More Altcoin Mining to be Integrated by Mining Pools in 2020 – Report

2020 will see the mining pools start to integrate more altcoin mining with huge market potential and risks, says token data and rating agency TokenInsight.

The agency’s 2019 mining industry report claims that there are only 64 mineable coins including Bitcoin (BTC) with more than USD 100,000 trading volume in 24 hours, and these (with BTC) account for 82% of total crypto market capitalization. What we’re seeing now is altcoin mining and staking entering the “main” stage, says the report. These will get more market attention, and an increasing number of mining pools will start to integrate them, wanting to differentiate their services, diversify revenue streams and compete with other mining pools.

Also, as the industry faces the issues of transparency and supervision, major mining pools are actively building brand credibility, and it’s likely that the future will bring inspection and reporting in cooperation with independent third parties and decentralized mining pool protocol.

This year, we might also see more cloud mining products launched targeting the broader market. However, the future of the cloud mining market is outside of China, particularly in Russia, TokenInsight finds, adding that the number of users in Russia is “staggering.” The country’s development and participation in BTC mining will increase in 2020 with the ease of policies on crypto, but also the weather advantages.

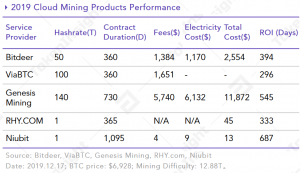

According to the researchers, cloud mining platforms are relatively concentrated, with nine platforms sharing more than 80% of the market, while most of the cloud mining products are currently unprofitable.

Taking the Bitcoin mining reward halving in May into account, under the current mining difficulty and BTC price, “most of the cloud mining products on the market are not worth investing in.” When the block reward is halved, if the hashrate, or the computing power of the entire network, is reduced by the same proportion, then less than half of the cloud mining products tracked by TokenInsight can’t make a positive ROI (return on investment), says the agency.

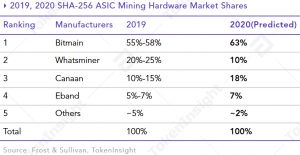

Also, the researchers claim that the whole mining industry is extremely concentrated, with the top four companies accounting for c. 95% of the market. The agency made 2020 predictions for SHA-256 ASIC mining hardware market shares, finding that Bitmain will continue its reign with 63%, Canaan will climb up, back to the 2nd place, with 18% of the market share. If Eband goes public in 2020, it will have a positive impact on its market share and will squeeze out other players. Whatsminer has more than 20% of the market share in 2019, but its founder Yang Zuoxing, was arrested in 2019.

Nonetheless, what will largely determine the success or failure of mining hardware manufacturers, says the report, is the support of chip makers. The chip supply is relatively in shortage, and mining hardware manufacturers have to compete with mobile phones for it.

____

Watch Bitcoin educator, entrepreneur Andreas M. Antonopoulos, discussing the economics of mining pools and is it possible that certain wallets are collaborating with mining pools to propagate there first.