Crypto Launderers Use Blockchain ‘Antinalysis’ To Evade Law Enforcement

In a never-ending arms race pitting crypto compliance firms and cybercriminals, a blockchain analytics tool has been made available on the dark web, enabling bitcoin (BTC) addresses to be checked for ties to criminal activities, according to blockchain analytics company Elliptic. The tool enables crypto launderers to test whether their assets could be identified as criminal proceeds by legitimate exchanges.

Crypto exchanges worldwide use blockchain analytics tools to check customer deposits for links to illegal activities.

“By tracing a transaction back through the blockchain, these tools can identify whether the funds originated from a wallet associated with ransomware or any other criminal activity. The launderer, therefore, risks being identified as a criminal and being reported to law enforcement whenever they send funds to a business using such a tool,” Tom Robinson, Co-founder and Chief Scientist at Elliptic, said.

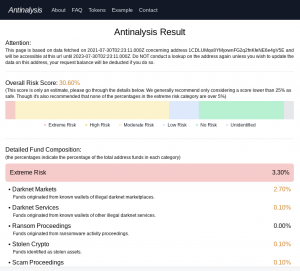

Known as Antinalysis, the tool allows criminals to avoid identification by providing them with a preview of what a blockchain analytics tool will determine based on their BTC wallet and the funds it comprises. The site runs on Tor, a version of the web that shields users’ anonymity.

The service charges its users about USD 3 per BTC address, providing a breakdown of where it believes the crypto originates come from, categorizing proceeds by the risk of identification.

“Proceeds of darknet markets, ransomware, and theft are considered to be ‘extreme risk’, while funds from regulated exchanges and freshly-mined coins are classed as ‘no risk’,” according to Robinson.

He said that the creator of Antinalysis is also one of the developers of Incognito Market, and the tool was likely created in relation to the “difficulties faced by the market and its vendors in cashing out their bitcoin proceeds.”

“Compliance professionals should be aware of this new tactic. It is also significant because it makes blockchain analytics available to the public for the first time,” Robinson cautions, emphasizing that to date, similar analytical tools have been employed primarily by regulated providers of financial services.

Per crypto intelligence business CipherTrace, in 2020, major crypto thefts, hacks, and frauds totaled some USD 1.9bn. This was the second-highest annual value in crypto crimes to be recorded to date. According to the firm, last year, criminally-associated BTC addresses sent more than USD 3.5bn worth of bitcoin. To compare, BTC trading volume in the past 24 hours reached almost USD 35bn.

____

Learn more:

– Debunking the 4 Big Bitcoin Myths Promoted By Central Banks in 2021

– ‘Don’t Be Lulled’ as European Commission Mulls a Crypto KYC Trap

– A Bright Side to the Dark Web

– Cybercriminal ‘Bitcoin Billionaire’ JokerStash Retires

– This Is How Confiscated Bitcoin, Ethereum, And Monero Sold By The Taxman

– BTC 1,700 In Limbo As Fraudster Won’t Give The Password To Prosecutors

– Taproot, CoinSwap, Mercury Wallet, and the State of Bitcoin Privacy in 2021

– US-Sanctioned Actors Use Crypto in New Ways to Evade Restrictions – Report