What is DeFi Liquidity Mining? Everything You Need to Know

In decentralized finance (DeFi), liquidity mining enables crypto holders to actively participate in the ecosystem while simultaneously earning rewards.

DeFi liquidity mining involves providing liquidity to decentralized exchanges (DEXs), helping ensure that tokens can be bought and sold at all times. In turn, miners are rewarded with various incentives. This guide will delve deep into the intricacies of DeFi liquidity mining, its benefits, associated risks, and best practices for success.

What is Liquidity Mining?

Liquidity mining is the process of lending cryptocurrency to a decentralized exchange (DEX), providing them with the liquidity to facilitate trades. In exchange for doing so, the lender — or liquidity provider — will receive rewards in the form of extra cryptocurrency for locking their tokens. These rewards are usually generated from the trading fees charged by the DEX.

DEXs need capital or liquidity to function. These exchanges allow traders to buy and sell tokens without a centralized authority facilitating the trade. As such, liquidity is derived from the ecosystem through liquidity mining and not any central party. Now that we’ve answered the key question of what liquidity mining is let’s look at how it works.

How Does Liquidity Mining Work?

In crypto, liquidity comes in the form of pairs of tokens that traders can exchange. As such, you’ll need to lock in two assets in what’s known as a liquidity pool. For example, ETH/BTC would be a liquidity pool of Bitcoin and Ethereum. You’ll lock in an equal value of both tokens.

The DEX will issue you tokens to represent your locked assets called liquidity pool tokens or LP tokens. Then, you will begin earning the promised rewards in the form of trading fees.

Select a DeFi Platform

Selecting a DeFi exchange to mine with is the first step in the process. When doing this, you will need to consider their reputation, how long have they been around, do they have a good social-media community, etc. Next, what are the annual percentage yields (APY) you will receive from the platform? Some exchanges could offer yields of up to 300%; however, they may not have the greatest reputation.

Additionally, it is important to factor in the lock-in period. Some exchanges will allow you to withdraw your tokens at any time, while others could require you to lock them in for a couple of months or more. So it is key to find flexibility.

Finally, find out how their reward system works and what tiers they offer. These are associated with the fee structure of the pool. For example, Uniswap has 4 tiers: 0.01%, 0.05%, 0.3%, and 1%. According to Bloomberg, Uniswap is one of the most popular DeFi exchanges in the market. Other popular DEXs include PancakeSwap, SushiSwap, and Curve Finance

Deposit Assets into Chosen Pool

Now that you have a platform, it’s time to deposit. Select a specific liquidity pool that the decentralized exchange offers and deposit your crypto assets into it. Choosing the right pool depends on factors like expected yields, risk tolerance, and the tokens involved.

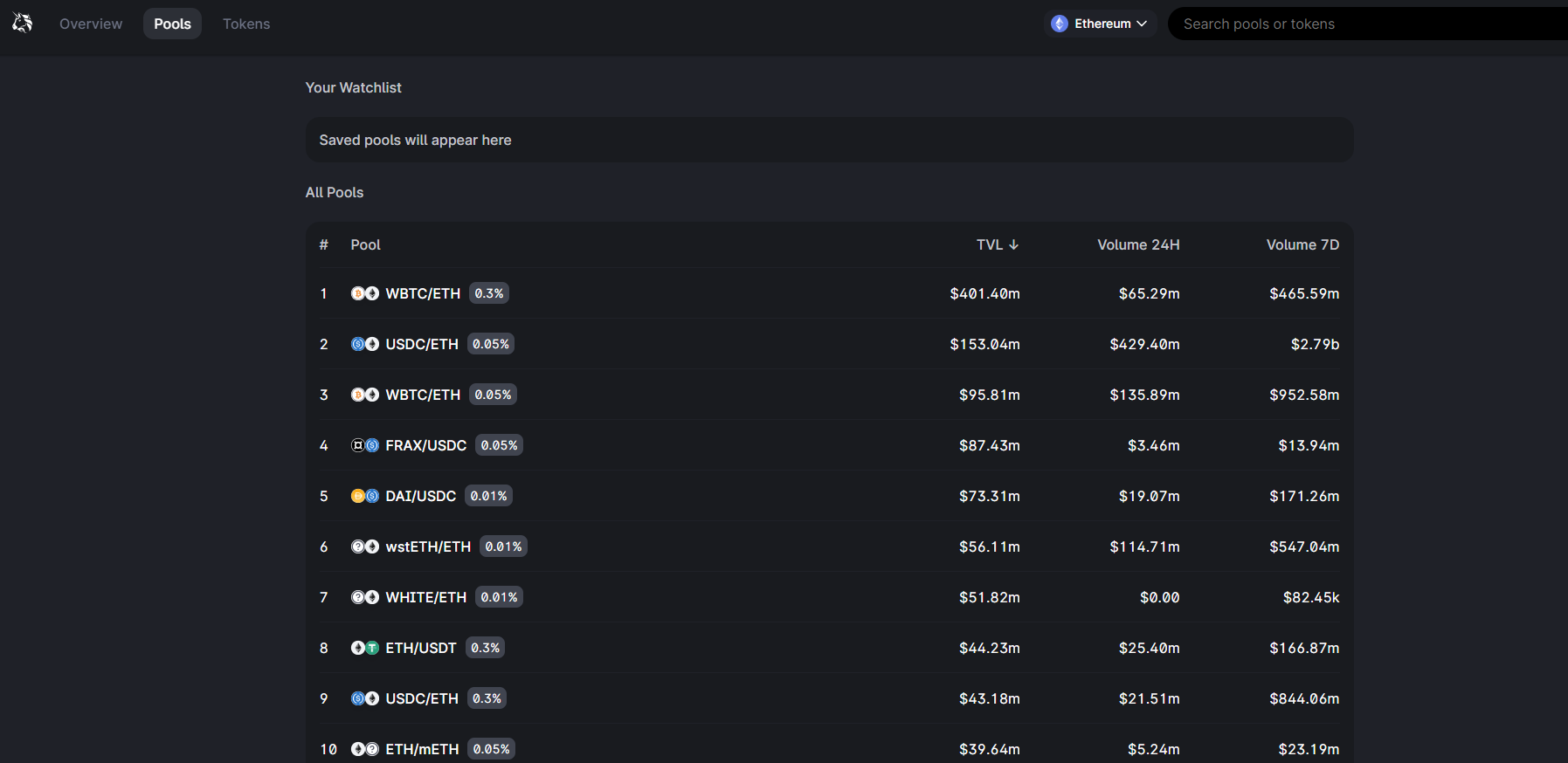

Additionally, it is important to factor in market volatility when choosing liquidity pools. Typically, the more volatile the market, the higher the yields will be due to the fluctuating value of the asset. Below is an example of LPs on Uniswap.

Earn Rewards and Trading Fees

Once deposited, the DeFi exchange will mint what are called Liquidity Provider (LP) tokens and issue them to you. These represent the liquidity you’ve contributed to the ecosystem. All rewards and fees will be accumulated on these tokens.

As mentioned above, when selecting a liquidity pool, you will have muliple tiers that are based on rewards and fees. All miners receive rewards that are collected as trading fees on the platform. Back to Uniswap, their four tiers are 0.01%, 0.05%, 0.3%, and 1%. Depending on which one you choose, you will receive a contribution of the fees generated.

What Are The Benefits of Liquidity Mining?

Participating in a liquidity mining pool is beneficial for several reasons; let’s go through them.

Passive Income Potential

It is a good way to earn passive income from your otherwise dormant crypto tokens. Each pool offers liquidity providers different reward levels or annual percentage yields (APY), so it is important to choose the best option for yourself based on your risk tolerance.

Supporting DeFi Ecosystem

Additionally, by contributing liquidity to decentralized platforms, you will be also actively supporting the growth and stability of the broader DeFi ecosystem. Liquidity mining helps ensure that token trading is done smoothly. With over 687 DEXs trading and a daily trading volume of 8.85 million, according to CoinGecko, liquidity providers are a vital part of decentralized finance.

Distributed Governance

Many DEXs will grant liquidity providers governance tokens for participating in liquidity mining, allowing you to contribute to the decisions related to the platform’s development and protocol upgrades.

Liquidity Mining vs Other Investment Strategies

Liquidity mining has often been compared to staking and yield mining, which both allow you to generate passive income from your tokens but differ in important ways.

- Staking is the process of participating in a blockchain network by holding and locking up a certain amount of cryptocurrency to support network operations and earn rewards.

- Yield farming is a more general form of liquidity mining, where token holders lend their tokens to various decentralized finance protocols to provide liquidity and earn rewards.

Let’s illustrate the differences for you.

Liquidity Mining vs Staking

| Liquidity Mining | Staking | |

| Rewards | Token rewards and a share of trading fees. | Staking rewards in the form of additional tokens. |

| Lock-up Period | Most allow you to withdraw liquidity at any time. | Typically, it involves a lock-up period for staked assets. |

| Flexibility | More flexible in terms of asset management. | Locks assets for a predetermined period. |

For more details on staking platforms, visit our guide on the Best Crypto Staking Platforms.

Liquidity Mining vs Yield Farming

| Liquidity Mining | Yield Farming | |

| Rewards | Token rewards and a share of trading fees. | Additional tokens or governance tokens from yield farming. |

| Risk | Generally considered lower risk. | May involve higher risks, especially in new or unverified pools. |

| Purpose | Focus on providing liquidity to pools. | Involves actively seeking out the highest-yielding opportunities. |

For more details on yield farming, visit our guide on the Best Yield Farming Crypto Platforms.

Risks Associated with Liquidity Mining

While having its benefits, many still ask if DeFi liquidity mining legit and what are the risks associated with participating.

Impermanent Loss

Impermanent loss (IL) refers to the potential loss caused by fluctuations in the relative prices of the tokens you have deposited in a liquidity pool. Due to the volatile nature of crypto assets, this is a continuous risk that liquidity providers must consider when liquidity mining.

Volatility and Market Trends

Additionally, this same volatility can affect your deposited assets and the entire liquidity pool. As such, rewards could be impacted by the high swings in the price of certain tokens. In bear markets, tokens will likely depreciate, reducing the trading volume, and in-turn the fees generated by each transaction.

Rug Pulls

Be careful when using lesser-known platforms or liquidity pools with extremely high Annual Percentage Yields (APYs). This poses the risk of bad actors executing rug pulls, where a project will raise a lot of money before shutting down the project prematurely. In liquidity mining, the platform will rug-pull clients by taking all the deposited crypto assets, leaving them with the now worthless liquidity tokens. Coinbase has removed several rug pulls from its platform over the years.

Best Practices for DeFi Liquidity Mining

Liquidity mining profitability depends on various factors and best practices.

Careful Pool Section

Ensure you research and carefully pick the pool you are depositing to. Do not deposit solely based on APYs or rewards. Look at the history of the DeFi platform, how long it has been around, and what are people on Discord and Telegram channels saying about it.

Consistent Performance Evaluation

Regularly evaluate the performance of your chosen pool. Depending on market conditions and trends, you may need to adjust your strategies to maximize returns. Monitor changes in trading volumes, liquidity depths, and token prices to make informed decisions.

Strategic Diversification

Don’t put all of your eggs in one basket; manage your risk by diversifying your pool selection. This can minimize the impact if a project fails or a crypto asset significantly devalues. You may also be able to expand your passive income channels by doing this.

Conclusion

DeFi liquidity mining offers a unique opportunity for investors to actively participate in the crypto and blockchain ecosystem. It is a great opportunity to earn rewards while supporting the growth of decentralized applications (dApps).

To be a successful liquidity miner, you must understand the nuances, risks, and best practices involved, as this is crucial for navigating the world of DeFi mining without falling victim to scams or other associated risks.

Explore our list of the top decentralized exchanges to use for liquidity mining.

FAQs

What is the difference between liquidity mining and yield farming?

Liquidity mining involves providing liquidity to a decentralized exchange, earning rewards and fees, while yield farming is the act of actively seeking the highest-yielding opportunities.

Can you lose money liquidity mining?

Yes, crypto liquidity mining carries risks, including impermanent loss (IL) market volatility and the potential for rug pulls on lesser-known platforms.

Is DeFi liquidity mining legit?

DeFi liquidity mining is legit and is used by many within the crypto space. However, there are several risks associated with this, so ensure you have done your due diligence before investing.

How much money can you make from liquidity mining?

This varies on the liquidity pools you choose, the current market conditions, as well as diversification strategies you may be using.

Is liquidity mining risky?

Yes, liquidity mining is risky. Risks include impermanent loss, market volatility, and the potential for rug pulls from potential fraudulent projects and platforms.

How do I start liquidity mining?

You can start liquidity mining by choosing a reputable DeFi platform and depositing your crypto tokens into a pool tostart earning rewards and fees.

References

- Uniswap surpasses Ethereum in crypto fees ( Bloomberg)

- Top Decentralized Exchanges Ranked by Volume (CoinGecko)

- Coinbase removes rug pulls links from its platform (Reuters)

Kane Pepi

Kane Pepi

Eric Huffman

Eric Huffman

Michael Graw

Michael Graw