Is Passive Income A Dream in Crypto? Learn How Metropoly Makes Genuine Passive Income a Reality

Disclaimer: The text below is a press release that is not part of Cryptonews.com editorial content.

A passive income stream is usually one of the top priorities for investors across the globe. They’re always looking for an asset that they can invest in that produces a consistent and reliable return each month without the need for them to allocate any effort once the investment is made.

Unfortunately, crypto is very short on passive income options. Lots of projects claim to provide a passive income for investors, but their rewards typically last a short period of time until the income stream dries up.

Fortunately, one upcoming project is gaining momentum as investors believe it will finally provide a method to achieve a genuinely passive income stream into a reality through the magic of real estate. Let’s meet Metropoly.

Passive Income: Something to Strive For?

In most cases, passive income is usually a pipedream that is unattainable or unsustainable. For years, investors have sought out opportunities that allow them to earn a consistent passive income from their initial investment. However, the opportunities are usually few and far between. In addition, they typically tend only to last a short period of time until the rewards dry up and the passive income fades.

Bitcoin mining was often considered a fantastic passive income option. Through cloud/hosted mining, Bitcoin miners can purchase hardware through a provider who will host their equipment to start mining BTC. Although it does provide a passive income for the investors, the rewards are very volatile as they’re tied to the price of Bitcoin. During the 2022 market capitulation, many miners had to turn off their hardware as they stopped making a profit through mining.

The legacy real estate market is one of the most reliable passive income sources. The wealthiest 1% of individuals globally grew their fortunes through real estate. The passive income is generated from the rental yield on the real estate, with capital appreciation making the investors much richer.

Although real estate provides the opportunity for a fantastic passive income, it’s often been highly inaccessible. This is primarily due to the fact that large down payments are required to purchase a property. In addition, a good credit score is also required, and mountains of paperwork also need to be filled out.

As a result, this usually leaves most investors locked out from starting their real estate investment journey – until now. With the introduction of platforms like Metropoly, crypto investors can easily start their real estate portfolios in a matter of seconds with as little as $100. Here’s how.

How Metropoly Makes Passive Income a Reality.

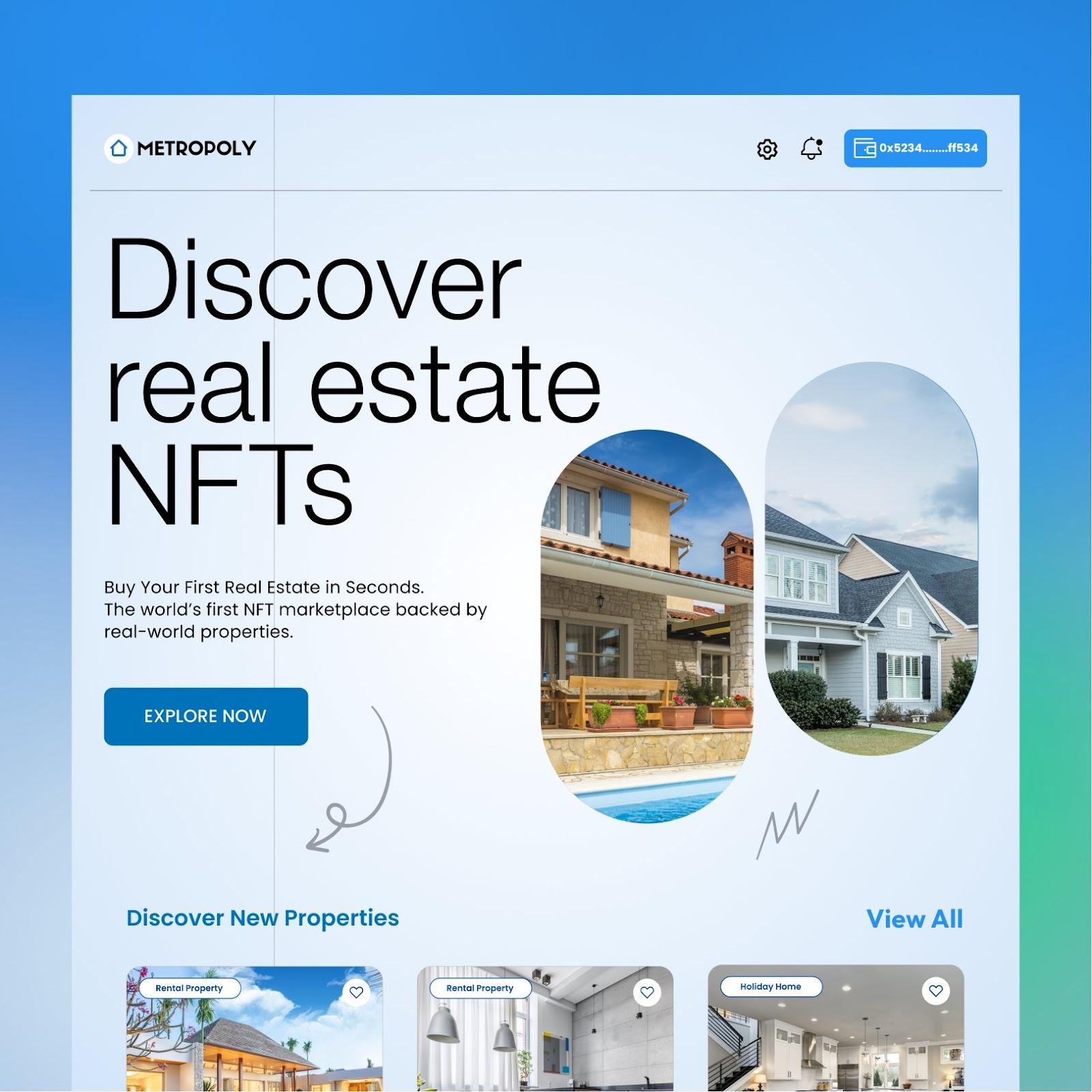

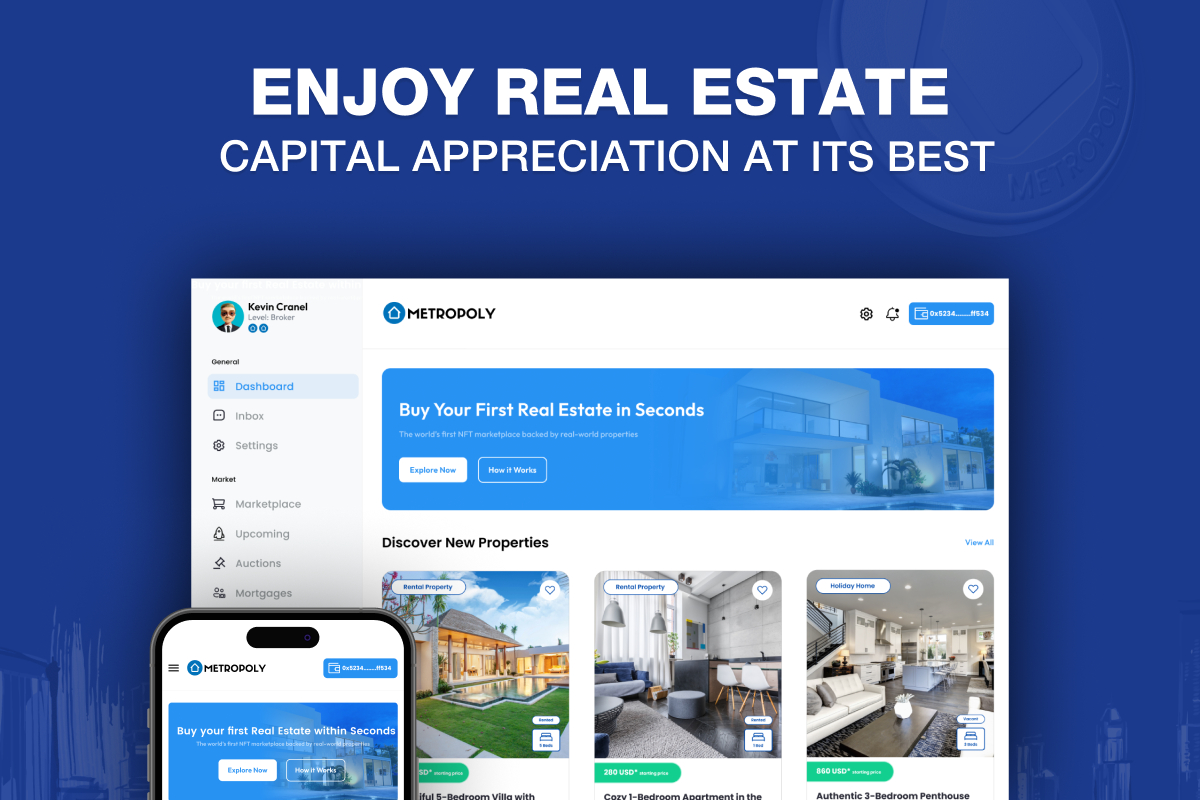

Metropoly is the world’s first NFT marketplace filled with NFTs backed by real-world real estate properties – all of which produce a passive income for holders.

The platform NFTs are backed by real-world utility, allowing you to buy real estate in a matter of seconds. Metropoly is changing the way that real estate is done by reducing the lead time it takes for investors to purchase real estate from 90 days to as little as 20 seconds.

The project lets investors begin their real estate portfolios with as little as $100 because all of the properties in the Metropoly portfolio are fractionalized and tokenized. This means that they are broken down into little pieces to be sold as individual NFTs. As a result, investors don’t have to purchase 100% of the property. Instead, they can purchase a fraction of the real estate and still earn a passive income from their investment.

Holding one of the NFTs entitles the owner to all the benefits of real estate investment. For example, NFT holders can easily take advantage of any capital appreciation by selling their NFTs on the Metropoly marketplace. In addition, they’re also entitled to their share of the passive income generated from the monthly rental yield – which is distributed in USDC.

The income is genuinely passive because the Metropoly team handles all of the property maintenance. They also ensure there is a tenant in the property paying rent, which is the source of income. As a result, real estate investors simply have to purchase the NFT to get started earning.

Is Real Estate the Only Way to Passive Income?

As mentioned, there are a host of projects claiming to provide a passive income to investors, but most of them are highly unreliable. Sure, the rewards might last a short period of time, but they always tend to dry up eventually. Furthermore, most of the passive income options in crypto aren’t really passive. Some projects require you to keep track of the market and your investment – requiring time and effort for the investors.

This is not the case for Metropoly.

The project hasn’t created a new type of investing. Instead, it’s taken one of the most reliable and consistent passive income methods, brought it on-chain, and made it accessible to the broader pool of investors. Using one of the most reliable sources of passive income is the only way to ensure the income is consistent over time.

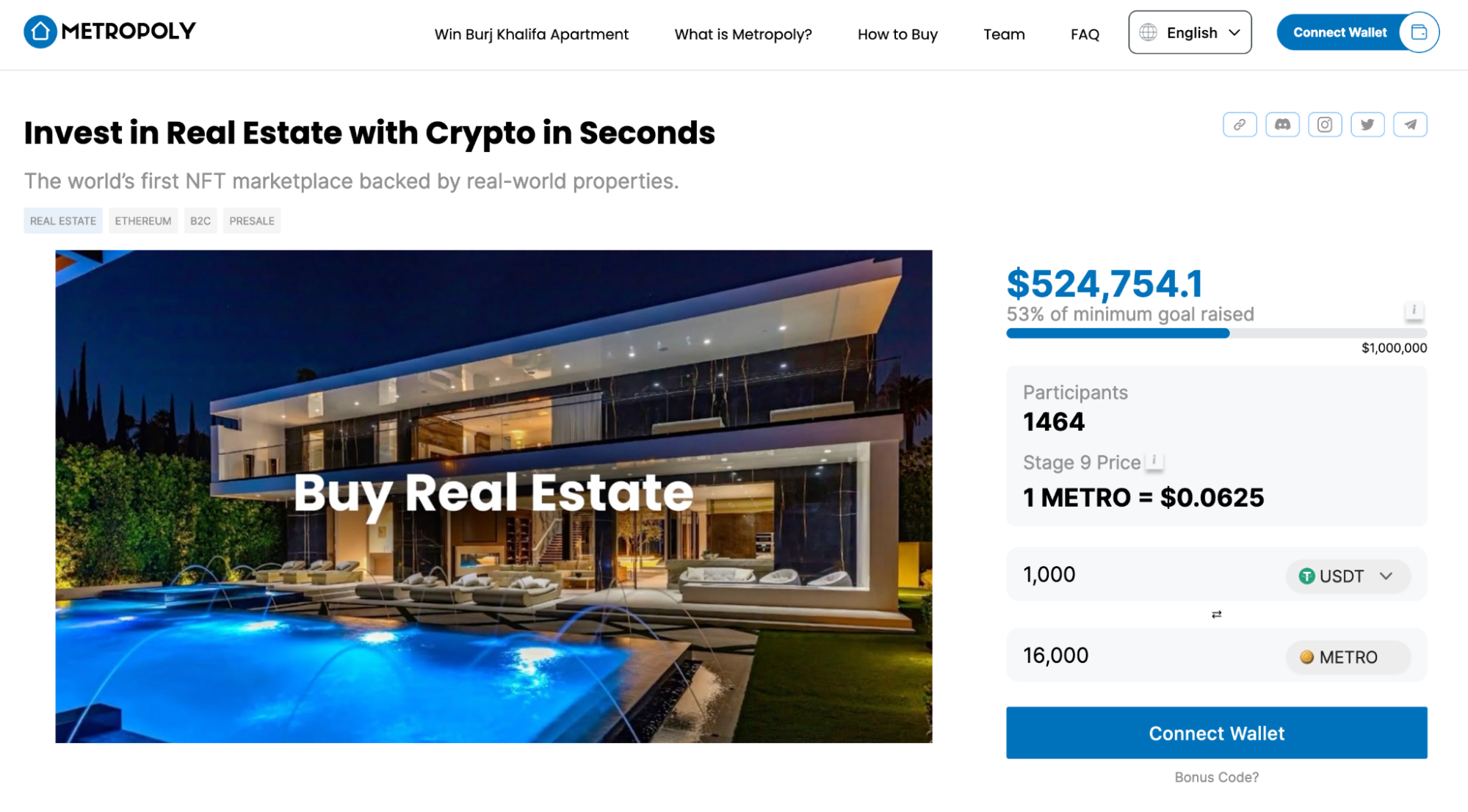

Presale Surges Past $500,000

Metropoly is currently undergoing a presale for its METRO token, which will be the transaction and reward token on the platform. The presale for METRO recently surged past $500,000 as investors quickly rushed to the new project that makes passive income a reality.

The current price for METRO sits at $0.0625 in the 9th stage of the presale. Once the fundraising hits the $1 million threshold, the price for the token will increase. As a result, those buying in the earlier stages of the presale benefit the most once the presale is complete and the token lists on exchanges.

How to buy METRO: A quick guide

— METROPOLY (@metropoly_io) February 12, 2023

Step 1: Get a crypto wallet: Download MetaMask or Trust Wallet

Step 2: Investors need to own Ether, Tether or BNB, which will be exchanged for METRO tokens

Step 3: Link wallet on https://t.co/tpOwICvgol

Step 4: Buy METRO tokens! pic.twitter.com/aGmFZemKnf

Overall, Metropoly is finally providing prospective investors with the opportunity to generate a true passive income through the magic of real estate. The best thing about holding one of the Metropoly NFTs is that the returns can be expected to stay consistent throughout the year, and holders are still entitled to benefit from any capital appreciation on the property.

Disclaimer: The text above is an advertorial article that is not part of Cryptonews.com editorial content.