EU May Tighten Grip on ICOs

As financial regulators in the European Union are expressing concern that their initial “hands-off” approach to initial coin offerings (ICOs) is not working, EU and national regulators are now moving to the opposite end of the spectrum by assessing ICOs on a “case-by-case” basis.

Steven Maijoor, chair of the European Securities and Markets Authority (ESMA), reportedly said he is looking into how ICOs affect competition in “the wider capital raising sector,” and that he is now examining ICOs individually to find out how these token sales can be covered by the existing regulatory framework, Reuters reported.

Meanwhile, chair of the European Banking Authority, Andrea Enria, reportedly told EU legislators that the laissez faire mindset that the authority previously held with respect to ICOs “is not working as expected,” while adding that “more regulation at the European level could be warranted.”

“Consumer warnings don’t seem to be sufficiently effective in raising awareness among consumers that there is a lack of safety net for these investments,” the top regulator warned.

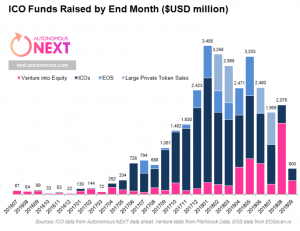

In September, a Belgian economic think-tank named Bruegel – which advises governments on regulatory issues – suggested that financial authorities should make European companies meet certain criteria if they are to issue ICOs. It is estimated that ICO funding originating in the EU currently accounts for 30% of the worldwide market.

Despite the currently depressed market for ICOs, European regulators seem to believe that more regulation is necessary to curb speculation in the new asset class. However, the regulation of the crypto world is a very complicated task, while some even doubt that it could be regulated at all. One of the main problems is the lack of clear definitions, while the tokenization of assets, competition between countries, and different regulatory approaches makes this even more challenging.

Lithuanian representative to the European Parliament and backer of Cryptonews.com, Antanas Guoga, recently said that politicians will have to “live with” the fact that they may not have “much say” over the development of cryptocurrencies.

Earlier this month, the European Parliament voted in favor of a resolution on distributed ledger technologies dubbed “Building trust with disintermediation,” which calls for “progressive and innovation-friendly regulation.”