Freezing Russian Reserve Assets Marks End of Monetary Regime; Gold, Bitcoin to Rise – Arthur Hayes

The world’s current monetary regime effectively ended with the freezing of Russian foreign reserves by Western governments on February 26. In the new era, central banks will no longer save reserves in Western fiat currencies — instead, turning to gold and bitcoin (BTC) as their preferred reserve assets, according to former BitMEX CEO Arthur Hayes.

“The current PetroDollar / EuroDollar monetary system ended last week with the confiscation of the Russian Central Bank’s fiat currency reserves by the US and EU,” Hayes wrote in a lengthy essay published on Thursday titled Energy Cancelled.

The reason for this, Hayes said, is that as countries around the world see what happened with Russia’s reserves, they will no longer feel comfortable saving their reserves in currencies controlled by foreign governments.

He added that historians in the future will point to February 26 as “the date on which this system ended, and a new, currently unknown-to-us system sprouted.”

“A new neutral reserve asset, which I believe will be gold, will be used to facilitate global trade in energy and foodstuffs,” Hayes said about what he sees replacing the current US dollar-centered system.

He further explained that countries around the world “appreciate the value of gold” from “a philosophical standpoint.” Bitcoin, however, is not yet there – at least not in the West, the former exchange boss said.

“Human civilization is approximately 10,000 years old, and gold has always been valued as a monetary instrument. Bitcoin is less than two decades old. But don’t worry: as gold succeeds so will Bitcoin,” Hayes said.

Referring to two widely shared articles from the Wall Street Journal and Bloomberg that discussed the implications of freezing Russian central bank reserves, Hayes said the shift in global perceptions about the US dollar as a trusted asset “is so obvious” that even the mainstream financial press “completely understand what occurred.”

“[…] Rational countries with a capital account surplus must now save in another currency,” said Hayes.

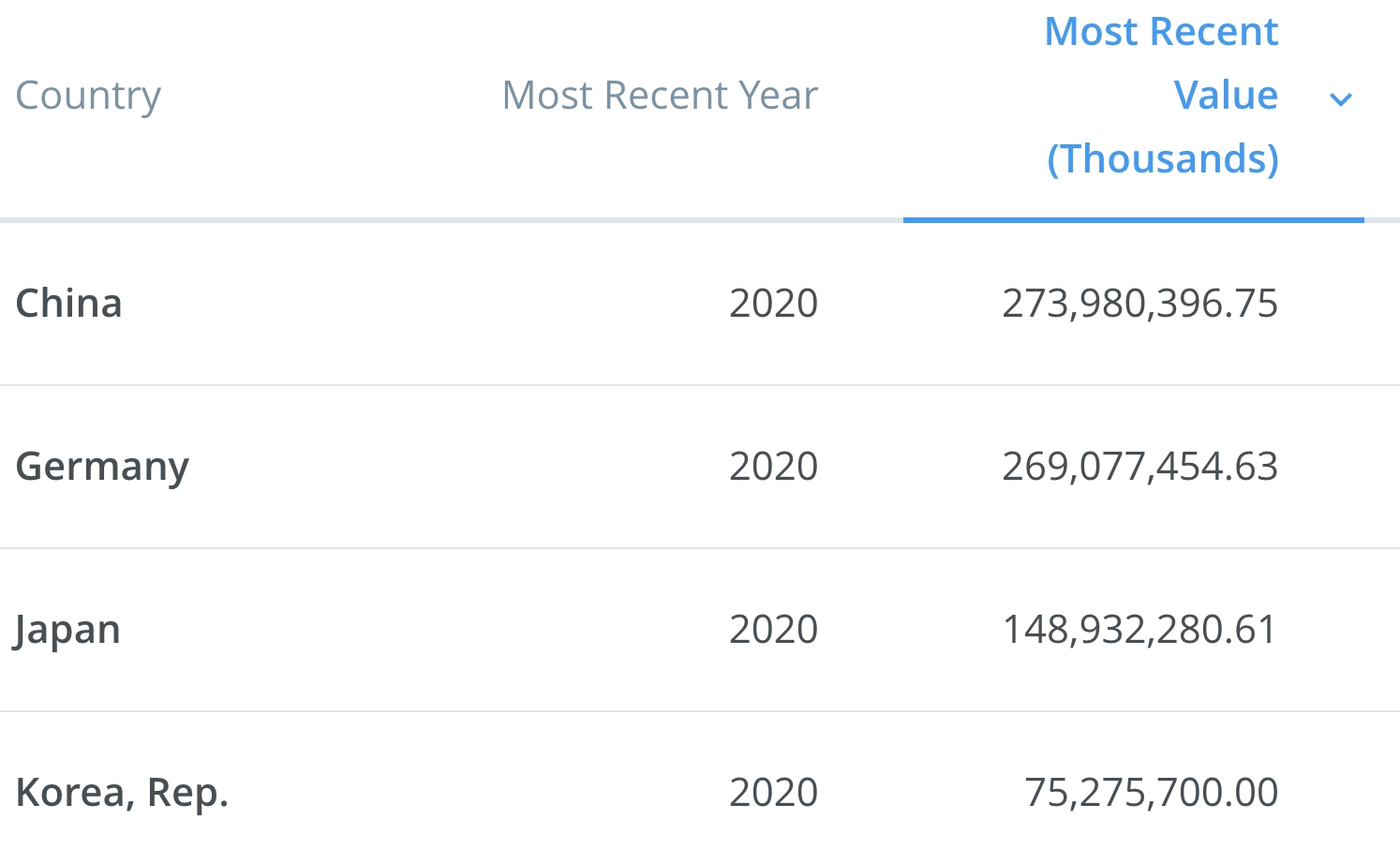

The key countries in this regard are the largest “surplus countries,” meaning countries that export more than they import. Among these, China is the biggest, Hayes said, referring to a World Bank ranking of the countries with the largest current account balances.

The largest surplus countries:

What China will do, according to Hayes, is not conduct international trade using gold or other commodities. Instead, it will continue to accept fiat currencies, before immediately exchanging them for a harder asset.

“Given gold is the hard money choice for humanity, China and others like it will begin to provide a sizable bid in the physical gold market,” Hayes said.

He went on to elaborate how this will play out in the gold market, arguing that the price of gold will “phase shift multiples higher than it is today,” Hayes noted, and that the competition among bidders will “push the marginal last price well north of USD 10,000” over the next decade.

And while gold still remains the preferred asset for the world’s central banks, Hayes argued that bitcoin will also benefit.

“As gold marches its way above USD 10,000, Bitcoin will march its way to USD 1,000,000. The bear market in fiat currencies will trigger the largest wealth transfer the world has ever seen.”

The convenience of Bitcoin

Meanwhile, commenting on the current cycle of rising interest rates that the US Federal Reserve (Fed) has started, Hayes called this “a theatrical performance about raising nominal rates.”

“Do not get distracted, it’s all about real rates. And they mathematically must remain deeply negative for many years,” Hayes wrote, referring to the interest rate that is received after adjusting for inflation.

The essay repeatedly referred to a concept brought up in a recent note by Credit Suisse strategist Zoltan Posar about “inside money” and “outside money.” Only the money that is truly controlled by the owner, such as physical gold or bitcoin held in non-custodial wallets, can be considered outside money, Hayes argued.

Learn more: Ukraine War Raises Questions About the ‘End of Monetary Regime’ and Role of Bitcoin

Further, the outspoken former trader and exchange CEO also argued that there is no reason other than a “historical precedent” for why central banks will buy gold instead of bitcoin. In fact, this is likely to change over time, Hayes said, arguing that “some central banks may tire of shipping gold around the world to pay for things.”

“They would rather conduct a small but rising amount of trade in a digital currency, which would naturally be Bitcoin.”

He added that a shift towards bitcoin would happen faster for the group of countries sometimes referred to as “the Global South,” which largely “lack the ability and access to trade and store gold efficiently.”

“El Salvador opened the door to this possibility, and many are watching how Bitcoinification of their reserves helps or hurts their economy,” Hayes wrote, before finally arriving at his price prediction:

“For a single Bitcoin, my unit is in the millions. For an ounce of gold, my unit is in the thousands.” […]“On a medium-term basis, it is time to back up the John Deere excavator and scoop up as much gold and Bitcoin as you can afford,” Hayes concluded.

____

Learn more:

– Market Cap of Gold-Backed Tokens Crosses USD 1B as Ukraine War Makes the Metal Shine

– Bitcoin vs Gold Debate Continues as Both Assets Rise Following Ukraine War

– Bitcoin Could Reach USD 100K in Five Years If It Takes on Gold – Goldman Sachs

– Arthur Hayes Tells Crypto Traders ‘It Pays to Wait,’ Stronger USD Coming

– Russia Sanctions Means Countries May Transition to Bitcoin Reserves – Pantera’s CEO

– Ukraine War and the Financial Markets: the Winners and Losers So Far