Surprising Bitcoin Crash Left the Market Bewildered

Following a sharp drop in the bitcoin (BTC) price on Wednesday that brought the price of the asset down by almost USD 1,000 in less than an hour, the market still has no clear answer what caused the drop.

As noticed by cryptoasset analyst at ARK Invest Yassine Elmandjra, yesterday’s drop marks the fifth largest hourly U.S. dollar price drop in bitcoin’s history: “the only other time we’ve seen a greater dollar price drop is at the Dec. 2017 peak.” Looking at it in percentage terms, however, paints a less dramatic picture, although nearly 1,000 dollars down in an hour is still significant for many traders and hodlers.

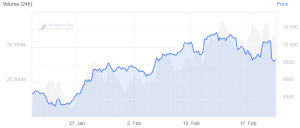

As of press time on Thursday (11:11 UTC), bitcoin is down 5% over the past 24 hours after it reclaimed some lost territory from the hour-long crash seen earlier. After having been as low as USD 9,280 following the crash, bitcoin is now trading at a price of USD 9,632 per coin and is also down 5% in a week, trimming its monthly gains to 11%. Bitcoin trading volume on Wednesday was around 15% smaller than on Tuesday.

BTC price chart:

Perhaps due to the recently very bullish trend for bitcoin, the crash also seems to have caught many by surprise. Popular crypto trader and economist Alex Krüger ironically pointed out that the crash occurred shortly after bitcoin made a “golden cross” in its chart.

“It could be a technical move with highly leveraged derivatives positions getting called,” Emmanuel Goh, who runs crypto-derivatives tracker Skew, told Bloomberg. He noted that some long perpetual swap positions got liquidated on Bitmex around the time of the drop.

In either case, due to this crash bitcoin volatility returned to levels not seen since early November. Historical swings over the past 10 days on the Bitcoin-U.S. dollar pair surged to 65% on Wednesday, according to data compiled by Bloomberg.

As previously reported by Cryptonews.com, we may have just seen the tip of the iceberg in terms of volatility to come this quarter, according to analysts.

However, speaking on CNBC on Wednesday, Morgan Creek Capital’s Mark Yusko said he is still highly bullish on the number one digital asset, regardless of the sudden sell-off:

“I think the best thing about the market today is the fundamentals. The fundamentals continue to increase and improve. Adoption is growing, the number of wallets is up, the number of transactions is up, all the fundamentals really continue to get stronger,” Yusko said in the interview, while also pointing out that the upcoming Bitcoin mining reward halving will put further upward pressure on the price of bitcoin.

Meanwhile, some even speculate that the crash was related to a U.S. Marshals Service auction of seized bitcoins held on February 18, where more than BTC 4,000 (USD 38 million) was unloaded. However, others dismiss this narrative as nothing more than a coincidence – it is a private sale of bitcoin to registered bidders only and it’s not unloaded onto the open market.

{no_ads}