DeFi Extravaganza: DeFi Exceeds USD 6B, Curve Drops and YFI Rises

After yet another eventful weekend in the fast-paced world of decentralized finance (DeFi), the surging popularity of DeFi protocol Curve, as well as a fast-growing “valueless” token, followed by a poll revealing that many crypto investors have no clue about DeFi, are catching the attention of traders.

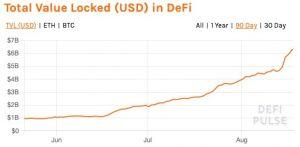

Following the weekend DeFi craze, the total value locked in the entire DeFi ecosystem has now surpassed USD 6 billion, to reach a record level of USD 6.34 billion, according to tracking site DeFi Pulse. The record amount is up by a whopping USD 1 billion since last Friday, in what is just a continuation of an exponential growth in capital allocated to earning yields from DeFi protocols.

However, it’s not just the amount of money locked in DeFi protocols that is rising quickly. The same also goes for the market capitalization of those protocol’s native tokens, often referred to as ‘DeFi tokens,’ which have now reached a combined market cap of USD 15.6 billion, with Chainlink (LINK), Synthetix (SNX), Aave (LEND), and Maker (MKR) leading the pack, per Coingecko.

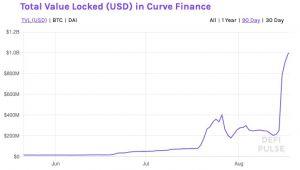

Meanwhile, Curve, the decentralized exchange that is currently ranked as the 3rd largest DeFi protocol by total value locked, reached a new milestone today with USD 1 billion in locked value on its platform.

The new all-time high comes after a weekend of outstanding growth for the protocol, rising from USD 254 million in total value locked on Friday, to the aforementioned USD 1 billion today.

Further, the huge growth also comes as the protocol launched its own native token, the Curve DAO Token (CRV), which enables so-called vote locking on the platform. The process of vote locking involves locking up CRV tokens to accumulate voting power, and in turn multiply the CRV rewards a user can receive by 2.5 times.

The entire process of how to go about vote locking on Curve has been laid out and explained in detail by the Curve Finance team here.

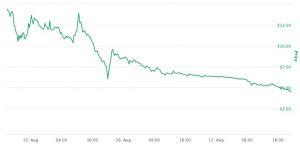

Unfortunately for early buyers of the new token, however, the launch did not receive the warm welcome in the market that many had probably hoped for. Starting on the launch day on Friday, the token price fell from USD 15.05, to USD 8.77 on Saturday, and to a new low of USD 4.40 at 14:54 UTC today, a loss of about two thirds of its price in just one weekend.

As a reminder, the governance token CRV of Curve, exchange liquidity pool on Ethereum (ETH), was launched prematurely by an anonymous developer, with Curve adopting it to the surprise of many – a move that wasn’t welcomed by many people within the Cryptoverse who had been anticipating the token’s launch.

While some drop, others rise

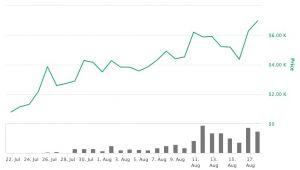

On a more positive note, the native token of another popular popular DeFi protocol, namely yearn.finance’s YFI token, saw a strong rise in its price over the weekend, jumping from a price of USD 5,142 on Friday, to a current price of USD 7,992.

Launched as recently as July, the YFI token has seen a significant rise in price during its life, and is currently ranked 59 in terms of market capitalization, according to Coinmarketcap.

Interesting to note is that the recent price growth for the YFI token comes despite the team behind the token openly saying on its blog that the token “is completely valueless.” According to the same blog post, the token was released in an effort to give up control of aspects of the protocol from the team and to the community “mostly because we are lazy.”

“We re-iterate, it has 0 financial value. There is no pre-mine, there is no sale, no you cannot buy it, no, it won’t be on uniswap, no, there won’t be an auction. We don’t have any of it,” the team wrote.

Yet, the token is traded on, among other exchanges, Binance, where it is up by more than 40% in US dollar terms since it started trading a week ago.

While DeFi might be the future, it appears that many still know nothing about it

Speaking of Binance, which is one of the largest centralized exchanges, its CEO Changpeng Zhao, revealed in an interview on the Boxmining YouTube channel last week that he sees DeFi as “a really innovative space” that they are “very supportive of.”

“Today the majority of users still choose a centralized exchange because it’s much easier to deal with an email and password and have customer support, than saying do a backup of your own keys and if you lose it you’re screwed,” the exchange CEO said, adding: “I do think in the future, if we can make the secure backup easier and useable, I think DEX is going to be the future.”

And although the DeFi train continues to move at an ever-faster pace, it still appears to have a long way to go before widespread participation from crypto investors will be achieved. A recent poll conducted by portfolio management software Blockfolio revealing that 32% of the app’s users have no idea what DeFi is.