Retail May Consume 50% of Bitcoin Supply After Next Halving – Report

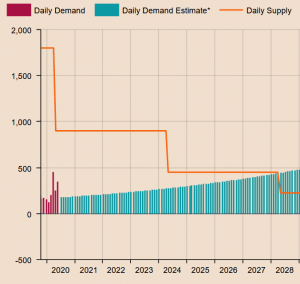

Despite all the talk of financial institutions entering bitcoin (BTC), retail demand may in fact end up consuming more than half of all physical supply of bitcoin after the next halving, a new report by crypto derivatives exchange Zubr said.

According to the report, which analyzed data from analytics provider Chainalysis, Bitcoin’s next halving, which is expected to occur in 2024, will limit BTC supply to the extent that demand from retail investors alone “could potentially account for eating up over 50% of the physical supply.”

Now, around BTC 900 are generated per day on average.

Zubr’s definition of “retail” is any wallet that holds a round number of bitcoins, up to 10, i.e. 1, 2, or 3… BTC. And although the report did not offer any further explanation for why these wallets are more likely owned by retail investors than by institutional investors, chief economist at Chainalysis, Philip Gradwell, offered his take on Twitter, simply saying “humans like round numbers”:

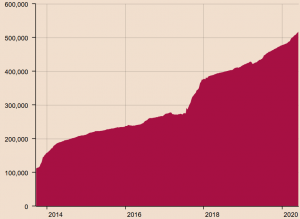

Nevertheless, the report did find that there has been a consistent rise in the number of bitcoins held in these round number wallets since 2010, with an average growth year-on-year of 1 to 1.5% since 2014.

Total number of BTC held in precise number addresses (1 up to 10)

And although these wallets today only hold about 2.5% of the total circulating BTC supply, that number is bound to continue growing, Zubr said. Given the historical growth rate, the report pointed to the year 2028 as a critical year when these retail wallets will “begin to eat up all the new supply alone”

Bitcoin retail demand estimates versus supply

Finally, the report also took a look at bitcoin compared to gold as a store-of-value, and found that “although Bitcoin remains in its infancy compared to gold, the data shows that “cryptocurrency believers” have stayed true to their belief despite sharp fluctuations in price over the past few years.

It also made the case that although it could be argued that bitcoin was designed to mimic gold, “technology has aided bitcoin in remaining truly limited in supply,” while it “has done the opposite for gold,” with new market supply of gold generally increasing year after year while demand is dropping.

At pixel time (08:45 UTC), BTC trades at USD 9,234 and is unchanged in a day. The price is down by 1% in a week, 9% in a month and 18% in a year.

__

Learn more:

Most Bitcoin Traders are Retail, But Pros Dominate the Market – Report

Bitcoin Whale Population Growth Might Be A Mirage

‘Real’ Bitcoin Free Float Supply Figures May Be off by 22% – Report