DeFi Goes Through Its Own Major Turbulence

The crypto market crashed, and the total value locked (TVL) in decentralized finance (DeFi) is not here for it. Nonetheless, it bounced back.

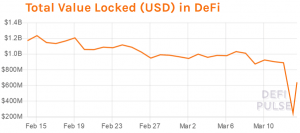

TVL crashed 62% today, from USD 649.497 million to USD 244.398 million, before recuperating to where it currently (UTC: 10:24) stands: USD 641.6 million, according to DeFi Pulse.

Nonetheless, this is a far cry from its recent glory days. TVL hit a milestone of USD 1 billion on February 7 this year, going as high as USD 1.235 billion eight days later. It stayed between that number and USD 900 million all the way until March 9, when it fell to USD 873.606 million. After shortly staying in the USD 800 – USD 950 million range, this recent crash happened.

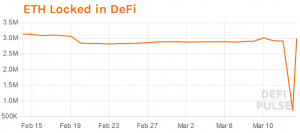

But that’s not all the turbulence DeFi is experiencing today. After stagnating at c. ETH 2.8 million locked in DeFi for the most part of the last thirty days, this value crashed as well today: a whopping 77%, from ETH 3.03 million to just ETH 686,338. It bounced back since, currently standing at 3 million ETH.

While BTC locked in DeFi has had a much more gradual decline and only a 0.84% drop in three days, DAI locked in DeFi crashed with USD and ETH, in its case 89%, before recuperating swiftly, now standing at DAI 61.1 million.

MakerDao faces issues

The sudden and massive drop in the price of ETH has had a major impact on applications built on Ethereum. Given its prevailing dominance, MakerDao, a decentralized lending facility built on the Ethereum blockchain and the creator of DAI, is the largest of such applications, and even it is facing trouble in the light of this price drop. Besides the dramatic price drop, a Maker oracle couldn’t catch up to provide accurate prices, plus there was a rapid increase in gas prices and devaluation of collateral, as MakerDao’s blog post says.

Now the foundation and the community are discussing what to do next. Even an emergency shutdown was suggested, but it seems that it’s “not being considered as an immediate option.” However, the community has been invited to vote today, so to adjust the parameters in case the situation repeats itself. There are several options to vote on, as stated in the blog post, and these include: lowering the DAI savings rate, setting SAI (Single-Collateral Dai) stability fee, giving more time for liquidation auctions, and setting a governance delay module.

Furthermore, Compound, a protocol for algorithmic money markets on the Ethereum blockchain, has announced changes meant to combat the volatility, which will be activated only if necessary:

- a new price feed that allows DAI to become unpegged from USD 1 in a MakerDAO emergency shutdown

- options to boost the liquidation incentive from 5% to 8% or 15%, which would apply to all markets.

Meanwhile, the founder of crypto lender BlockFi, Zac Prince, stated that “in extremely volatile markets, we generally see heightened activity across our product suite (trading, USD loans, crypto lending, and interest accounts),” adding that all their systems and product continue to operate normally, despite the Covid-19 outbreak and the market crash.

Blockchain consultant Maya Zehavi, however, listed what she says are four known risks in DeFi that appeared in the markets at the same time, discussing the potential future of DeFi projects:

Meanwhile, Opendime and ColdCard founder Rodolfo Novak (aka @NVK) commented that bitcoin-backed loans (borrowing money with bitcoin as collateral) are liquidated, adding that loans and credit are a “fantastic tool for efficient capital allocation,” but that “people need to know how to use them properly.” Replying to a comment by Francis Pouliot, CEO of BullBitcoin and founder of Cyphernode, that this is not a good thing as “Lots of people were using this as a conservative long-term 2x long on bitcoin to avoid having I just got fucked,” Novak argued that “There is no good and bad, just the market,” and that people “will change strategies on the next go-round.”

As reported, the crypto market went red yesterday, and it has still not recovered, though trying to do so. BTC is currently trading at USD 5,655, having dropped 22% in a single day and 38% in a week.