DeFi on ‘Tesla’s Path’ as Tokens Skyrocket On Hopes, Not Results

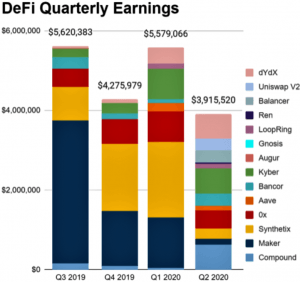

Decentralized finance (DeFi) earnings took a downturn in the second quarter of 2020, but DeFi tokens are rocketing to new highs thanks largely to yield farming – suggesting DeFi could become the financial industry’s answer to Tesla.

American electric card producer Tesla is famously valued at around USD 268 billion by investors, despite the fact that it is yet to turn a profit. And DeFi could be the finance industry’s growth engine for the industry 4.0 era.

According to the Bankless program’s token report for Q2, the similarities are striking.

The report’s authors wrote,

“Tesla doesn’t even post positive earnings while other major tech companies like Netflix are also boasting […] [price-to-earnings or PE] ratios in the low hundreds. That’s because the PE ratio is all about future growth potential. DeFi is on a similar path. The future is not heading in the direction of more banks. It’s less banks.”

They added that the sky appears to be the limit for digital finance, and DeFi in particular, writing that “these are early-stage digital technologies for a completely open and transparent financial system accessible by anyone in the world. There’s no shortage of future growth potential.”

Bankless stated that as numerous prominent DeFi protocols are valued at less than USD 500 million and show PE ratios in the low hundreds, the industry is hardly “scratching the surface” of its future growth potential. As such, weaker quarterly results are unlikely to disrupt the flow of investors into DeFi, they concluded.

The authors stated that the actions of two companies in particular were likely to have skewed Q2 figures somewhat. They said,

“In Q2, DeFi protocols took a downturn in revenue as earnings fell by -42% from the last quarter. This was largely due to MakerDAO shifting towards 0% SF [stability fee] and DSR [dai savings rate] environments as the protocol scrambled to return DAI’s peg back to its rightful place amid Black Thursday volatility in late March.”

The other major contributor to the decrease in Q2 DeFi earnings, said the authors, was Synthetix (SNX). They expanded,

“As we mentioned in earlier pieces, [the company] was suffering from front-running attacks that disproportionately reported earnings for the derivatives protocol.”

The downturn in earnings did not really put a dent in DeFi token performance from April to June 2020, as, on average, DeFi assets rose by 199% in the second quarter, largely outperforming both ethereum (ETH) and bitcoin (BTC). The two leading tokens expanded by 70% and 43%, respectively, according to Bankless.

There were also some stunning rises among the statistics. The authors noted,

“The best performing DeFi asset in the quarter was Bancor’s BNT as the token surged 546% following the announcement of the liquidity protocol’s V2 upgrade.”

They also pointed to Aave’s LEND. In Q2, it rose by 514% while the “protocol simultaneously increased its value locked from USD 30 million to over USD 120 million by the end of June,” they continued.

Another Q2 report on DeFi, compiled by crypto research company TokenInsight, pointed at the growth in DeFi user numbers this year.

The TokenInsight report’s authors wrote,

“The [number] of users in DeFi … experienced a consistent increase, from nearly 100K at the beginning of the year to more than 230K by the mid- year end, indicating a robust growth of the DeFi ecosystem from the view of the user activities.”

TokenInsight concluded that compared to the conventional finance industry, the DeFi ecosystem “is still rather small but is rapidly gaining traction.”

However, a recent report by ConsenSys said that while yield farming has taken the DeFi scene “by storm” of late – but has failed to bring large amounts of new people to the DeFi table, and has done little to help the “DeFi community grow beyond its current borders.”

___

Learn more:

DeFi Faces Multiple Challenges On Its Way To Dominate Crypto

Value Locked In DeFi to More Than Double in 2020 – Spartan Capital’s Koh