Crypto Market Sentiment Drops Again, Bitcoin Out of Positive Zone

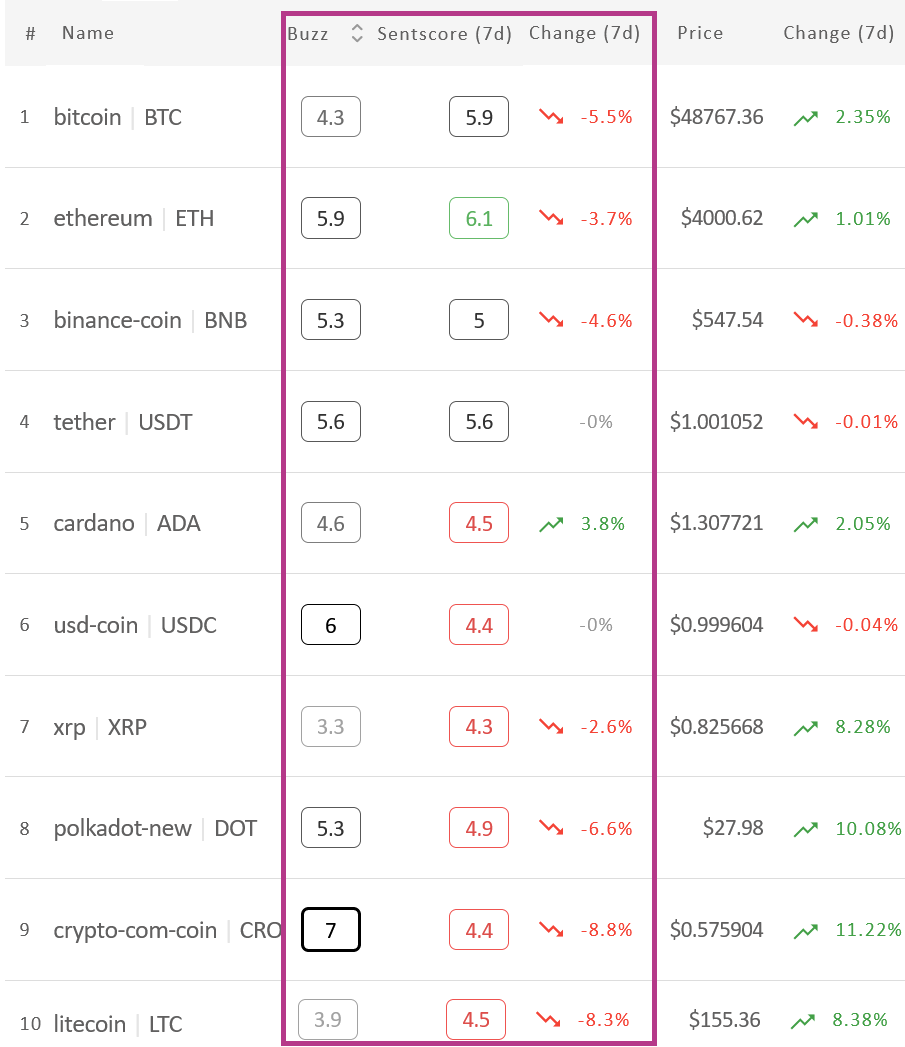

After hovering above the border between the scores of 4 and 5 for about a month, the market sentiment dropped below 5 over the past week. The average 7-day moving crypto market sentiment score (sentscore) for ten major cryptoassets stands today at 4.96, while a week ago it stood at 5.18, according to the market sentiment analysis service Omenics. That’s not all, as now, only one coin remains in the positive zone – ethereum (ETH).

A single coin has seen a positive change in its sentscore over the past seven days, this being cardano (ADA). It is up by almost 4%, and is therefore this week’s winner.

On the other hand, while the two stablecoins on the list – tether (USDT) and USD coin (USDC) – remained unchanged, the rest have dropped in the same timeframe. The two highest falls are crypto.com coin (CRO)‘s 8.8% and litecoin (LTC)‘s 8.3%. This is followed by polkadot (DOT)‘s drop of 6.6% and bitcoin (BTC)‘s decrease of 5.5%. Binance coin (BNB), ethereum, and XRP fell between 4.6% and 2.6%.

This drop in BTC’s sentscore pushed it below the score of 6, and therefore out of the positive zone. Ethereum’s drop was not as large, and it now stands as the only coin with a score above 6. As a matter of fact, most coins now stand below the score of 5. While only USDT and BNB, besides BTC, have scores of 5 and above, the rest sit in the 4.3-4.9 range.

Sentiment change among the top 10 coins*:

Interpreting the sentscore’s scale:

– 0 to 2.5: very negative

– 2 to 3.9: somewhat negative zone

– 4 to 5.9: neutral zone

– 6 to 7.49: somewhat positive zone

– 7.5 to 10: very positive zone.

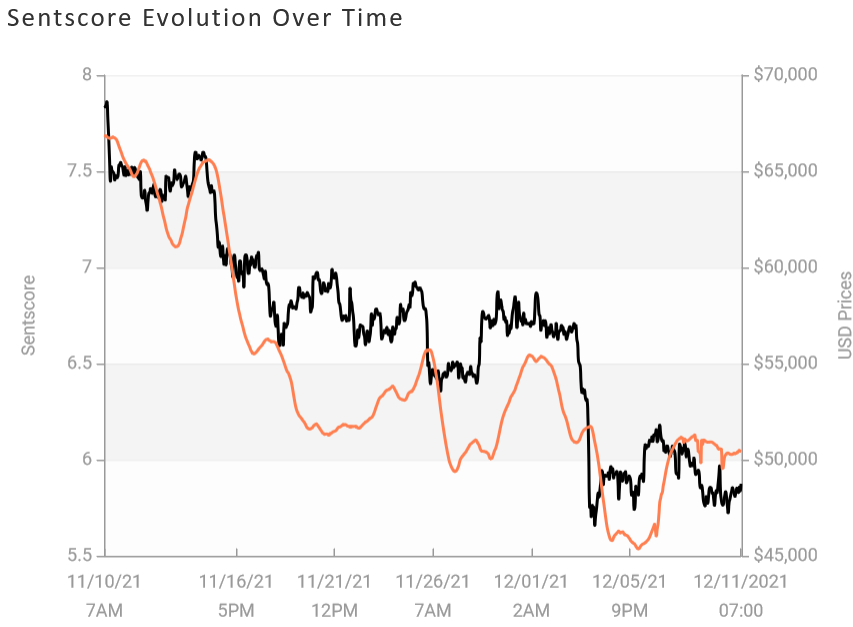

Meanwhile, the 24h situation is rather a mixed picture. The combined sentscore for these same 10 coins in the past day currently stands at 4.97, compared to 4.74 seen last Monday. So it’s higher than a week ago and is practically the same as the weekly score. Furthermore, bitcoin is still in the positive zone, even if on the verge of it, with a score of 6. Ethereum is leading the list with 6.2. At the same time, we have a coin in the negative zone for the first time in a while: CRO is now at 3.9, after seeing the highest, and the only double-digit drop among the 10, of 12.5%. The smallest drop is BTC’s 0.2%. Additionally, there are only two green coins currently: USDC’s sentscore is up 6.6% and LTC’s is up 3.4%. While BNB and USDT have sentscores of 5.4 and 5, respectively, the rest are below 5.

Daily Bitcoin sentscore change in the past month:

Now turning our attention to the 25 coins outside the top 10 list, and which are also rated by Omenics, we find the large majority of them red. Actually, only yearn.finance (YFI) and EOS have gone up in the last week, 3% and 2.5% respectively, while NEO is unchanged. Meanwhile, the highest among the drops is maker (MKR)’s 19%, followed by REN’s 18.9, and QTUM’s 18%. 0x (ZRX) and zcash (ZEC) are the only other two coins with double-digit drops (12% and 11%, respectively), while the rest sit between WAVES’ 9% and cosmos (ATOM)’s 0.7%. There are no coins in the positive zone, four sit within the 5.1-5.3 range, the large majority has scores between 4 and 4.8, and there are now two coins in the negative zone – one more than last week, as OMG (3.8) is joined there by vechain (VET) (3.9).

____

* – Methodology:

Omenics measures the market sentiment by calculating the sentscore, which aggregates the sentiment from news, social media, technical analysis, viral trends, and coin fundamentals-based upon their proprietary algorithms.

As their website explains, “Omenics aggregates trending news articles and viral social media posts into an all-in-one data platform, where you can also analyze content sentiment,” later adding, “Omenics combines the 2 sentiment indicators from news and social media with 3 additional verticals for technical analysis, coin fundamentals, and buzz, resulting in the sentscore which reports a general outlook for each coin.” For now, they are rating 35 cryptoassets.