Litecoin Trading at “Massive Discount” – Analyst

Litecoin, the 7th largest cryptocurrency by market capitalization, could be trading at a “massive discount to what it should be worth,” according to a research report published by Mati Greenspan, senior market analyst at the social trading platform eToro.

The report argues that while litecoin has historically been seen as a contender to bitcoin with its faster and cheaper transactions, it is also one of the most liquid digital currencies in existence, has a large market cap, and acts as an important gateway from fiat currencies and into the world of crypto.

Greenspan further claims that businesses, retailers, and exchanges are increasingly accepting payment in litecoin, both in person and online, which adds to the real-world use cases of “the silver to bitcoin’s gold.”

As reported, back in July, the Litecoin Foundation, in partnership with the Swiss decentralized payment platform TokenPay, acquired a 19.8% stake in Germany-based WEG Bank. Also there is an option to purchase as much as 90% in the bank. The take-over of the bank is widely believed to have implications for the mainstream adoption of litecoin as a means of payment.

The research paper goes on to compare litecoin’s fall of 81% from its all-time high in December last year with the overall decline in the crypto market of 71%, suggesting that this could mean that Litecoin is oversold at current levels.

Litecoin price chart:

“Given that litecoin has an established and stable working product, as well as significant adoption, this bear market of the whole cryptocurrency industry could have led to Litecoin being oversold,” Greenspan concluded.

However, not everyone agrees with the analyst, as debates on Twitter show:

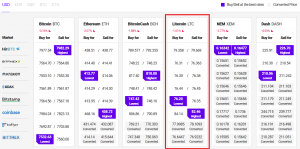

At the time of writing, among the exchanges followed by Cryptonesws.com, the lowest price to buy litecoin was at Bitstamp (USD 76.20), while Coinbase offered the highest price to sell litecoin (USD 82.46).