eXFi Review – Web3.0’s Decentralized Derivative Exchange

Disclaimer: The text below is an advertorial article that is not part of Cryptonews.com editorial content.

eXFi is a last-generation decentralized derivatives trading platform launched in 2022 that offers up to 100x leverage for all trading pairs. eXFi offers deep liquidity, simplistic user interface, multiple collaterals and advanced risk management for their users, while allowing for enhanced privacy.

eXFi built on Layer 2 for fast order fulfillment and low gas fees. Users can place large orders with the best possible prices without KYC and stay in full control of their private keys.

Table of Contents:

- User Interface

- Deposits and Withdrawals

- Trading Pairs

- Leverage

- Fees

- Security

- Decentralized Features

- Most Asked Questions About eXFi

- eXFi Beginner’s Guide

| Pros: | Cons: |

| Decentralized Exchange | Limited amount of trading pairs |

| Up to 100x adjustable leverage | |

| Dedicated Live-chat Support | |

| Stop Loss & Take Profit Orders Available |

User Interface

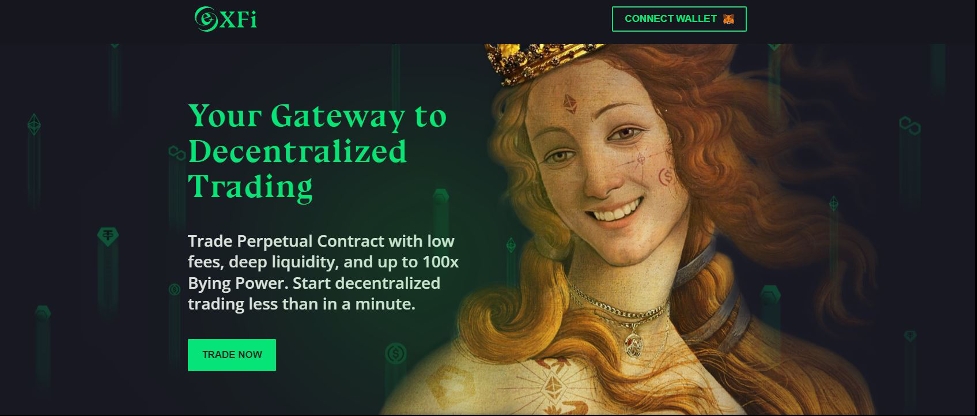

The eXFi user interface is intuitive and combines all the advantages of a CEX with those of a DEX. At the top of the screen is a quick access bar to all available pairs for trading, which allows users to quickly switch between different pairs by interacting with it.

In the middle of the screen is the trading chart, which contains all the charting tools a trader might need to do their technical analysis.

On the right side is the order submission window, which is the helm of any trader when interacting with any kind of trading platform. It is designed with clarity in mind and allows you to enter your order size in US dollars or using percentages of your balance, a leverage slider and buy/sell buttons.

Below is the order information window. It displays all outstanding, fulfilled, and current orders as well as your order history.

eXFi is one of the most transparent derivatives exchanges when it comes to order information. All order specifications are always available to the user, including opening timestamp, margin used for the trade, open price, last price, expected liquidation price, take-profit and stop-loss prices, commissions paid, funding fees, unrealized and realized pnl and return on investment.

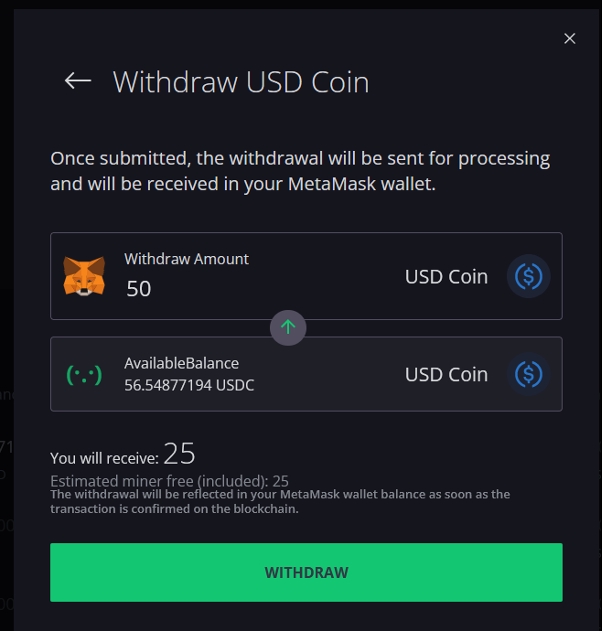

Deposits and Withdrawals

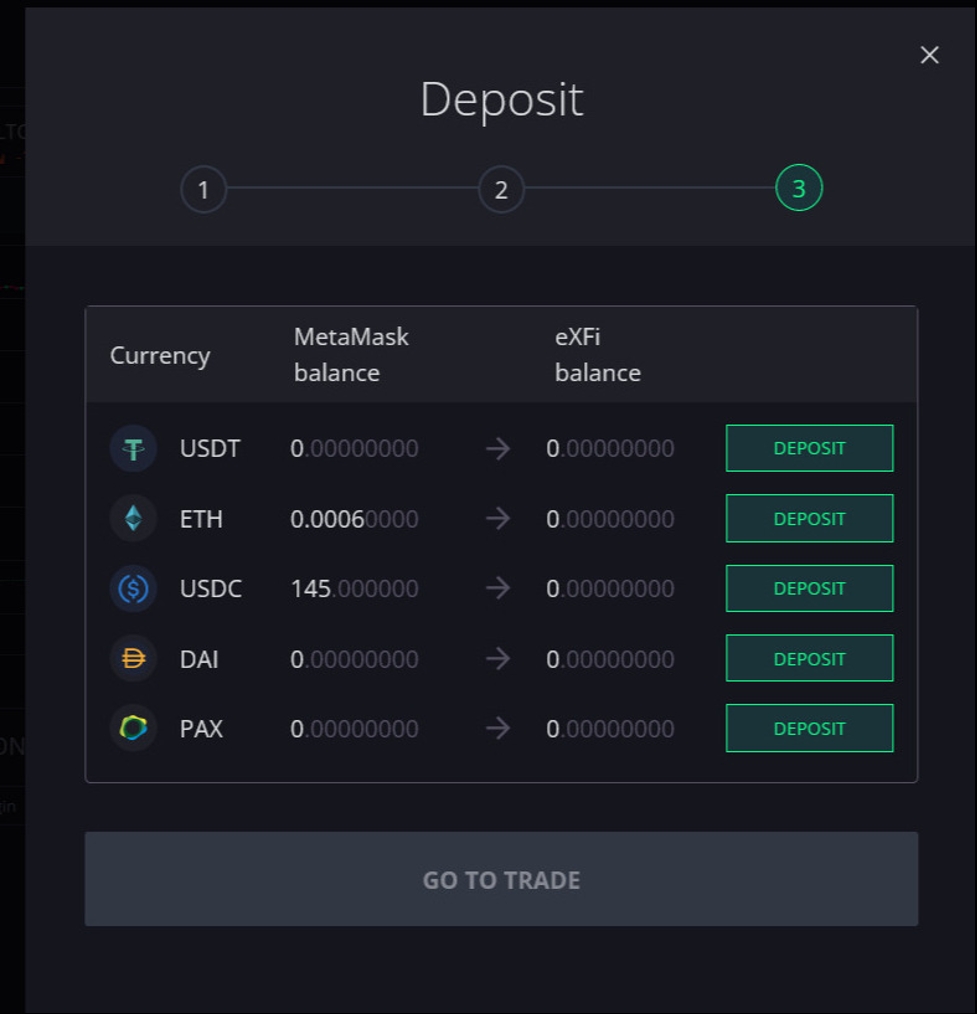

eXFi differs from regular cryptocurrency derivative exchanges because it is DEX, which means you will hold custody of your private keys and will not hand over your data when opening an account.

To fund your account and start trading, simply go to your “Wallet” page and interact with the protocol to allocate enough balance to use as margin when trading on the exchange.

eXFi has no deposit fees, and withdrawal fees are on par with industry averages.

Users can deposit in USDT, MATIC, DAI, USDC, LINK, WBTC, PAX and any other erc20 token listed on the trading platform.

Trading Pairs and Collateralization

eXFi offers a good hand selected bucket of trading pairs, albeit slightly limited, all of them are proven cryptocurrency coins and tokens that are liquid and volatile enough to be worth trading on.

Some of the cryptocurrency trading pairs available on eXFi include BTC/USD, ETH/USD, XRP/USD, LTC/USD, EOS/USD, ADA/USD, SOL/USD, UNI/USD and the list keeps on growing as the exchange adds more trading pairs on a regular basis.

An unique feature of eXFi is the ability to trade all trading pairs without the need to own any of the underlying assets, meaning you can open trades in ETH/USD while using LINK as margin collateral on your trades, allowing you to settle all trade outcomes in LINK even though it is completely unrelated to ETH/USD.

Leverage

By using leverage, traders can significantly increase their trading profitability. Leverage allows you to “borrow” assets from the exchange and execute trades at larger quantities than you normally would in spot trading, while maintaining a funds requirement proportional to the leverage used.

As an example, let’s imagine that the price of 1 Ethereum is 1000 USD, a long ETH/USD position would normally cost you 1000 USD to execute, while using 10x leverage you could open the same trade with 100 USD in your account.

eXFi allows you to use up to 100x adjustable leverage on all trading pairs, meaning you can unwind on any trading pair that is listed on the exchange.

Leverage often also gives you the opportunity to short sell. If you believe an asset is bound to go down, you can borrow it, sell it, then buy it back at a lower price and pay back the borrowed amount, leaving a profit on the difference between the price you sold at and the price you bought back.

Keep in mind that using leverage involves risks and should not be taken lightly, but rather with caution as it may result in a loss.

Liquidity

Liquidity is often overlooked when choosing an exchange and sometimes causes consternation for consumers when the markets they trade on turn out to be illiquid, leading to price sways and slippage. eXFi excels in terms of liquidity by aggregating it from multiple exchanges, allowing you to stay calm even when executing the largest orders.

In this way, slippage is kept to a minimum and market prices that never deviate from the global average are guaranteed, meaning that the market price you see when you press the long or short button is certainly the price at which the order will be placed and opened.

Fees

Trading fees on eXFi are currently the lowest on the market at 0.019% for market makers and 0.060% for market takers. Refer to the table below for detailed information on the fees for some of the trading pairs listed on the exchange.

| Trading Pair | Market Makers | Market Takers |

| BTC/USD | 0.019% | 0.060% |

| ETH/USD | 0.019% | 0.060% |

| XRP/USD | 0.019% | 0.060% |

| LTC/USD | 0.019% | 0.060% |

| ADA/USD | 0.019% | 0.060% |

| EOS/USD | 0.019% | 0.060% |

| UNI/USD | 0.019% | 0.060% |

| SOL/USD | 0.019% | 0.060% |

Compared to other derivatives exchanges, be it centralized or decentralized, eXFi offers the lowest fees on the market on some of the most sought-after trading pairs such as BTC/USD, ETH/USD, XRP/USD, SOL/USD, LTC/USD, UNI/USD.

Security

eXFi offers security on par with the highest industry standards, consisting of multi-layered security protocols and round the clock auditions performed by placing amongst the top decentralized exchanges when it comes to safety for the user.

Some of the features include:

- SSL Encryption for all data transferred between your devices and the eXFi servers

- Real-time monitoring

- DDoS protection

- Ability to link your email account to your eXFi account

Is eXFi a scam?

To date, there are no reports that eXFi is a scam. The platform remained stable during our extensive testing and performed great under load.

Decentralized Features

In the ever-evolving world of cryptocurrencies, derivatives play a huge role in market movements. So far, dozens of security breaches have been recorded on other exchanges and user data has been stolen and/or lost, along with users’ funds and identities being constantly at risk from hacker attacks.

A cryptocurrency exchange is only as secure as its weakest link, and for this reason decentralized exchanges have started gaining traction, simplifying the process while allowing the user to remain private.

eXFi is built with decentralization, scalability and user experience in mind. Some of the prominent features on eXFi include:

- The ability to remain in control of your private keys

- Anonymously trade with up to 100x leverage

Beginner’s Guide on eXFi

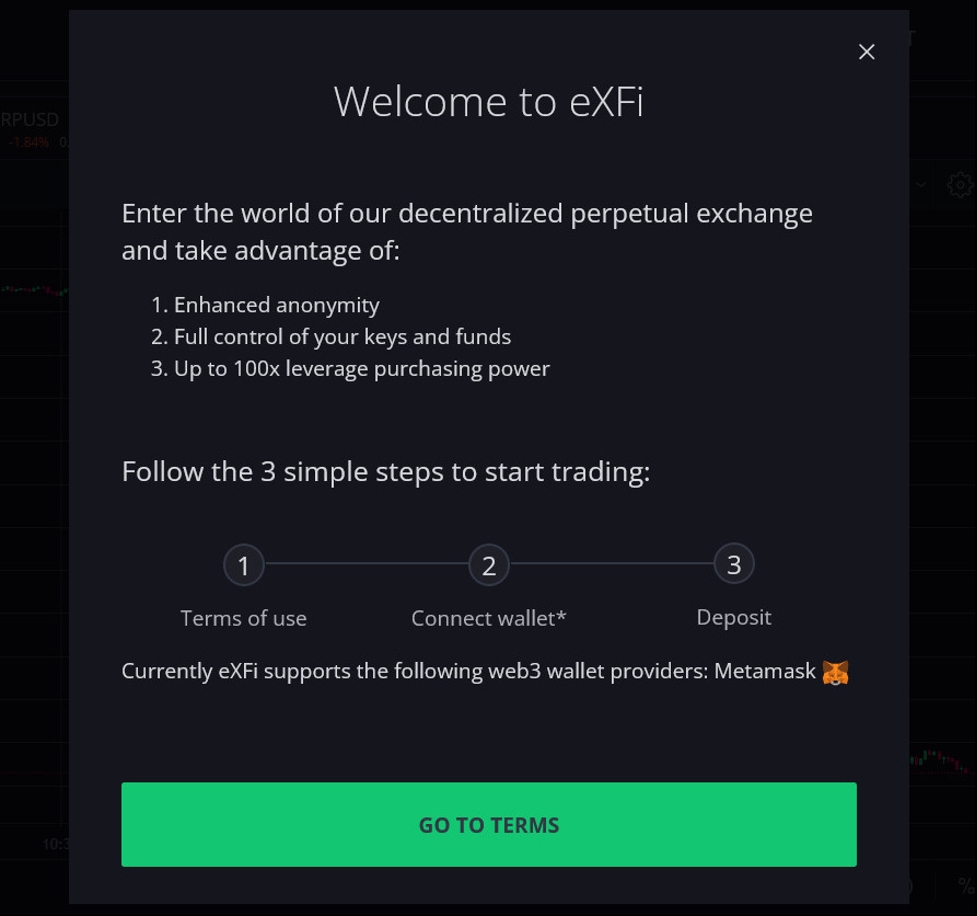

1. Head over to eXFi.trade

2. Click on “Trade Now” or “Connect Wallet”

You will be redirected to the eXFi trading application where you click on “Connect Wallet” located in the top right corner of the browser window.

3. Once you click “Connect Wallet,” a pop-up will appear prompting you to read the terms and conditions and complete connecting your MetaMask wallet to eXFi.

4. After completing the steps above, you can head over to the “Wallet” page and fund your margin account with enough collateral and begin executing trades immediately.

Once your transaction is completed on the blockchain, head over to the “Trade” page, and begin trading.

5. And last, but not least, to withdraw your margin from eXFi, head over to the “Wallet” page, select the coins you’re going to withdraw back to your MetaMask wallet and complete your withdrawal.

How to Open an Account with eXFi?

You don’t need to open an account. eXFi is a decentralized derivatives exchange, meaning you can simply sign-in with your metamask wallet and get right on trading without the need to fill-in personal information.

Does eXFi allow short selling?

Yes. eXFi is a decentralized futures exchange, allowing users to go long or short on various cryptocurrency trading pairs with the use of leverage.