Seoul Postpones ICO Ruling Amid Market Drop

The chairman of South Korea’s National Policy Committee has stated that a parliamentary debate on the country’s controversial ICO (Initial Coin Offering) ban could take place next month – and says Seoul will likely make its position clear on the matter in December, rather than this month as previously pledged.

Anti-ban activists have criticized the government for dilly-dallying on the issue, allowing millions of dollars worth of South Korean money to flow out of the country in the process. Regulators have been quizzing blockchain, legal and business experts on the possibility of allowing regulated ICOs, and had said they would give an update on their stance “sometime in November.”

Committee chairman Min Byung-Doo stated, per media outlet iNews24, that the government would make efforts to bring about blockchain and ICO public hearings at the National Assembly in December, and that it was unlikely to make its decision known before the end of November.

Min also stated, “The government has been conducting international surveys, and has yet to reach a decision. We hope that we will be able to hold a formal [and open] hearing with [blockchain] experts in the National Assembly in December.”

The ban came into force in September last year, with all forms of ICO outlawed. Earlier this year, the regulatory Financial Supervisory Commission stated it had no plans to seek a reverse of the ruling, claiming “investor protection” was its priority.

Seoul is under enormous pressure from the country’s IT sector, with internet giants Naver and the Kakao Group known to be keen on launching ICOs, but instead now turning their attentions to foreign markets. Per media outlet News1, Kakao yesterday revealed plans to create a new Singapore-based subsidiary with the aim of “attracting cryptocurrency investors.” Naver’s Line subsidiary has also been pushing ahead with cryptocurrency-related activities elsewhere in Asia.

Meanwhile, the government’s apparent indecision on crypto-related matters, say critics, has seen many of the country’s major exchanges focus on overseas expansion, rather than domestic growth, with the likes of Bithumb, Upbit, Coin25, Coinone and Korbit operator NXC all making major international moves in recent months.

Meanwhile, the global ICO market keeps shrinking. ICOs raised around USD 1.8 billion dollars in Q3 – a steep downturn compared to Q2, when USD 8.3 billion was collected, according to a new report from rating agency ICORating. 57 percent of them were unable to raise more than USD 100,000, and only 4% managed to get listed on exchanges (compared with 7% in Q2.)

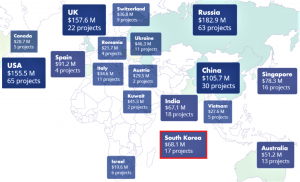

According to ICORating, in Q3, 17 projects with South Korean origins raised USD 68 million, compared with 16 projects and USD 301 million in Q2.

____

Geographical distribution of projects based on origin of the project team, Q3 2018