps worryingly for some in the United States, the authors conclude that the pace of regulatory approval will play a key role in the industry’s expansion prospects. In recent months, a wide range of blockchain companies have fallen afoul of regulators in America – with old and somewhat restrictive laws applied to a range of innovative fintech technologies.

In either case, new security token projects are still being announced. For example, on Wednesday, tZERO, Overstock’s blockchain subsidiary, said it will help tokenize at least USD 25 million of the value of Alliance Investments’ River Plaza, a 180-unit luxury residential development that is located in Manchester, UK.