Governments ‘Will Need to Respond’ to this Crypto Surprise by Bermuda

A big adoption news came to the Cryptoverse today as Bermuda, a British island territory with a population of c. 65,000 people, started accepting payments for taxes, fees and other government services in USD Coin (USDC), a U.S. dollar-pegged stablecoin, managed by major players in the crypto market, Circle and Coinbase.

This latest use case in Bermuda is a part of a broader initiative by that country’s government, says Circle, as its goal is to support the usage of USD-dollar backed stablecoins and decentralized finance protocols and services.

USDC can be used “in an incredibly diverse range of decentralized finance products and services,” thanks to building on popular public blockchains like Ethereum. Businesses and individuals in Bermuda will, therefore, be able to use all that comes with adopting USDC to this degree, including products for savings, lending, borrowing, securities offerings and trade finance, Circle explains.

Stablecoins are becoming an increasingly more popular option, but unlike projects like Facebook’s Libra which want to create entirely new global currencies, or countries like China which aim to have their own national currencies, “the broader crypto ecosystem continues to push ahead by building on existing, working public blockchains, and supporting major existing global currencies such as the U.S. dollar,” the announcement says, adding that governments across the world “will need to respond to this fundamental innovation, and this initiative from Bermuda builds on their broader leadership around crypto and digital asset policy and regulatory issues.”

Earlier this year, Circle received a license enabling the company to build products and operations in Bermuda that support a broad range of financial services built entirely on crypto and digital assets. Part of that license was permission to operate a payment system built on USDC.

In related news, Shyft Network, a developer of a decentralized credential verification protocol, said today that they are working on a blockchain-based national identity system in partnership with the government of Bermuda.

Meanwhile, USDC emerged last year, becoming another rival for the most popular stablecoin, Tether (USDT). In September this year, USDC celebrated its first anniversary, reporting that it has “established itself as the second most popular stablecoin in the world; it has unparalleled support from more than 100 companies across the global crypto ecosystem; and it’s the first stablecoin to reach USD 1 billion in issuance in less than a year.”

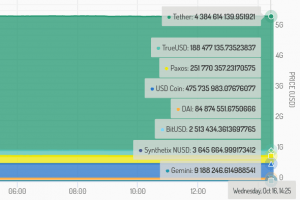

Stablecoins by market capitalization, USD

Additionally, when Circle and Coinbase partnered up, they also created the Centre Consortium, which is working to establish “a standard for fiat on the internet and providing a governance framework and network for the global, mainstream adoption of fiat stablecoins.” In June this year, it opened the stablecoin network for industry participation and broader membership.

__

Learn more: Is Stablecoin Business Model Stable Or Is It Endangered?