Is Bitcoin a Good Investment in 2024?

Whether Bitcoin is a good investment is a question posed relentlessly in today’s market, given the tremendous growth in the BTC price over the past decade. However, the coin’s high volatility and colossal carbon footprint have pushed bitcoin miners and crypto investors towards other projects in recent times – leading many to speculate whether Bitcoin can thrive in the long term.

In this article, we’ll take an in-depth look at Bitcoin and its place in today’s crypto market, covering its price history and looking at its prospects. We’ll also detail where investors can buy Bitcoin today before providing our thoughts on whether BTC represents a good investment, given the current market conditions.

Is Bitcoin a Good Investment?

So, is investing in Bitcoin a good idea? There’s no questioning that Bitcoin has been one of the top crypto gainers since it hit the public consciousness in the early 2010s – yet it’s hard to imagine the coin providing the same level of returns as it did back then.

Most retail traders gravitate towards Bitcoin for two reasons – they’re interested in the world of cryptocurrency, and they’re hopeful of generating market-beating returns. However, what these traders often don’t realize is that Bitcoin is now a relatively ‘mature’ asset within the context of the market. As such, the days of 2,500% returns are likely in the past.

There are some good points concerning Bitcoin, such as the fact that it’s now part of many crypto index funds, making it the first cryptocurrency to be adopted by the traditional financial markets. From this perspective, BTC may actually represent a good opportunity for investors with a higher risk tolerance and who wish to gain exposure to digital currencies.

However, those looking to get rich off crypto will need to look elsewhere. Yes, Bitcoin has outperformed the S&P 500 in six of the last seven years. This is over 3x more than the S&P 500’s drawdown and hints that Bitcoin’s time as a rapidly-growing asset could be coming to an end.

How Bitcoin Has Performed Since Launch & in 2024

The mysterious Satoshi Nakamoto created the concept of Bitcoin in the paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System”. The Bitcoin code was released in January 2009 and was initially used by murky websites like Silk Road to facilitate anonymous payments.

Over the following years, Bitcoin expanded and entered the public consciousness. It’s no wonder that people started wondering if they should invest in Bitcoin as its value began to rise exponentially. To put this into perspective, BTC was valued at $13.30 in 2013 yet rose to $770 by early 2014 – a remarkable 5,689% increase.

This growth continued in the following years, prompting many new cryptocurrency projects to spring up (dubbed ‘altcoins’). The popularity of altcoins grew in tandem with Bitcoin, helping set the stage for crypto exchanges like Binance and Coinbase to expand. By 2020, high-profile names like Elon Musk and Jack Dorsey had publicly expressed their optimism for BTC.

All told, if an investor had bought BTC at the beginning of its rise in early 2017 and the coin’s all-time high in November 2021, they’d have generated a return of 7,297%. To put this another way, an investment of $1,000 would have been worth $73,970 at the end of the bull run – highlighting why investors began clamoring to get involved in the crypto market.

However, since November 2021’s peak, it’s been challenging for BTC to maintain its status. The combination of rising inflation and interest rate increases has created a ‘risk-off’ environment, making cryptocurrency much less popular.

Nonetheless, since the start of 2024, ahead of the bitcoin halving event, and the approval of Bitcoin exchange-traded funds (ETFs) by the SEC, BTC has performed very well.

Here’s a quick summary of the key points to be aware of regarding Bitcoin:

- Satoshi Nakamoto came up with the concept of Bitcoin in 2008.

- Bitcoin’s source code was released in January 2009.

- Dubious online sites initially used BTC to facilitate anonymous payments.

- Bitcoin began entering the mainstream as an investment asset and helped kickstart the growth of the entire crypto market.

- After peaking in November 2021, BTC has been on an extended downtrend.

- Since the start of 2023, it has witnessed an uptrend before facing resistance at the $30.9K level.

- Bitcoin fell again in Q3 of 2023, before starting back on its upward trajectory.

- It started 2024 with a bang with the SEC approval of spot Bitcoin ETF, reaching a high of $47.1K before settling back to around the $42K mark.

Bitcoin Price History

Given the coin’s past, is it a good time to buy Bitcoin today? To answer this question, it’s essential to look more closely at the coin’s price history to determine whether what we’re seeing today has been seen before.

As mentioned in the previous section, Bitcoin’s first real ‘spike’ was between 2017 and 2018, when the price surged by over 5,600%. However, this peak was short-lived, and BTC’s value gradually decreased over the following year.

However, many believed Bitcoin was the best long-term crypto due to its size and reputation relative to others in the market. This helped BTC generate some momentum in late 2019 – yet it wasn’t until the beginning of the COVID-19 pandemic in March 2020 that the coin’s true potential was unveiled.

Between March 2020 and November 2021, Bitcoin’s price rose by 1,657%. According to CoinMarketCap, this led BTC to create an all-time high of $68,789. At this point, the bullish sentiment around Bitcoin was at its peak – but this peak would be short-lived.

Between November 2021 and November 2022, Bitcoin’s value fell by 74%. The year 2022 has been challenging for BTC investors, as regulatory issues and rising interest rates have hampered price momentum.

However, 2023 has helped the king coin regain some momentum. Starting at around $16.5k, BTC almost doubled in price by July 2023, gathering huge momentum as major asset managers such as BlackRock, Fidelity and Wisdom Tree applied for spot Bitcoin exchange-traded funds (ETFs).

The US SEC is seemingly dragging its heels on a decision over the ETFs, but it appears likely they will be approved, it is more a matter of when. Bitcoin has lost a bit of momentum in August and September – which has historically been one of the worst months for the coin and has not posted a green candle in six years.

However, with the next Bitcoin halving approaching in mid-2024 – a catalyst for all previous bull runs – there could be light at the end of a tunnel after two painful years in the space.

Bitcoin Highs & Lows

- High of $19,735 in December 2017

- Low of $3,270 in December 2018

- High of $13,910 in June 2019

- Low of $3,881 in March 2020

- All-time high of $68,789 in November 2021

- Current low of $18,120 in November 2022

- Regained high of $30,000 in July 2023

- Dipped to $26,300 in September 2023

- Fell to $15,761 in November 2023

- Climbed to $44,084 in December 2023

- Surged to $46,659 in January 2024

Bitcoin Price Forecast

Is Bitcoin worth buying at today’s price? There’s an argument that BTC is relatively ‘undervalued’, given its worldwide adoption and popularity with institutional investors. It’s clear that BTC’s downtrend is more to do with external factors rather than internal ones, leading many to speculate that another price rise could be looming.

However, deciding how much to invest in Bitcoin is crucial, as there’s also the chance that the price will keep dropping. The Federal Reserve is expected to continue increasing interest rates into early 2023, which makes ‘risky’ assets like Bitcoin less appealing. Naturally, this could lead to more bearish pressure over the next six months.

So, will Bitcoin go up, or will it continue plummeting? Given the points raised above, we forecast that BTC will continue to hover around this area for the next 6-12 months. However, we do believe that Bitcoin will rise again in the years that follow – just not to the same level as before. Here are our Bitcoin price predictions for the following years:

- BTC Prediction for End of 2023: $30,000

- BTC Prediction for End of 2024: $62,000

- BTC Prediction for End of 2025: $83,000

- BTC Prediction for End of 2030: $150,000

Is the Bitcoin Halving in 2024 Bullish?

Yes, the next Bitcoin halving that will take place in 2024 is considered to be bullish.

Halving is built into the protocol of Bitcoin to reduce the rate of BTC production. This event limits the influx of new BTC tokens into the market. When this happens, the market tends to react to the reduction in future supply by increasing demand, which can drive up the price of BTC, which means that it could potentially be a good time for investors to buy Bitcoin.

This halving will halve mining rewards from 6.25 BTC to 3.125 BTC. Historically, halvings significantly influence Bitcoin’s price. For instance, after the 2012 halving, we saw an incredible four-digit rise. Post-2016 halving, the price grew by over 280% in the following months.

After 2020’s halving, Bitcoin surged by more than 500% and peaked at a record $69,000 in November 2021. Should Bitcoin demand escalate, BTC coins’ value might potentially surge significantly.

Bitcoin’s Utility – What Does the Future Hold?

Answering the question “Is Bitcoin still a good investment?” involves taking a closer look at the coin’s utility – or lack thereof. Naturally, Bitcoin’s primary use case is to allow individuals and businesses to transfer cash in a decentralized manner. Not only is this considered safer by many, but it’s often a lot cheaper, too.

For the longest time, Bitcoin’s popularity revolved around this aspect. People no longer had to rely on centralized banking institutions to handle their payments – they could ‘step outside’ the system and use Bitcoin instead. Furthermore, since BTC had first-mover status in this regard, it was often the go-to for those looking to make decentralized payments.

However, as more people opted to invest in cryptocurrency, new and exciting projects began to spring up that challenged Bitcoin. Projects like Ethereum, Solana, and Cardano implemented ‘smart contract’ functionality, which created limitless possibilities for decentralized application (dApp) developers. In turn, this began to affect Bitcoin’s reputation.

The critical issue is that Bitcoin’s utility is lacking relative to these other projects. As stated by Fortune.com, the Bitcoin network is hobbled by a lack of capacity. Moreover, Bitcoin’s network still relies on the outdated ‘mining’ process, which is exceptionally energy-intensive and has been roundly criticized by all corners of the media.

All of these factors play into the increasingly bearish sentiment towards Bitcoin. Although the coin has had some significant milestones in recent years, such as becoming legal tender in El Salvador, many believe this to be a result of its first-mover status. When compared to other crypto projects, Bitcoin can’t really compete.

So is Bitcoin a good investment when taking these points into account? In our eyes, Bitcoin is now deriving its value from its scarcity rather than its utility. Over time, it’s unlikely that this approach will hold up – meaning investors may need to look elsewhere for high returns.

Spot Bitcoin ETFs

A spot Bitcoin ETF (Exchange-Traded Fund) is a type of investment fund that allows investors to gain exposure to Bitcoin without directly owning the cryptocurrency itself. Unlike futures-based ETFs, which invest in Bitcoin futures contracts, a spot Bitcoin ETF holds the actual Bitcoin. Bitcoin ETFs were approved by the US SEC in January 2024.

Like traditional ETFs, a spot Bitcoin ETF is traded on stock exchanges. Investors can buy and sell shares of the ETF through their brokerage accounts during regular trading hours. The ETF provider is responsible for securely storing the Bitcoin held by the ETF,

The value of shares in a spot Bitcoin ETF is directly linked to the price of Bitcoin. As the price of Bitcoin fluctuates, the value of the ETF shares also changes accordingly.

Are Spot Bitcoin ETFs a good investment option?

Some investors believe that spot Bitcoin ETFs offer certain advantages over other investment methods, such as direct ownership of digital assets or futures-based ETFs. They provide exposure to Bitcoin’s price movements in a regulated, publicly traded vehicle, potentially appealing to institutional investors and those seeking a more convenient way to invest in Bitcoin.

However, Bitcoin ETFs, like all other ETFs, are also subject to risks such as liquidity risks, counterparty risks, and dividend risks. Changes in regulations or tax laws can also impact the performance and tax treatment of ETF investments. It’s important to keep monitoring the market for developments, and as always, do your own research ahead of making any investment.

Is Bitcoin a Good Long-Term Investment or Short-Term Investment?

Following on from the previous section, there’s a school of thought that Bitcoin has evolved from being a long-term investment to a short-term investment. Although it might not be the next cryptocurrency to explode, BTC has still shown itself capable of outperforming equities on the smaller timeframes.

For this reason, many people opt to day trade Bitcoin, as it’s not uncommon for the coin’s value to rise by 5% (or more) in a matter of hours. The image below highlights this, yet this isn’t an isolated incident – moves like this occur regularly.

At the same time, it’s important to remember that bearish moves are just as common. The crypto market is inherently volatile, so day trading BTC is best-suited to risk-seeking traders. However, those happy to trade both sides of the market may find an abundance of opportunities – making it a viable alternative to the FX market.

But is Bitcoin a good investment over the long term? We struggle to believe that BTC has superior long-term value due to its reliance on high-energy mining processes and the lack of utility. As such, we believe BTC is best for short-term traders – investors with a long-term investment horizon may find better opportunities elsewhere.

What Experts Say on Whether You Should Invest in Bitcoin

Experts often weigh in on the debate of “Is now a good time to buy Bitcoin?” which tends to influence the minds of retail investors. This is understandable, as when a high-authority figure places their backing behind an asset, it’s likely that a sizable percentage of the investment community will follow what they are saying.

With that in mind, detailed below are three high-profile names that have discussed Bitcoin in the past, along with their thoughts on the coin:

Elon Musk

Elon Musk needs no introduction, as the CEO of Tesla (and the new owner of Twitter) is regularly in the headlines for a myriad of reasons. In 2021, Musk revealed that Tesla had invested significantly in Bitcoin. However, as reported by the BBC, Tesla has since offloaded 75% of its BTC holdings.

Whether this was to raise capital or because insiders believed Bitcoin was past its peak remains to be seen. However, Musk has stated in the past that he wants to see Bitcoin “succeed” and that he wouldn’t “dump” the coin.

Michael Saylor

Michael Saylor is the co-founder of MicroStrategy, a US-based business intelligence firm. Saylor is estimated to have a net worth of roughly $500m and is a strong advocate for Bitcoin. In fact, MicroStrategy has become the world’s largest corporate holder of Bitcoin, owning around 130,000 BTC at the time of writing.

Saylor has been quoted as saying that Bitcoin represents “the digital transformation of money, property, currency, energy & matter”. The entrepreneur has also stated that he believes BTC could be valued at more than $65,000 in the next four years, highlighting his bullish stance.

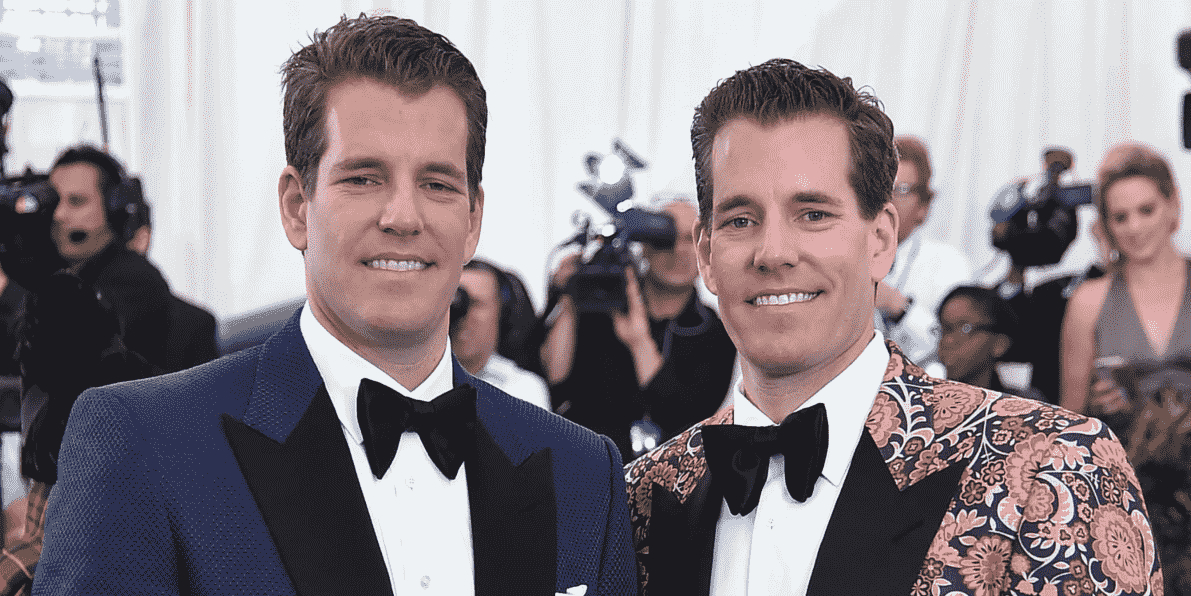

The Winklevoss Twins

Cameron and Tyler Winklevoss are best known for suing Mark Zuckerberg, claiming that he stole their idea for Facebook. However, the Winklevoss Twins have gone on to become prominent crypto investors and founded Gemini – one of the world’s leading crypto exchanges.

Tyler Winklevoss has been quoted as saying that “Bitcoin is better than gold”, whilst Cameron Winklevoss has stated that the coin has “a tremendous power of social good behind it”. Moreover, the Twins are reportedly one of the world’s largest BTC holders, owning around 1% of the total supply.

Where to Buy Bitcoin

Investors wondering, “Should I sell my Bitcoin – or should I buy more?” will need to partner with a reliable and low-cost crypto exchange to facilitate their trades. All top crypto exchanges will offer Bitcoin trading services because it is the most-traded crypto globally.

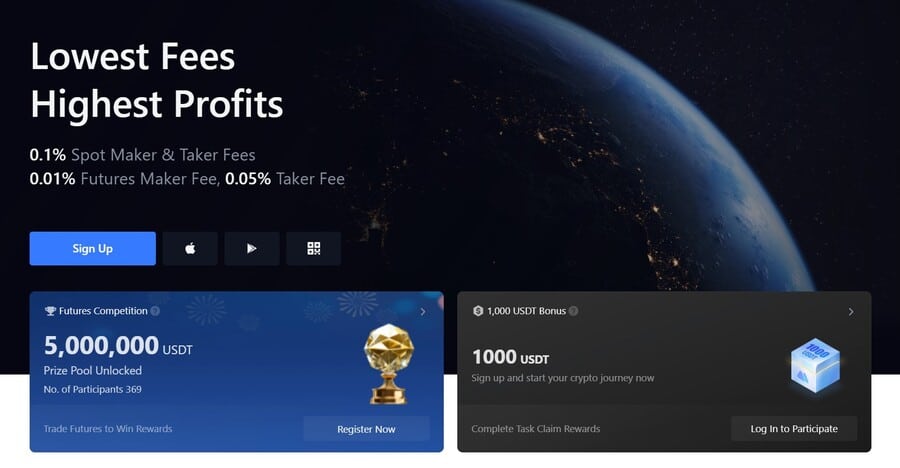

We’ve completed the necessary research and testing and found that MEXC is one of the best places for investors looking to get involved in the crypto market.

MEXC lets its users trade over 1,700 different tokens and coins, including Bitcoin and a selection of the best altcoins. When buying or selling crypto, users simply have to pay a 0.1% spot trading fee. And that’s the fee you will pay to buy Bitcoin on MEXC if you make a bank transfer deposit to your account.

If you decide to buy Bitcoin faster, MEXC will connect you with a third-party provider like Mercuryo where you can buy BTC directly with a card. This comes with slightly higher fees, but it’s the fastest way to get your hands on some Bitcoin.

Once you have the amount of BTC you want, withdraw it to your wallet. Keeping your funds on an exchange isn’t recommended, but if you want to keep your BTC there, you can lock it with MEXC Savings where you can get up to 1.80% annual percentage yield.

Should I Buy Bitcoin Now? Our Verdict

In conclusion, is Bitcoin a good investment? Like many of the best future cryptocurrency projects, Bitcoin’s value has decreased substantially over the past year due to adverse macroeconomic factors. Whilst sentiment towards the coin may have been bullish before, it certainly isn’t now.

In our opinion, Bitcoin undoubtedly still has a role to play in the crypto market’s growth – yet not as big a role as it has had previously. Bitcoin’s ‘first-mover’ status has paved the way for new and exciting projects to take centre stage, gradually pushing the coin towards the back of the pack.

The coin’s lack of utility and outdated validation process has made it difficult for the project to innovate and keep up with the likes of Ethereum and Solana. Moreover, there are now hundreds (if not thousands) of tokens that can facilitate decentralized payments, so Bitcoin’s ‘unique selling point’ (USP) is no more.

We do believe that Bitcoin can increase in value over the coming years since it is favored by financial institutions, meaning that it’ll likely be the go-to for investment products (e.g. ETFs) focused on crypto. However, retail investors looking to get rich off crypto are best looking elsewhere.

Bitcoin Alternatives

Now that we’ve provided our thoughts on the question of “Is Bitcoin a good investment?”, let’s look at some alternative coins.

Given the saturated nature of the market, finding the next big crypto can be challenging.

However, investors should consider that even should Bitcoin reach $100,000 in the next bull run – a figure that would require an incredible pump and huge volume – that would only represent a 4x ROI.

Nothing to be sniffed at, certainly, but there are other opportunities in the market to make larger gains, although they can come with larger risks.

Investing in top altcoins or new cryptos is a potentially lucrative way to earn ROI from crypto, as they can offer lower entry points and larger room for growth.

We would always recommend having a diverse investment portfolio that includes safer assets, such as Bitcoin, as well as some riskier ones. The sections below discuss a few alternative investments to Bitcoin. Both the cryptos are currently available to buy on presale.

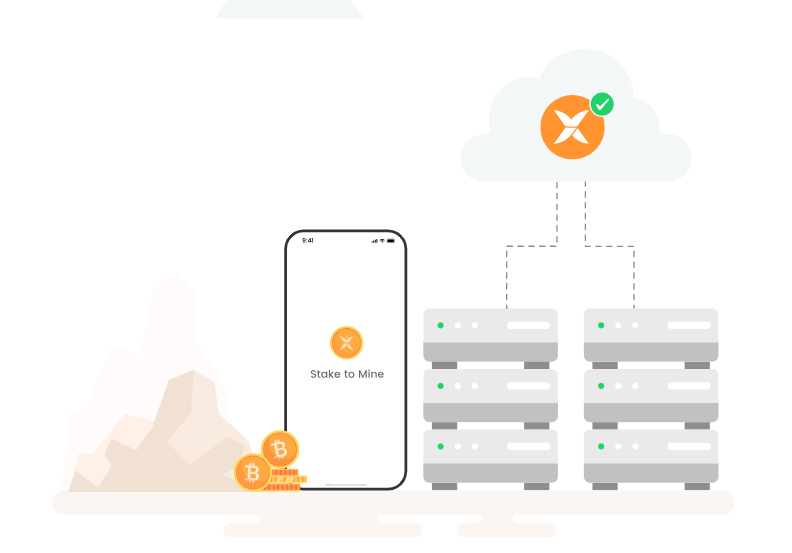

Bitcoin Minetrix – New Stake-to-Mine Crypto Offering 59% APY

Bitcoin Minetrix ($BTCMTX) is a new crypto ICO that has just launched but quickly raised more than $11.4 million.

It is the world’s first stake-to-mine project and allows token holders to enter into the ecosystem for just $10 and be part of a safe, secure and tokenized cloud mining project.

Traditional Bitcoin mining has become too expensive – due to the hardware required and soaring energy prices – for average investors to take part in.

Cloud mining has been a popular alternative but the market has become riddled with scammers, with high entry fees, fixed-term contracts that cannot be broken, and hidden fees that make it unclear how much BTC will actually be earned.

By tokenizing the process, Bitcoin Minetrix allows retail investors to mine BTC while also keeping autonomy and control by holding onto their tokens.

The project works by BTCMTX holders staking their tokens to generate cloud mining credits which can then be burnt for allocated cloud mining time – allowing a holder to earn BTC. The whole process is easily managed by a dedicated mobile app that is currently in development.

Token holders are also able to stake tokens to earn incredible annual percentage yield with the current APY at over 59% – although that will drop.

The ICO has only just launched and is already making huge waves in the space, with over $11.4 million raised. At the time of writing, $BTCMTC is priced at $0.0137 per token.

More information and the latest news can be found on Telegram and in the Bitcoin Minetrix whitepaper.

| Presale Started | September 5 2023 |

| Purchase Methods | ETH, USDT, BNB |

| Chain | Ethereum |

| Min Investment | $10 |

| Max Investment | None |

Is Bitcoin a Good Investment in 2024? Verdict

Despite its huge drop since its 2021 peak price, Bitcoin remains one of the safest and best cryptocurrency investments, especially for those with a long-term view.

Institutional investors continue to look at BTC as ‘digital gold’ with the likes of BlackRock and Fidelity – companies with trillions of dollars of assets under management – even moving to offer spot Bitcoin ETFs, showing their confidence in its future.

With the next Bitcoin halving due in April 2024, a major catalyst in previous bull runs, many consider BTC’s current price to be a discount ahead of future gains.

We would always recommend having a diverse portfolio that includes Bitcoin – a relatively ‘safe’ crypto investment – as well as some riskier projects that could outperform BTC. As outlined above, Bitcoin Minetrix is an alternative option that is more sustainable and more cost effective than investing in Bitcoin.

This cryptocurrency offers high staking yields, and provides holders with exposure to the lucrative world of Bitcoin mining.

Is Bitcoin a Good Investment? And Other FAQs

Is Bitcoin still worth investing in?

Bitcoin may still be worth investing in for those seeking exposure to the digital currency market. Although Bitcoin’s explosive growth may be a thing of the past, it has shown an ability to outperform other asset classes – making it a suitable option for risk-seeking investors.

Should I buy Bitcoin in 2024?

Is Bitcoin a good investment long term?

If Bitcoin were to be considered a good investment over the long term, we’d need clarity in the regulatory landscape. The rules around BTC are still unclear in many countries, which has stifled growth. If this were to clear up, we could see the sentiment around BTC become bullish once more.

Will Bitcoin go back up in 2024?

Nobody can ever say for sure if Bitcoin will go up or down. However, 2024 is expected to be a good year for Bitcoin, perhaps even the start of a bull run, as the next halving is due around April.

Can you make money from Bitcoin?

Yes – like all investment assets, Bitcoin has a value dictated by supply and demand forces. This means that if someone were to buy Bitcoin and the price increased, they could sell their Bitcoin holdings and make a profit.

References

- https://www.forbes.com/uk/advisor/investing/cryptocurrency/bitcoin/

- https://coinmarketcap.com/currencies/bitcoin/

- https://fortune.com/2021/04/25/bitcoin-btc-value-drop-use-case-currency-digital-gold/

- https://www.statista.com/statistics/326707/bitcoin-price-index/

- https://www.bbc.co.uk/news/business-62246367

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Nick Pappas

Nick Pappas

Eliman Dambell

Eliman Dambell

Eric Huffman

Eric Huffman

Kane Pepi

Kane Pepi