Solana Price Prediction – Can SOL Recover as it Falls 40% in a Week?

Solana price prediction is bearish; however, the closing of the daily candle above $11.50 is signaling chances of a bullish reversal. According to crypto influencer DrProfitCrypto, the Solana (SOL) team delayed the start of the staking unlock period by two days. However, token holders could still access and sell their SOL holdings.

Solana, what a big scam. Peoples coins will be suddenly unlocked in two days instead of today, now after devs were able to unlock their own! + Shutting down website

— Doctor Profit 🇨🇭 (@DrProfitCrypto) November 10, 2022

A slap in the face for those who believed that altcoins are truly decentralized.

Only #Bitcoin is decentralized pic.twitter.com/dV96urj14t

Solana Unlock

Lock-in for Solana’s staking was intended to finish on the 9th or 10th of November. Following the conclusion, 18,000,000 SOL tokens will be made available.

Given the recent events surrounding the FTX (FTT) crash and Solana’s ties to the FTX, technical outlook predicted a double-dip for SOL as a result of the unexpected surge in supply.

18 mil #SOL about to hit the market within 24h. 👇

— Duo Nine ⚡ YCC (@DU09BTC) November 9, 2022

Those with a lot of coins locked in staking are about to join the liquid supply.

This will represent a second wave of selling.

The lesson from Terra was to never lock your coins. You may regret it. pic.twitter.com/WBZ7tAUZBH

By delaying the unlock, the expected double-dip has also been delayed, providing Solana’s developers more time to sell their SOL tokens at the present price before the token’s value drops.

Solana Has Ties to FTX

In 2021, Solana attracted a diverse group of private investors, including Alameda Research, who contributed $300 million to the company’s native token sale. In this round of funding, Andreessen Horowitz was the main investor. Fried’s, a financial services provider, has kept its Solana blockchain integration.

Investors are concerned that SBF and FTX may lose their investments in Solana and its ecosystem. Worse, the Solana blockchain is currently having performance challenges. As a result, it’s one of the primary reasons for Solana’s bearish bias.

Solana is currently experiencing network issues, causing transactions to fail. Some are still going through, so try again if your transaction fails.

— ◉ Solend (@solendprotocol) November 8, 2022

The status dashboard for the Solana network shows that the network is now operating at a lower capacity. As a result, it appears that investors considering investing in Solana should proceed with care.

Solana Network Disruptions

There have been 13 disruptions recorded so far this year, with the biggest lasting for 16 hours and 24 minutes on January 6.

On November 8 as the FTX crisis was developing, the DeFi protocol Solend issued a warning that transactions were failing owing to unforeseen network problems.

Solana is currently experiencing network issues, causing transactions to fail. Some are still going through, so try again if your transaction fails.

— ◉ Solend (@solendprotocol) November 8, 2022

Solana’s uptime tracker has not detected any mainnet network disruptions since October 1st, despite Solend’s warning.

Solana Price Prediction

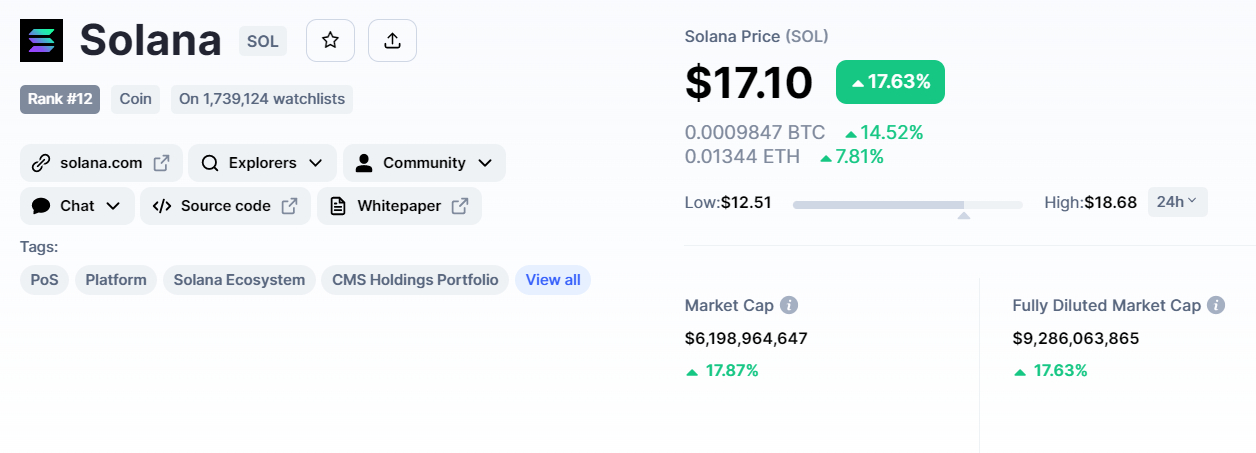

Solana’s current price is $17.41, with a $4.7 billion 24-hour trading volume. Solana has gained more than 6% in the last 24 hours but is still down 46% in the previous seven days. CoinMarketCap is now ranked #12 with a $6.3 billion live market cap. The circulating supply of SOL coins is 362,468,570.

The SOL/USD pair has rebounded above the $11.50 support level and has broken through a critical resistance level of $16.30. After falling below $30, the 50-day moving average, the price of Solana may continue to fall.

Under Solana’s 50-day moving average, a “three black crows” pattern has formed, indicating that the decline is likely to continue. If sellers push SOL below its immediate support at $11.50, it could fall to $5.5.

On the upside, Solana may encounter immediate resistance near the $21.75 level, which is extended by 38.2% Fibonacci retracement. A break above this level may expose Solana’s price to $28, the 61.8% Fibonacci retracement level.

Alternative Coin – Dash 2 Trade (D2T)

As a result of the Solana drop, the market is experiencing a risk-off attitude, which is driving the broader crypto market slump. The market is currently focused on D2T presale, one of the most prominent coins with significant upside potential.

Dash 2 Trade is an Ethereum-based trading intelligence platform that provides real-time statistics and social data to traders of all skill levels, allowing them to make more informed decisions.

It started its token sale three weeks ago and has now raised over $5.8 million, while also confirming its first CEX listing on the LBank exchange. 1 D2T is currently worth 0.0513 USDT, but this is expected to rise to $0.0533 in the next stage of sales and $0.0662 in the final stage.