How Are Bitcoin, Ethereum, Litecoin, BCH, BSV Hodlers Doing After the Rally?

The sentiment among investors in several major cryptoassets is on the rise, as a growing number of hodlers are seeing positive numbers on their account balance, on-chain analysis shows.

According to data from on-chain analytics firm IntoTheBlock, more holders of bitcoin (BTC), ethereum (ETH), bitcoin cash (BCH), bitcoin SV (BSV), and litecoin (LTC) are now sitting on profits from their crypto investments.

As defined by IntoTheBlock, holders that have a positive difference between the purchase price and current price are defined as being “in the money.” In cases where there is no difference, the holder is said to be “at the money,” while holders at a loss are “out of the money.”

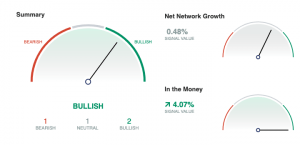

Bitcoin

For bitcoin specifically, a positive change of 4.07% in the number of wallets “in the money” shows that this asset is again producing profits for its holders, which contributes to the overall bullish rating that IntoTheBlock gives bitcoin.

Further, the underlying data shows that 75% of holders are currently (12:25 PM UTC) sitting on profits in fiat terms on their investment. Meanwhile, 19% are still “out of the money,” while 6% of holders are “at the money.” However, earlier today, when BTC was still above USD 9,000, 80% of the hodlers were profitable.

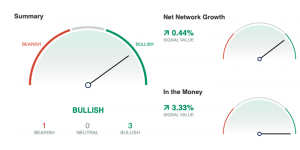

Ethereum

Out of the five biggest cryptoassets with on-chain data available, ethereum is the most bullish asset judging from the “In the Money” signal, with a positive change of 4.1% in the number of wallets with profits. Looking at the underlying data, we can see that 45% of holders in ethereum are currently profiting, while 49% are sitting on losses, and 6% are at break-even.

Ethereum also stands out as even more bullish than bitcoin from an on-chain analytics standpoint, largely due to a stronger “net network growth,” defined as the number of new addresses minus the addresses that go to zero.

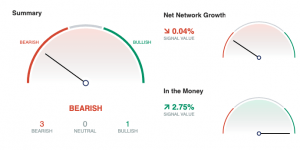

Bitcoin cash

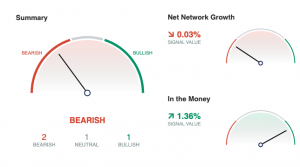

Moving over to bitcoin cash, we get a different picture, with an overall bearish rating being assigned the asset by IntoTheBlock. Again, the contributing factor is largely the negative network growth revealed by the analysis.

However, the large majority of bitcoin cash holders that are currently seeing a positive account balance, with 85% of holders being “in the money,” and 13% being “out of the money.”

Bitcoin SV

Bitcoin SV is largely reflecting the same situation as bitcoin cash, with a bearish overall rating, despite the fact that there is a growing number of holders that are sitting on profits. For this asset, however, IntoTheBlock’s data shows that there has been a large decline in the number of large transactions being made over the network, which has greatly contributed to the overall bearish outlook.

Based purely on the number of holders that are “in the money,” however, few assets can boast similar results as bitcoin SV, with a whopping 97% of holders currently in the green, the underlying data showed.

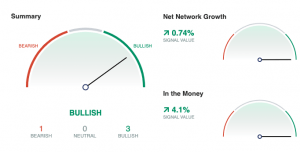

Litecoin

Lastly, litecoin is looking more like bitcoin from an on-chain analysis point of view, with an overall bullish rating thanks to strong growth in the number of holders that have profited from their investment. Interestingly, however, the “silver to bitcoin’s gold” differs in the way that a far lower share of the current holders actually have made money, with only 21% of holders being “in the money.” That leaves room for a large majority of 73% of investors, who are currently sitting on unrealized losses in their litecoin wallets, which is more than for any of the other assets we have analyzed.