Kraken Joins Exchanges Looking for Big Money Investments

Kraken, a popular crypto exchange, is considering a private offering as it looks to raise capital for possible acquisitions. Such a move would be in line with the decision of many other exchanges like Coinbase, Bitstamp, Bithumb, Poloniex, all of which have received big investments from traditional venture capital (VC) and investment firms.

The report by Finance Magnates claims that Kraken’s team has sent out emails to select high-value clients asking them for input. The email states that to receive more information about the offering, customers are invited to fill out an online survey. Although they claim they’re not in need of financing, they consider the current bear market and the company’s “significant reserves” as opportunities for acquisitions. Kraken would be looking at targets that would have strong “synergies with their existing product/service offerings, and with great teams,” CEO Jesse Powell told CoinDesk. Kraken has already purchased companies such as Coinsetter, CAVirtex, CleverCoin and Cryptowatch.

The company also adds that its valuation that’s listed for sale is USD 4 billion, with a minimum investment size of USD 100,000.

Kraken is also going to be evaluating each prospective investor for eligibility to be a part of the share offering, according to the report. The customers which received the email have until the 16th of December to respond to the survey. The company also adds that more details will be available in the near future.

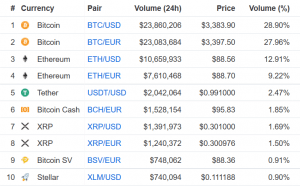

At the time of writing, the 24 hour trading volume at Kraken stands at almost USD 83 million.

Top 10 markets at Kraken:

The influx of “big money” into the cryptocurrency space, most notably in the case of exchanges, has had the community wondering whether businesses will eventually push the small players and retail investors out of the game. Still, many argue that this is a necessary move in the further development of the industry. Back in November, CEO and co-founder of the Swiss-based loyalty platform qiibeetold Cryptonews.com, “No, I don’t believe this is something we need to be concerned about. If anything, this is an opportunity for HODLers and traditional investors to work together within the cryptosphere to achieve mainstream adoption.”

In October, Coinbase announced that it is officially valued at USD 8 billion, following a mega funding round led by Tiger Global Management and infusing the company with USD 300 million to accelerate its global expansion.

Lou Kerner, a partner at CryptoOracle, an advisory and investment firm, explained to Cryptonews.com, “[O]ver time, as the new technology matures, as more investors understand the potential for disruption and wealth creation, more traditional investors start investing. So traditional financial sources investing in crypto, and crypto exchanges, is just signs of a maturing industry.”