Ethereum Transaction Fees Rise Further, Gap with Bitcoin Narrows

As transaction fees on the Ethereum (ETH) blockchain continue to rise, some are warning that the network’s competitors may benefit if the issue is not dealt with. Meanwhile, the gap between the number 1 and number 2 coins by market capitalization got a lot narrower – as the former’s fees dropped significantly since the May highs.

With their latest surge, Ethereum fees have to an extent reached towards the infamously high bitcoin (BTC) transaction fees.

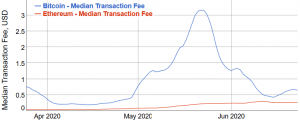

The closing of the gap in fees between the two networks became notable after bitcoin fees started to drop sharply around May 20, data from Bitinfocharts shows.

Ethereum and Bitcoin median transaction fees, USD, 7-day simple moving average

On June 23, the median transaction fee on the Ethereum network (raw values) stood at USD 0.341, versus USD 0.635 on the Bitcoin network.

Meanwhile, the 7-day moving average chart for the same day shows ETH fees at USD 0.271, and BTC fees at USD 0.646.

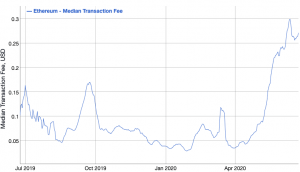

Ethereum median transaction fee, USD, 7-day simple moving average

The sharp rise in fees for the network has even led some people to argue that scalability issues and high fees on Ethereum may drive users and dApp developers to other smart contract platforms. Among these people is managing partner at Blocktown Capital, Joseph Todaro, who posted on Twitter that Ethereum competitors may get more attention as a result of the surging fees.

On the positive side, many Ethereum fans are pointing to the upcoming Ethereum 2.0 upgrade of the network as a solution to the scaling issues. And as stated by Ethereum co-founder Vitalik Buterin, development of the upgraded version of the network is “on track,” with a possible release sometime in the third quarter of this year.

Still, some argue that there are fixes that could make an impact faster than waiting for Ethereum 2.0.

As explained by SetProtocol product marketing manager and co-founder of EthHub, Anthony Sassano, in his recent The Daily Gwei newsletter, miners can – and do – vote to increase the block gas limit on the network.

However, one could also say that increasing the block gas limit is just kicking the can further down the road, as this increases the size of the Ethereum blockchain itself, which is another challenge the network has struggled with.

Indeed, the latest rise in Ethereum fees is not the first time the community has voiced concerns about the issue. The same also happened back in May, when community members complained about sharp rises in both bitcoin and ethereum transaction fees.

At pixel time (14:00), Ethereum is trading at USD 239. It dropped 1.39% during the last day and appreciated 2.68% in a week. Meanwhile, Bitcoin is changing hands at USD 9,407, having dropped 2.57% in a day and 0.61% in a week.

__

Learn more: Bitcoin and Ethereum Networks Hit All-Time Highs