ECB: Stablecoins Could be Rendered Useless by Financial Institutions

If financial institutions were to use DLT (distributed ledger technology) to record traditional assets, such as commercial bank money and regulated electronic money, stablecoins could be rendered redundant, claims the paper by three employees of the European Central Bank.

Euro symbol in front of the European Central Bank in Frankfurt, Germany. Source: iStock/77studio

This comes in light of the growing regulatory and governance uncertainties around stablecoins. Even if stablecoins were to be used more, even if their governance were to be improved, including the smart contracts updates and a cyber-security framework, even if they have a clear governance framework, they may still be hindered by the uncertainty “relating to the lack of regulatory scrutiny and recognition,” the authors say.

Looking at the primary mechanisms used to stabilize the value of stablecoins, the authors conclude that regardless of market developments, some types of stablecoins have the potential to maintain a stable value in the currency of reference. “This result shows a trade-off between the level of innovation offered by different types of stablecoins and their capacity to keep their price stable in the currency of reference.”

The authors classified stablecoins based on the primary mechanisms:

- Tokenized funds: Looking at the market and the types of stablecoins, the authors find some major stablecoins follow the same business model as traditional electronic money and prefunded payment systems. This means that they issue a “tokenized” form of the funds that back them, on DTL networks, denominated in the currency of reference. However, they carry the same risks as “their non-DLT competitors”.

- Collateralized stablecoin (on-chain and off-chain collateralized stablecoins): these are “subject to the volatility of the underlying collateral,” the paper finds, and they have many secondary stabilization mechanisms “that may be seen as truly innovative.” Additionally, some stablecoins backed by on-chain collateral resisted the fluctuations and drop in the price of crypto-assets used as collateral. However, “it is unclear whether this is due to effective stabilization mechanisms or to the stickiness of users driven by a strong interest in protecting their privacy and/or remaining outside the financial system.”

- Algorithmic stablecoins: these are economically insignificant – “a theoretical alternative rather than a practical solution” – given that those in production have a combined average market capitalization of EUR 9.7 million (USD 10.7 million) from January to July this year. The authors say that there has been a debate between rules and discretion within the central banking community for decades. So, while algorithmic stablecoins seem innovative, “they are a move in the opposite direction compared with the approach taken by major monetary authorities and have not proven to be capable of limiting the volatility of their value beyond the short term”. Still, their development should be observed for potential new debates.

The authors conclude that there is a strong relationship between the two inversely related characteristics: the innovation of a type of stablecoin and that stablecoin’s ability to limit price volatility expressed in a currency of reference. Those who are looking for a stable store of value may find it in the less inventive stablecoins “especially if legitimized by adherence to the standards typical of traditional businesses”. However, when it comes to the more innovative but volatile stablecoin types, “the jury is still out” on what their future role might be.

Meanwhile, back in July, in a written testimony to the U.S. Senate Banking Committee, co-founder of the Wyoming Blockchain Coalition and 22-year Wall Street veteran Caitlin Long, explained that “outdated financial regulations” are the reason why stablecoins such as Libra have developed. But since politicians have essentially created the need for stablecoins, she said that they could also easily make them “irrelevant,” simply by allowing banks to deal with digital assets, so traders and investors would just use real U.S. dollars to trade digital assets against, “just as they do when trading stocks or commodities back and forth with dollars”.

___

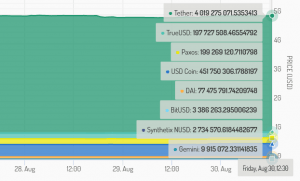

Market capitalization of stablecoins:

Source: stablecoinindex.com