Stablecoins See Growth With Crypto Market Stuck in ‘Bearish Lull’

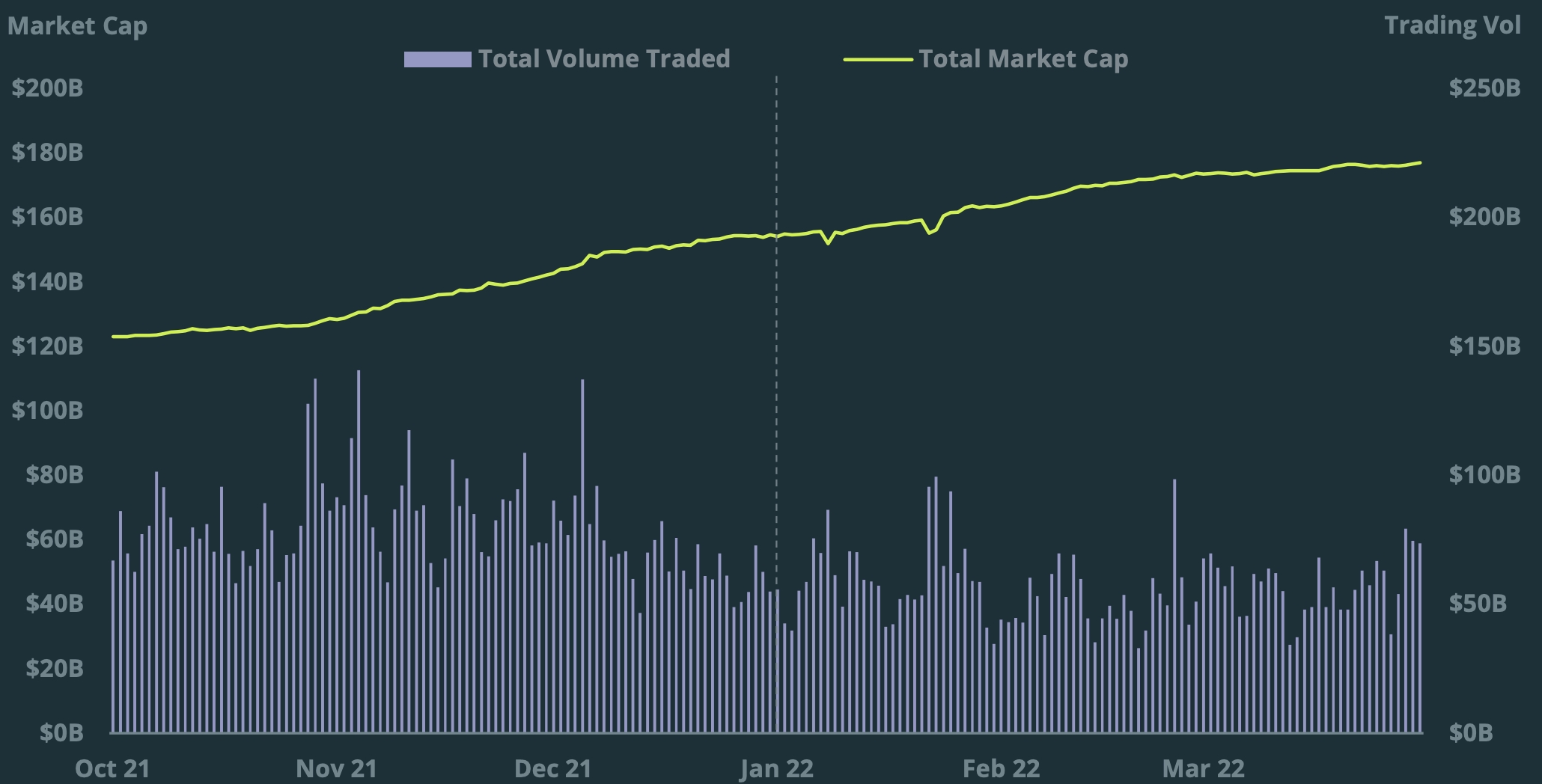

A “bearish lull” in the crypto market fuelled growth in stablecoins, with the market capitalization of the top five stablecoins growing by 13% in the first quarter, according to a new report from the coin tracking site CoinGecko.

The growth in the market capitalization of stablecoins is notable given that it happened during a period of falling trading volumes and prices in the crypto market in general.

According to CoinGecko, the increase in the market capitalization of the top five stablecoins — which included tether (USDT), USD coin (USDC), binance USD (BUSD), terraUSD (UST), and DAI — can be attributed to crypto investors “derisking in the midst of geopolitical and macroeconomic uncertainties.”

Top 5 stablecoins market capitalization and trading volume (Oct 2021 – Mar 2022):

The report noted that USDT remains the dominant stablecoin in the market, although the growth of this coin “has slowed greatly” compared to USDC, BUSD, and UST.

Similarly, it said that the growth of DAI, the decentralized stablecoin issued by MakerDAO (MKR), “has also slowed significantly” compared to its peers.

Out of the top five stablecoins, UST saw the strongest percentage growth in market capitalization over the course of the first quarter, while USDC increased its market capitalization the most in absolute terms, the report said.

UST is dominant among decentralized stablecoins

Commenting on the rise of UST, the decentralized stablecoin issued on the Terra (LUNA) protocol, CoinGecko’s report said that the coin has seen its market capitalization grow by 61% to USD 16.3bn as of the end of the quarter.

At the same time, DAI’s market capitalization increased by only 3%, the report pointed out.

With the impressive growth over the quarter and the overtaking of DAI in December, UST has now consolidated its position as the “dominant decentralized stablecoin,” the report said.

Still, some doubts exist about the UST, CoinGecko said, pointing to a USD 1m bet between Terra founder Do Kwon and critics of his project who claim that the model used to maintain UST’s dollar peg is unsustainable.

“The primary reason for UST’s strong adoption is due to Anchor’s high lending interest rates of 20%,” the report said, noting that critics call this yield “unsustainable” and argue that adoption will inevitably “spiral down” when the yield is reduced.

Anchor Protocol (ANC) is a lending platform on Terra used to lend and borrow UST.

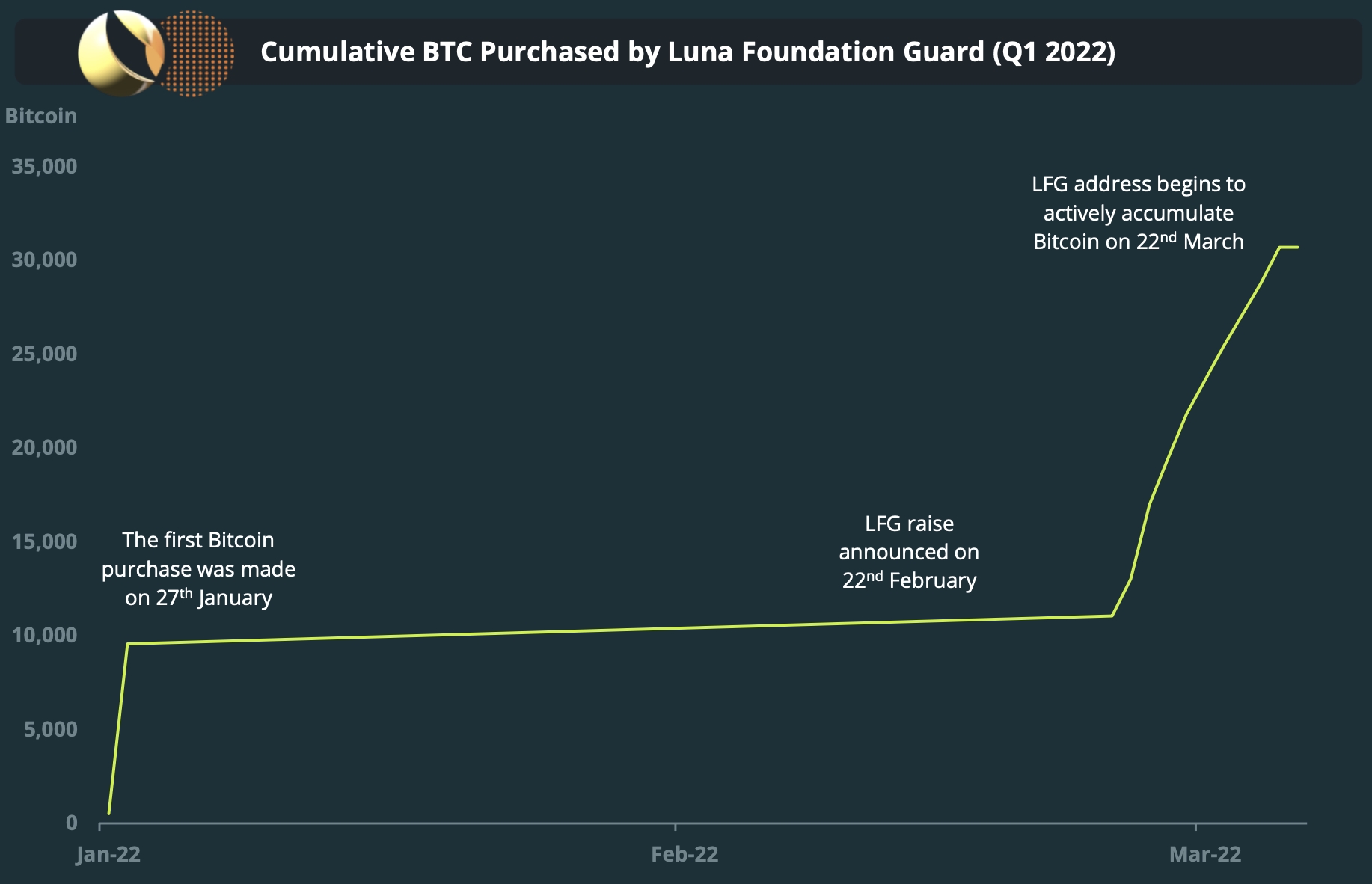

Meanwhile, the report also pointed to Terra’s buying of bitcoin (BTC), done through the Luna Foundation Guard (LFG), as a reason for increased attention around the UST stablecoin.

The LFG “has emerged to become one of the largest holders of BTC, just behind Tesla and MicroStrategy,” the report said.

Terra’s Do Kwon previously said that LFG plans to purchase up to USD 10bn worth of BTC to partially back UST, making it the largest holder of bitcoin after Bitcoin’s creator Satoshi Nakamoto.

At 12:24 UTC, the market capitalizations of the top five stablecoins, per CoinGecko, are as follows:

- USDT: USD 82.63bn

- USDC: 50.56bn

- BUSD: 17.67bn

- UST: 16.95bn

- DAI: 8.74bn.

____

Learn more:

– Financial Giant BlackRock Becomes ‘Strategic Investor’ in USDC Issuer Circle

– Luna Foundation Guard Buys Additional USD 100M in Bitcoin, Now Holds BTC 42.4K

– Whales Make Up More Than Half of Stablecoin Volume, Tether Losing Dominance

– Bitfinex, Tether Launch Bitcoin, USDT Donation Funds for Victims of El Salvador Gang Crime

– Tether Trading Volume in Ukraine Rises Again, Russian Volume Down

– Neutrino USD Loses Peg as WAVES Dives, But Developer Claims It Will be ‘Absolutely Fine Very Soon’

– US Senators Fail to Find Stable Ground on Stablecoins