Justin Sun on Poloniex Investment Rumors: ‘I’m Not Buying Anything’

Tron (TRX) founder, Justin Sun, said he’s “not buying anything,” in a response to a report that he’s involved in the Poloniex‘s spin-off from Circle.

“Just invest some and help out my friends. Actually I have a huge bag of $BNB, $HT, $OKB etc and bet on all exchanges that support $TRX & $BTT,” Sun tweeted on Saturday, without elaborating any further.

At pixel time (11:11 UTC), TRX, the native token of Tron, is the best performing coin among the top 30 tokens by market capitalization. It trades at c. USD 0.0156 and is up by 3.6% in the past 24 hours, trimming its weekly loss to 2.8%.

On Friday, U.S.-based cryptocurrency exchange Poloniex said they’re spinning out from Circle into a new company, Polo Digital Assets, Ltd., with the backing of an undicslcosed “major investment group.”

In a separate blog post, Sean Neville and Jeremy Allaire, founders of Circle, said that this is an Asian investment group.

Both companies did not provide any further details about the deal. Circle acquired Poloniex in 2018 for USD 400 million.

Meanwhile, according to a report by The Block, based on claims by “several Circle employees,” “Justin Sun is heavily involved” in the aforementioned Asian investment group.

The founders of Circle added that “the new international operation plans to invest more than USD 100 million into the development and expansion of the Poloniex exchange.” Also, investors reportedly plan to employ more than 100 full-time employees with the majority coming from the existing Poloniex operations.

“The spinout will free us to focus on the needs of global crypto traders with new features, assets and services,” Poloniex said, stressing that the U.S. traders are not among these global traders:

- Starting October 18, U.S. persons are no longer able to create new accounts on Poloniex.

- Starting on November 1, U.S. customers will no longer be able to execute trades on the exchange.

- When trading ends, U.S. customers will still be able to withdraw their assets through Circle until at least December 15.

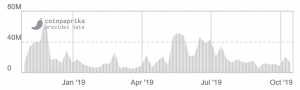

The exchange is ranked 89th by trading volume (USD 15.4 million in the past 24 hours), according to Coinpaprika.com.

Trading volume in Poloniex:

“We have also faced challenges as a US company growing a competitive international exchange. This spin-out will finally give Poloniex the freedom and capital to compete in the international market, and the leadership team of Poloniex will be equipped to scale and grow beyond the scope of what Circle can provide,” Circle founders said.

As reported in May, Poloniex stopped offering nine coins to United States customers due to “regulatory uncertainty in the U.S. market.”

Meanwhile, Circle itself, said that after this divestment they will “significantly expand” the services they offer that are built around their stablecoin USD Coin (USDC), and grow SeedInvest, an equity crowdfunding platform in the United States. As reported this week, Bermuda, a British island territory with a population of c. 65,000 people, started accepting payments for taxes, fees and other government services in USDC.