First Bearish Quarter For Crypto Market Since Q3 of 2016

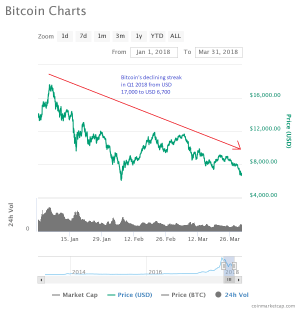

Bitcoin price closed the first quarter of 2018 on a negative note and trimmed most of its gains. BTC/USD traded as high as USD 17,140 in Q1 2018 before declining below the USD 8,000 support. There were a few altcoins which registered gains in Q1 2018.

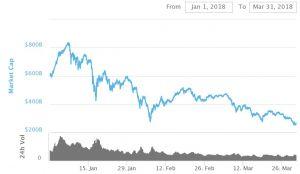

After growing for five consecutive quarters the total crypto market capitalization declined in the first quarter of 2018 from USD 600 billion to less than USD 270 billion. In January the capitalization even stood at USD 820 billion. Afterward, mainly regulation issues, Google and Facebook ban on crypto related ads, and China’s crackdown on bitcoin took the market by surprise and pushed it lower in Q1 2018.

Bitcoin started Q1, 2018 around the USD 14,000 level and jumped towards the USD 17,000 level. Later, BTC/USD started a major downside correction and traded below the USD 10,000 and 8,000 support levels to close the first quarter around the USD 6,700 level. Similarly, it was an overall bearish quarter for altcoins and most coins trimmed their gains and traded to new 2018 lows.

Bitcoin’s Performance in Q1 2018 and Q1 2017

Q1 2018 was definitely a bearish quarter as bitcoin price declined by more than USD 10,000. It started declining from well above the USD 17,000 level and broke a few important support levels such as USD 10,000 and USD 8,000.

The USD 6,500 support was tested two times in Q1 2018, and it seems like a decent support base is forming above the mentioned support.

When we compare Q1 2018 and Q1 2017, bitcoin price was mostly stable in Q1 2017. BTC/USD started near the USD 1,000 level with a high around the USD 1,250 level. Finally, the pair ended Q1 2017 flat near the USD 960 – USD 980 levels.

Conversely, Q1 2018 saw a lot of weakness and bitcoin price declined heavily (roughly by USD 10,000+).

Ethereum

Ethereum also followed bitcoin in Q1 2018. It started around the USD 775 level, jumped towards the USD 1,400 level before setting a top for a major downside correction.

ETH/USD closed the first quarter of 2018 on a bearish note and broke the USD 500 support. It even traded below the USD 400 level before finding support around the USD 380 level.

Q1 2017 versus Q1 2018 (ETH/USD) – Q1 2017 was one of the best quarters as ETH price jumped from the USD 7.50 level to well above USD 50.00 before closing the quarter just below USD 50.00. In contrast, the price declined more than 50% in Q1 2018 and trimmed most of its gains.

At the moment, the price is finding strong bids near the USD 350 – USD 360 support. Buyers need to gather momentum to push the price above USD 450 and USD 500 to start a fresh upward wave. A failure to break the USD 500 resistance may bring more losses to Ethereum in Q2 2018.

Bitcoin Cash, Ripple and Other Altcoins Market

Bitcoin cash and ripple followed a similar pattern and declined heavily in Q1 2018. At the outset, BCH/USD must stay above the USD 600 support to stage a comeback. Similarly, XRP/USD should stay around USD 0.50 to avoid a slide back towards USD 0.30.

A few very low cap altcoins such as MNC, DPC, ONG, ECN, SWP and ARG registered gains in Q1 2018, whereas most others declined (note – investing in very low cap coins is even more risky risky).

Overall, Q1 2018 was mostly bearish as the cryptocurrency market lost more than 60% of its overall value. Going forward, there are a few positive signs emerging, but it would take a brief period of consolidation before prices stage a recovery.