RadarUSD: USDR, Interest-free Isolated Lending & New Features

Disclaimer: The text below is a press release that is not part of Cryptonews.com editorial content.

The topic of borrowing, lending, and vaults is one of the most intriguing aspects of the cryptocurrency world. Many assets of this class have funds locked up that can no longer be used, or at the very least cannot be used for an extended period of time. Radar is here to change that.

Radar is a decentralized borrowing protocol that allows you to take out 0% interest loans against interest-bearing tokens used as collateral. Loans are paid out in USDR — a USD pegged stablecoin.

What assets can I use as collateral?

Radar accepts yield-bearing assets, or even underlying assets which are automatically converted in our UI to their yield-bearing equivalent for a better user experience. To better illustrate, Radar accepts:

- av3Crv

- sAVAX

- qiUSDC

- qiUSDT

- qiDAI

- qiBTC

- qiETH

- qiAVAX

These assets can be used as collateral to mint Radar Dollar (USDR).

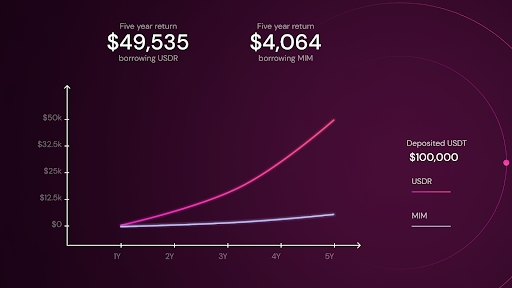

Your collateral value is always increasing because USDR is backed by interest-bearing tokens and loans are interest-free. This means that your loan instead of accumulating compounding debt, actually earns you a passive APY that adds up over time and surges your assets.

How does Radar work?

Using Radar is as easy as going through a couple of clicks.

Step 1 — Deposit the asset you want to use as collateral.

Step 2 —Choose your LTV ratio and receive USDR for your collateral

Step 3 — Use your USDR to buy anything you want.

Radar vs Other Platforms

qiUSDT vs. yvUSDT pool

How much USDR can I get?

Every asset you choose to deposit on Radar has a maximum Loan to Value ratio (LTV) and a Total Allowed Borrow (TAB) for your particular token of choice. The LTV will not change over time unless decided so through governance, but the TAB can be increased when necessary.

The LTV ratio varies between 45% (for more volatile tokens) and 92% (for stablecoins).

Similar services, such as Abracadabra, require the borrower to pay an interest rate on the loan. Radar does not charge any interest on the borrowed amount.

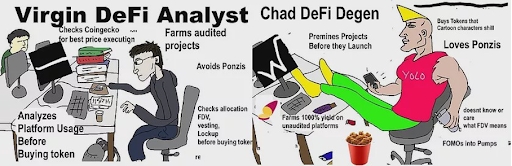

In the spirit of poking a bit of fun at existing solutions, how about we run through a quick scenario. Albeit, a slightly different one.

You’re an old crypto OG who does regular podcasts and has been asked to escrow $20,000,000 for some of your degenerate friends who are betting against each other. (“Tch…so unrealistic. Like who would do that?”)

Having gotten bored after escrowing your friends’ bet, you decide to spend it on buying something nice for yourself.

Now some of your friends try to explain for an entire evening how moving your stablecoins around through 8 different platforms will finally land you a loan that bears an interest you have to pay but you get lost around halfway through the explanation because frankly nobody got time for that.

Instead, as a true DeFi Chad who hates complicated things, you throw your USDT into Radar, and because you’re a degen through and through you mint 90% of the collateral so you now have 18,000,000 USDR which you can use to buy a new LaFerrari for starters.

(You will be paying no interest rate, regardless of your collateral choice).

You get to the dealership and the car dealer is a virgin DeFi Analyst named Messiah and asks you how much interest you’re paying and brags about how he took a $90,000 loan on which he pays less than 1% interest. Of course you laugh and tell him your loan actually earns you yield like it should and you pay no interest.

As you drive away in your new LaFerrari with the dealer’s wife in the passenger seat, you can hear the dealer yelling some nonsense from behind:

“Sim-sala-bim, fvck that fiat panda and the mim.”

“Hm, what mime could he have been talking about?” — you mull over the thought while driving away, then again, whatever, you earn too much yield on your no-interest loan to care about that kind of stuff. With a gross APR of a bit over 10% by the time the bet is over, you’ll have paid your loan back and be able to keep both the car and the dealer’s wife.

How does this help $RADAR?

RADAR is the token of the Radar Ecosystem, of which USDR is a part of. RADAR has a total supply of 85,000.000. It is currently live on Ethereum and BSC.

Similar to how things have worked until now, the main function of $RADAR remains to be staked in order to gain some advantages and perks within the ecosystem, as well as voting rights and a share of the generated fees.

Radar charges no interest and instead the generated protocol fees will come from entry and/or exit fees paid by users when taking or repaying a loan as that is the only fee that Radar ever takes. 100% of the funds will be held in the Treasury and used if market conditions demand.

Risks of Using Radar

Risk 1

All positions made through Radar have a chance of liquidation. When establishing a position, depending on the LTV ratio you choose, you get shown a liquidation price. In case the asset you have used as collateral goes below that liquidation price then the collateral will be sold to cover your debts.

Risk 2

Radar makes use of smart-contracts and because of that, there is always a possibility of a bug or exploit being used by someone. However, owing to our in-house security experts, no one has been able to exploit any of the Radar products to date.

TL;DR

- Choose from a multitude of options to use as collateral

- Every loan you take has no interest

- USDR is pegged to USD

- Compounding debt is annihilated

- A share of the profits goes towards $RADAR buybacks

- RADAR is only for gigachads.

- RADAR is the best choice for Cobie if he wants a new LaFerrari

Switch it up & access your 0% interest loan: https://radar.global/

📡 Want to learn more about RADAR?

📲 Follow us on Twitter.

🗨️ Join our Telegram Group.

📢 Join our Announcement Channel.

🌐 Visit our Website.

Disclaimer: The text above is an advertorial article that is not part of Cryptonews.com editorial content.