Iran Gov’t OKs Mining as Crypto Love-in Intensifies

An Iranian news agency claims that the country has given the green light to cryptocurrency mining, with more crypto-friendly measures and legislation to follow.

IBENA, which claims to be affiliated with the central bank, reported on September 4 that the bank and five major ministries have reached an accord on mining, which they all now “recognize as an industry” – although the government is yet to create any formal legislation pertaining to mining’s legality.

The same news outlet also claims the government is on the verge of issuing a “framework and final policies for trade and participation of startups and trade activists in the cryptocurrency sphere,” and that ministries hope to finalize their plans by September 22.

As previously reported on Cryptonews.com, Iran is reportedly eyeing cryptocurrency-related financial activities, including a possible digital fiat, as a way to get around American sanctions. The idea of using pro-crypto measures as a counter to American sanctions is one that that has also been adopted in Venezuela, and is now being mulled in Russia.

Iran banned all financial institutions, including banks and credit issuers, from dealing with cryptocurrencies in April this year, citing money-laundering concerns. However, IBENA has also reported that the central bank has been considering a reversal of the ban since August, and could even begin allowing cryptocurrency trading before the month’s end.

Financial Tribune, a Tehran-based newspaper, quoted Nasser Hakimi, the central bank’s deputy for innovative technologies, as saying, “It seems that after government consideration, [the] blanket ban will be reviewed.”

The economy of Iran is expected to maintain a steady growth of slightly over 4%, increasingly based on non-oil sectors, and fueled by a recovery in consumption and investment demand and overtaking the contribution of net exports, the World Bank estimated in April. In the medium term, inflationary pressures are likely to increase due to a widening output gap and further currency depreciation, pushing inflation into double-digit territory again. Also, poverty is estimated to have fallen from about 13% to 8% between 2009 and 2013. Poverty temporarily increased in 2014 to 10.5%, though this may be associated with a declining social assistance in real terms, according to the World bank.

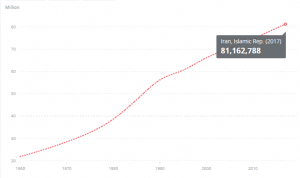

Iran population