These Three Graphs Show How Big Money is Coming for Bitcoin (UPDATED)

While the crypto market was disappointed by the slow start of Bakkt, recently released data suggests that large investors are becoming more interested in the most popular cryptocurrency and are fueling “a new renaissance of Bitcoin.” (Updated at 13:40 UTC: updates in bold).

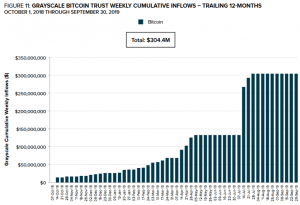

Grayscale, a major U.S.-based digital asset management firm, said today that 84% of total investment (USD 255 million) into Grayscale Products in Q3 2019 came from institutional investors.

“Grayscale Bitcoin Trust saw USD 171.7 million in inflows: In 3Q19, we saw the heaviest quarterly inflows to Grayscale Bitcoin Trust in the product’s six-year history, including nearly USD 75 million in a single day. July inflows also reached the highest level we’ve seen in a single month, well above the previous high of USD 64.7 million raised in December 2017,” the firm said, noting that the trust was closed to new investments throughout August and September.

However, institutions have also showed more attention to altcoins.

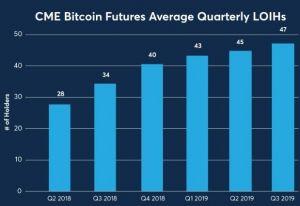

Meanwhile, U.S.-based financial derivatives giant CME Group said that its Bitcoin futures contracts have seen a greater interest in this year’s third quarter, but more specifically, it’s the institutional interest that continues to grow, with “a record number of large open interest [more than BTC 25] holders” (LOIHs) .

Other results of Bitcoin futures on CME:

- There’s a strong institutional flow, with 454 new accounts added in the Q3 2018, compared to 231 a year ago.

- The average daily volume of contracts traded was 5,534, which is up 10% compared to a year ago, and which is the equivalent of BTC 27,670 or USD 289 million.

Source: Coindesk

A couple of days before this statement, the company also said that the customer interest in CME Bitcoin futures remained strong during the third quarter, with daily open interest (OI) of over 4,600 contracts, which is up 61% compared to Q3 2018.

Meanwhile, using the data provided by crypto market analysis firm Coin Metrics, crypto researcher and analyst Willy Woo came to a “super bullish” conclusion that is bound to make a lot of people in the Cryptoverse happy or at least hopeful. He said that “we’re likely in a new renaissance of Bitcoin,” which is “powered by capital influx of high net worth investors,” while it were the tech savvy people bootstrapping the network who were behind the early BTC renaissance.

Woo was inspired to look back in time by a chart of address counts with BTC 1,000 or more posted by the on-chain market intelligence platform Glassnode, which shows a sharp rise in number of these addresses in the past year. Though some people also suggested that it could be an individual or an exchange moving a large amount of BTC to multiple wallets.

Whatever the case is, Woo discovered during his analysis that “the rate of growth of 1000 BTC addresses now matches the early growth in Bitcoin’s network.”

He explained that while gaining BTC 1,000 “was a matter of being an uber geek” when BTC was just born, at this point in its history, that same amount of Bitcoin means an investment of more than USD 8 million, says the trader, while the number of the world’s ultra-high net worth individuals (those with more than USD 50 million) stands at around 150,000. “It strikes me that this population is probably in the same order of magnitude of people who had that the interest and know how to mine BTC pre-2013, producing similar growth patterns.”

Meanwhile, just recently in an interview, the President of Fidelity Personal Investing (a unit of the U.S.-based mutual fund giant Fidelity Investments), Kathleen Murphy, said that the company – the CEO of which, Abigail Johnson, is a crypto fan – is being very careful about where it offers crypto, implying that the digital currencies carry heavier risks for retail investors than they do for institutional investors. While they’ve embraced the crypto in a sense that they want to be innovative and thoughtful, says Murphy, “we want to be very careful about making sure that investors […] who really aren’t institutional investors don’t make a mistake with cryptocurrencies.”

At pixel time (12:46 AM UTC), bitcoin trades at c. USD 8.318 and is almost unchanged in the past 24 hours. It’s up by 1% in the past week.