Top 8 Liquidity Staking Programs You Should Keep An Eye Out For [Updated March 2022]

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

Liquidity staking is a very powerful opportunity in decentralized finance. Rather than traditional staking, users can retain liquidity and explore additional revenue-generating opportunities. Finding the right program that suits your needs is key, and exploring multiple revenue streams through one provider can unlock tremendous returns.

What Is Liquid Staking?

Unlike the traditional concept of staking crypto assets for a certain period, liquid staking provides a welcome change. Locking crypto assets for a specific period prevents users from trading or selling them until that period ends. Liquid staking offers a liquid asset for users who contribute liquidity to the protocol, allowing them to explore other opportunities in the DeFi space.

Another benefit of liquid staking is how it bypasses any unstaking guidelines. Traditional staking lets users unstake before the period ends but forces them to pay the penalty. Moreover, it can take days or weeks for users to receive their initial deposit back. A liquid stake can be converted back to the original deposit at any time and often without any fees.

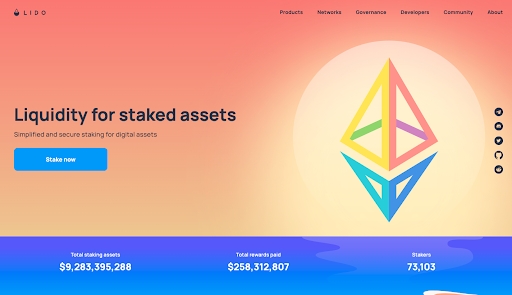

Lido (Ethereum, Terra, Solana)

The Lido ecosystem has gained tremendous momentum since its introduction of ETH 2.0 staking. Although Ethereum is not a proof-of-stake network yet, users can pre-stake their Ether to earn rewards. Lido provides these services and controls nearly USD 6 billion in staked Ether. Users earn an APR of 4.6%, but that is not the essential part.

Users receive liquid assets based on their stake when staking Ether, Terra, or Solana through Lido. The liquid assets can be used across other decentralized protocols and projects, giving users extra options to generate revenue. Current Lido APY for Terra (9.5%) and Solana (5.9%) are equally appealing.

Tempus (Yield-bearing Tokens)

The approach by Tempus is a bit different. Although it is a liquid staking provider, the team primarily aims to help users achieve a decentralized fixed income. The protocol supports yield-bearing tokens, such as stETH, cDAI, aDai, xSushi, and other assets on the Ethereum blockchain. By locking in these tokens, users can fix their future yield. Additionally, the platform enables speculating on the rate of future yield of supported tokens and liquidity provision to earn additional swap fees.

Moreover, Tempus does not charge protocol fees. However, users will pay a swap fee – distributed to liquidity providers – and the gas fee mandatory to use the Ethereum network. Tempus has integrated with Lido, Aave Compound, Yearn.Finance and Rari, and will support future integrations to unlock more liquidity.

Hubble (Solana, BTC, ETH, other assets)

Hubble is a new liquidity staking platform that introduces additional revenue opportunities for its users. Users will automatically earn a yield on their collateral by contributing liquidity – either in “vanilla” assets or yield-bearing formats, like mSOL or pSOL. Vanilla assets are delegated to partner lending platforms. Once the collateral is deposited, users can take out a loan of USDH, the native stablecoin of the Hubble protocol.

The USDH stablecoin can be sued across other DeFi protocols to earn yield or deposited into Hubble’s Stability Pool. That latter option earns users the near 10% difference from liquidated accounts and HBB rewards. Additionally, users can stake HBB for extra rewards and use it as the native governance asset as an extra revenue opportunity.

Marinade (Solana)

The Marinade protocol on Solana helps users stake SOL and benefit from liquid staking. In return for their deposit, suers receive mSOL, which increases in value relative to SOL every epoch. Additionally, mSOL can be used across multiple decentralized finance protocols on the Solana blockchain.

Moreover, Marina removes the need to deal with an unstaking period. Instead, users can delegate their SOL to over 400 top validators, helping to make the Solana ecosystem more robust and decentralized. As a result, the platform has over USD 807 million SOL in Total Value Locked today.

Meta Pool (NEAR)

The Meta Pool DeFi protocol offers liquid staking for NEAR holders at a projected 10% APY. Staking NEAR through Meta Pool helps avoid the unstaking period of up to 65 hours and awards users with stNEAR. Moreover, the protocol offers broader decentralziation of the Near protocol by delegated stakes to low-fee high-performance validators.

Similar to liquid stake assets on other networks, stNEAR can be used on other decentralized finance protocols. Any yield earned through stNEAR is for the user to keep, all the while generating the standard NEAR staking rewards. All income is compounded automatically into the staked NEAR token.

Revault (Powered by Orbs L3)

Vault aggregating DeFi protocol Revault is enhancing its auto-rebalancing feature. Protocol users can commit assets to vaults providing a high APY with the help of Revault. Moreover, the protocol continually searches for more lucrative vaults, notifying users of new opportunities. Moreover, the integration of Orbs’ Layer-3 technology ensures users can rebalance their position to the better vault through an automated process.

With the help of Orbs, Revault will scan the market for best-performing vaults and rotate user funds to maximize everyone’s APY. It is a different take on the liquid staking aspect, although it provides more flexibility than swapping vaults or unstaking and restaking assets manually. Automating the liquidity of asset staking to achieve a higher APY is a unique feature that would not be possible without the consensus-as-a-service Layer-3 architecture provided by Orbs.

Izumi (Uniswap V3 LP Tokens)

The purpose of Izumi is to give Uniswap liquidity providers an opportunity to enhance liquidity mining rewards through LiquidBox. Earning additional rewards is a powerful economic incentive and ensures users can keep their principle in Uniswap through Izumi’s non-custodial and fully decentralized approach.

Izumi supports liquidity mining across Ethereum and Polygon, with rewards issued in iZi tokens. The USDC/USDT pair on Ethereum offers an APR between 4.74% and 8.86%, whereas the same pair on Polygon – eligible for double rewards – earns 119% to 19.48%. Users earn iZi and YIN tokens, creating a powerful incentive for users to provide liquidity on Uniswap and leverage their LP tokens to unlock more rewards.

Balancer Labs (Ethereum/Polygon)

As one of the most established projects in the decentralized finance space, Balancer provides various liquidity pools for users to engage with. More importantly, several protocols have integrated support for Balancer LP tokens to be earned for liquid staking purposes, making Balancer Labs one of the frontrunners in the broader liquid staking space.

Moreover, Balancer serves as a protocol for programmable liquidity. That affects liquid staking and other aspects of decentralized finance, enabling broader liquidity for asset pools and introducing strong incentives for users to provide long-term liquidity.

Conclusion

The concept of liquid staking gains momentum in decentralized finance. But more importantly, this solution has become accessible across multiple blockchains and networks, providing more users with access to these revenue-generating opportunities. Maintaining liquidity while staking assets is crucial, as it provides users with more flexibility and additional revenue-generating opportunities.