Surging Altcoin Ampleforth Sees Strong Volatility

The little-known altcoin ampleforth (AMPL) has received more attention in the Cryptoverse after it rallied to become this week’s best-performing coin among the top 50 cryptoassets by market capitalization, while simultaneously seeing extreme volatility both to the upside and downside.

As of press time on Tuesday (11:23 UTC), AMPL, ranked 38th by market capitalization, was down by 11.2% over the past 24 hours, while recording a gain of nearly 78% over the past 7 days and trading at USD 2.55.

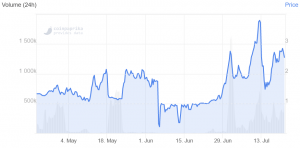

AMPL price chart:

AMPL, originally launched as a type of stablecoin alternative in 2019, aims to algorithmically stabilize purchasing power through a fluctuating monetary supply.

“The monetary protocol automatically adjusts the supply of AMPL across all user wallets based on price. This means the number of AMPL you own changes based on market conditions. When price is high wallet balances automatically increase. When price is low wallet balances automatically decrease,” the startup said on its website, adding that this supply adjustment operation happens once per day.

And while the altcoin is little-known in the crypto community, trading volume has picked up amidst the increased volatility, starting with an exponential price rise in late June. Back then, the price went from just USD 1 on June 22, to USD 3.2 on July 1, a rise of nearly 220% in a matter of nine days.

However, markets for the token remain relatively thin and are largely concentrated on the crypto exchange KuCoin. The exchange represented roughly 80% of trading in the token over the past 24 hours, and it was traded against both bitcoin (BTC) and tether (USDT).

Besides KuCoin, Bitfinex is the only major centralized exchange where the Ethereum (ETH)-based token is traded.

Following the recently extreme volatility in the token was also a governance poll in the Maker DAO (MKR) community, where MKR holders were asked to signal their support for several proposed changes to the protocol. Among these proposals was also the addition of AMPL as one of the approved collateral types on the Maker Protocol, a tweet from Maker showed.

Commenting on this, however, the founder of decentralized finance (DeFi) platform Synthetix (SNX), Kain Warwick, said that the efforts to “shill AMPL as collateral in MCD [multi-collateral DAI] is one of the scariest things I’ve seen in a while.”