How to Make Passive Income with Crypto – 4 Best Platforms

Disclaimer: The text below is an advertorial article that was not written by Cryptonews.com journalists.

When it comes to making a passive income, earning interest on savings deposits is the first thing that comes to mind. It has been around since the 18th century. However, it is the 21st century now, and there are more ways to make money while sleeping. This article introduces you to crypto staking and the four best platforms you can use to make a passive income if you own cryptocurrencies.

Crypto Staking Explained

If you are into cryptocurrencies, you know that you can buy and sell them, exchange them for fiat money or use them to pay for services and goods on the internet. But did you know that you can earn money even when not trading them?

Crypto staking refers to holding your digital money and earning interest on it. In a nutshell, it is the equivalent of keeping your fiat money in a savings account. Similarly, like in traditional banks, where your savings are put to use while you get paid a small portion of them in return, you can stake your cryptocurrencies. They will be locked in your account on one of the platforms, like AQRU which is considered one of the best in the industry. These platforms use deposited crypto assets for operating the blockchain and keeping it secure.

<<VISIT AQRU>>

While interests on savings in traditional money are typically small, sitting at 0.06% on average, crypto staking rewards are considerably higher, going up to 14% on some platforms. So, it comes as no surprise that staking has become popular among crypto enthusiasts as a way of making a passive income.

According to Staking Rewards, the leading data provider for staking tools, in May 2022, there were 227 yield-bearing assets, and an average interest rate was 10.94%. However, not all cryptocurrencies can be staked. For a cryptocurrency to be staked, it must be on the blockchain that uses the proof-of-stake consensus mechanism. Ethereum, Solana, Terra, Cardano and Avalanche are the top 5 crypto assets by staked value based on the list on the Staking Rewards website. There are various ways of approaching investments with bitcoin.

Top 4 Crypto Staking Platforms

Now that you know which are the best options when it comes to crypto assets for staking, let’s find out which are the best platforms where you can make a passive income on them.

1. AQRU

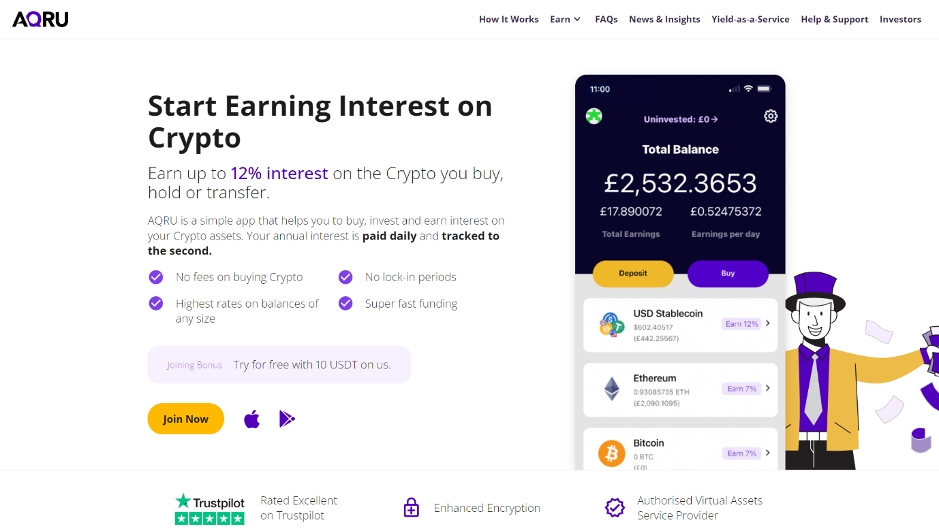

The first crypto staking platform on our list is AQRU. It is a simple app that helps you invest in crypto assets and offers up to 12% annual interest. If you join AQRU, you can earn an interest of 7% on crypto staples like Bitcoin (BTC) and Ethereum (ETH). At the same time, an interest rate on stablecoins, such as Tether (USDT), USD Coin (USDC) and Dai (DAI), is 12%.

The features that make AQRU one of the best options for crypto staking are no fees on buying cryptocurrencies and no lock-in periods. Once you join the platform and start earning on your crypto assets, your annual interest will be paid daily. New users will get a joining bonus of 10 USDT to try the platform out. You can also get a referral bonus of 75 USDT if you refer your friend. The good news is that both the referrer and referee get the bonus.

To start using AQRU, you have to create an account using the desktop version on your computer or the app you have installed on your mobile device. Then, deposit real money through a bank transfer or credit card or transfer crypto to your account. Neither bank transfers nor crypto transfers incur fees. The minimum deposit amount is USD 100.

As for withdrawals of your staking rewards, you can complete them within 24 hours in fiat or cryptocurrency. If you withdraw your earnings in fiat money, there will be no fees. On the other hand, crypto withdrawals incur a fixed fee of USD 20 charged in the crypto asset you are withdrawing. There is no minimum withdrawal amount, but you must cover the fee to cash out your staking rewards.

<<VISIT AQRU>>

2. Binance

Binance is a popular platform that offers two ways of earning interest on crypto: Locked-in Staking and DeFi Staking. The popular exchange offers a variety of options when it comes to crypto assets you can earn interest on. At the moment of writing this article, the platform supports 109 Locked Staking products. The list of DeFi Staking products is shorter, featuring 13 crypto assets in May 2022.

The biggest difference between Locked and DeFi Staking is the annual percentage yield (APY). Rates for Locked Staking are considerably higher, exceeding 100% on certain crypto assets for a lock-in period of 120 days. On the other hand, DeFi Staking offers lower interest rates. Still, this option allows you to earn rewards on more popular cryptocurrencies, such as Bitcoin, Ethereum and Binance USD, to name a few.

DeFi stands for Decentralized Finance, which refers to using smart contracts to provide financial services to users. If you opt for DeFi Staking, you can choose between a flexible and fixed lock of 60 or 120 days. The letter offers higher APYs, though. The minimum locked amount to start staking ETH and BTC is 0.001 and 0.0001, respectively.

3. Crypto.com

Crypto.com is another high-profile platform for crypto staking. Its Crypto Earn program supports more than 40 tokens, with interest rates of up to 14.5% per annum. So, for example, you can earn on staking Bitcoin and Ethereum an interest of 6% p.a. At the same time, an annual rate of 10% applies on USD Coin and other stablecoins.

The Crypto.com platform offers three holding term options to its users. They can choose from a flexible, 1-month or 3-month holding term. Annual rewards rates are higher if you opt for locked-in periods. Another option the platform offers is staking Cronos, its native cryptocurrency. Users who lock up CRO for a fixed term of 3 months will benefit from the highest interest rates.

The platform also offers the Crypto.com Private program tailored for the holders of its exclusive cards. They can benefit from various perks, including access to industry events and additional rewards. However, if you are from Hong Kong, Switzerland or Malta, you will not be able to use the Crypto.com App.

4. BlockFi

Another popular staking platform where crypto users can earn a passive income is BlockiFi, supporting the most popular virtual currencies and stablecoins. Users can benefit from APYs going to 11%, depending on the tier and crypto asset they stake. Some of the cryptocurrencies you can earn interest on include Bitcoin, Ethereum, Binance Coin, Litecoin, Dogecoin, etc.

To start earning on your crypto assets, you should transfer them from your BlockFi wallet to your BlockFi Interest Account (BIA). You will get paid the interest monthly. Furthermore, it compounds monthly, meaning that the interest in the next month will be based on your original amount plus the interest you have earned. Since there are no lock-in periods, you can cash out your crypto whenever you want. Unfortunately, the BlockFi platform is unavailable to US citizens as of February 2022.

Closing Thoughts

If you have decided to HODL your crypto assets, staking could be a great option to make a profit while keeping them. Choose one of the platforms given above and make your digital money work for you. Before transferring your crypto asset to them, study all the terms and conditions to make the most out of your membership.

While all listed platforms will provide you with a hassle-free user experience, keep in mind that investing in crypto involves risk. These assets are not governed by any institution. As such, they are unregulated and can be volatile, so make your investment wisely.

<<VISIT AQRU>>