Private Keys or Compound Interest? A New Crypto Debate

A recent announcement by US-based cryptocurrency lending startup BlockFi has triggered somewhat contradicting reactions in the crypto community.

Source: iStock/ToprakBeyBetmen

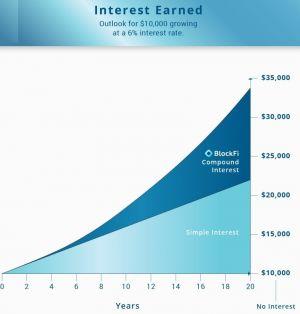

The company has introduced BlockFi Interest Account (BIA), or new saving accounts for Bitcoin and Ether with an industry-high 6% annual interest rate (traditional banks in the US offer roughly 2% interest on the saving accounts) paid monthly in cryptocurrency. On one hand, getting 6% (well, rates are subject to change) in a receding bear market sounds like a solid deal, but on the other, it means that you lose control of your private keys.

Today on #cryptotwitter pic.twitter.com/utT0T1AA67

— Dan Held (@danheld) March 5, 2019

According to Anthony Pompliano, co-founder and partner at Morgan Creek Digital, a digital asset management firm that invested in BlockFi in 2018, the BIA product has been in private testing for a few weeks, with more than USD10 million already deposited by retail and institutional customers.

Source: offthechain.substack.com

Aside from the extra counterparty risk, cryptocurrency saving and lending ventures are attractive for the investors because you get to keep your cryptocurrency while earning additional funds with it at the same time. Besides, BlockFi states that you can take your cryptocurrency back at any time, while the only trade-off is your private keys.

me contemplating whether or not to lend my bitcoin and collect a yield or just sit on them for all eternity pic.twitter.com/gL8X2lpEtK

— nic 🌠 carter (@nic__carter) March 5, 2019

No risk, no yield 🤷♂️

— Bitcoin is Saving (@BitcoinIsSaving) March 5, 2019

Also, holding most of your coins and lending some of them out are not mutually exclusive

In either case, BlockFi, which managed to raise over USD 58 million in venture capital, claims that the launch of the new service was marked by the influx of new users.

The volume on our site from the BlockFi Interest Account launch has been insane. Thanks to everyone for the overwhelming feedback. 2019 is going to be a fun year.

— Brad Michelson (@BradMichelson) March 5, 2019

The platform also supports XRP and Litecoin, but it remains to be seen if saving accounts will roll out for these tokens.

Meanwhile, although cryptocurrency lending and saving services are quite common, the compound interest deals have a dodgy history in the space. The most famous failed high-yield compound interest cryptocurrency project was Bitconnect, a project which made a ridiculous promise of 1% daily compound interest for the investors and was exposed as a Ponzi scheme, causing investors to lose millions.

Compound interest in Crypto… pic.twitter.com/q1eP55De1Z

— Neeraj Thakur (@NeerajT4) March 6, 2019