Crypto Market Sentiment: Slight Rise within the Neutral Zone

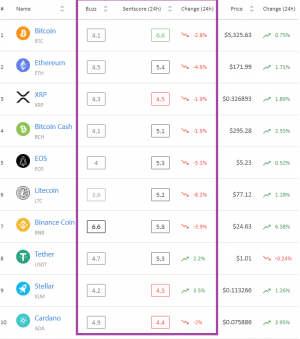

After last week’s drop quite deep into the neutral zone, this Monday, the total crypto market sentiment rose very slightly, remaining within the neutral zone. The current average sentscore is 5.19, while it was 5.18 last week, according to Predicoin, a crypto market sentiment analysis service.

Out of the top 10 cryptocurrencies by market capitalization, Bitcoin remains at the top of the list, but with a drop in its score yet again, the current score being 6.6, down from last week’s 6.7. Even though Stellar’s score is higher from last week’s 4.1, it is still at the bottom of the list again with the score of 4.3. There are no coins in the negative range yet again this Monday.

Sentiment change among the top 10 coins*:

Interpreting the SentScore’s scale:

– 0 to 2.5: very negative

– 2 to 4: somewhat negative zone

– 4 to 6: Neutral zone

– 6 to 7.5: somewhat positive zone

– 7.5 to 10: very positive

While Ethereum, XRP, Binance Coin, Tether, and Stellar saw a rise of their respective scores in the past week, Bitcoin, EOS, Litecoin, and Cardano dropped. Bitcoin Cash stands unchanged with a sentscore of 5.1. In terms of change over the course of the week, while it saw the largest drop last week, this time, Binance Coin had the biggest upward movement with 15%, arguably in light of Binance launching its own blockchain, Binance Chain. Binance Coin is followed by Ethereum’s 13.7% rise, and XRP’s 11%. Binance Coin has a strong technical side with a high score of 6.8, but its other aspects are strong as well: social and news at 5.6 and buzz at 5.4. However, its fundamental is at low 3.7. Meanwhile, last week’s winner, Ethereum is strong at news and fundamental, with scores of 6.5 and 6.3 respectively, while its weakest side is technical with the score of just 2.8. When it comes to XRP, its highest score is news at 6.3, but its technical remains its weakest aspect and is in the negative range with 2.5.

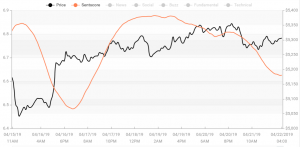

Bitcoin SentScore:

While the improvements were quite noticeable, the drops were more subtle. Cardano saw the biggest drop with 4.7%, followed by Bitcoin with 2.8%. Cardano’s weakest side is fundamental with the score of 3.7, while the strongest are news and social, standing at 5.6 and 5.5 respectively. Meanwhile, Binance’s weak points are social and buzz, both at a 4.9, while its news, technical, and fundamental are quite high, scoring 6.1, 7.3, and 8.7 respectively.

___

* – Methodology:

Predicoin measures the market sentiment by calculating the SentScore, which aggregates the sentiment from news, social media, technical analysis, viral trends, and coin fundamentals based upon their proprietary algorithms.

As their website explains, “Predicoin aggregates trending news articles and viral social media posts into an all-in-one data platform, where you can also analyze content sentiment,” later adding, “Predicoin combines the 2 sentiment indicators from news and social media with 3 additional verticals for technical analysis, coin fundamentals, and buzz, resulting in the SentScore which reports a general outlook for each coin.” For now, they are rating 30 cryptocurrencies.