Lithuania Central Bank: Limited Edition Digital Coin Ready for Launch

The Bank of Lithuania, the country’s central bank, has approved a physical sample of the LBCoin, a token that it claims will be the world’s first blockchain-powered digital commemorative coin. The bank says the token will be issued in spring this year.

The coin is made of silver and will be valued at exactly EUR 19.18 (USD 21.27) – a reference to 1918, the year when Lithuania first declared its independence from Russia.

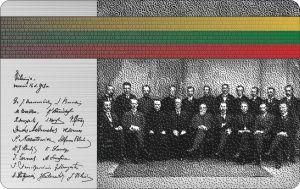

The bank says that the physical collectors’ edition coin has been designed to look like a credit card.

And its design is not short on symbolism: It features a depiction of the Independence Act signed on February 16, 1918, as well as a digitized picture of the Council of Lithuania.

The picture is made up of over 36,500 pixels – almost the same number of days that have passed since the Act of Independence was issued, the bank said in a statement shared with Cryptonews.com.

The bank added,

“The Lithuanian flag on the reverse of the coin [features] the national anthem inscribed in binary code.”

The other side of the coin bears the Vytis – the Lithuanian national coat of arms.

The design also features a QR code that is linked to the e-shop where digital tokens will be sold.

The bank is aiming to issue 24,000 LBCoins on its online store. The store will provide its customers with dedicated wallets where they can store the coin, although they will also be able to transfer their LBCoins to NEM wallets.

The bank added that digital coin buyers would be able to claim their physical silver coins from designated outlets.

__

__

Meanwhile, the bank is continuing in its efforts to step up its central bank digital currency (CBDC) operations.

In December last year, the bank said that the LBCoin was part of “a controlled experiment” and an “in vitro test of multiple practical aspects relevant to the broader CBDC discussion.”

The bank is also working on a blockchain-based technological sandbox named LBChain. The sandbox will see international fintech firms bid for the right to test their offerings at Lithuanian financial institutions.

So far, six companies from three countries have made use of the sandbox.

The bank says that these include a “Know-Your-Customer solution for anti-money laundering compliance, a cross-border payments solution, smart contracts for factoring process management, a payment token, a mobile point-of-sale and payment card solution, a crowdfunding platform and an unlisted share trading platform.”

Also in December 2019, speaking of CBDC, the Bank of Lithuania said that “Single-jurisdictional level initiatives are not capable of meeting a global citizens’ need for a safe, trustworthy, and cost-efficient instrument for cross-border payments.” According to the bank, modern-day technology seems to be able to address this need: “The issue, including the idea of multicurrency CBDC deserves deep joint analysis.”