Coin Race: Top Winners/Losers of March and Q1

April is here, with spring and some green shoots starting to form in the crypto market.

The beginning of April also marks the end of the first quarter, and we, therefore, take a look at what has happened over both the past month and the quarter as a whole.

In January, the crypto market ended largely in the red across the board, despite some green candles on the last day of the month.

February, on the other hand, turned out to be a good month, with many of the larger cryptoassets by market capitalization, the so-called ‘blue-chip’ cryptos, seeing double-digit percentage gains for the month.

With that said, let’s now take a look at March and the year’s first quarter: which coins have moved higher, which have fallen, and which still tread water?

Top 10 coins in March and Q1

Overall, the top 10 coins by market capitalization performed well in March, although the performance for major coins such as bitcoin (BTC) and ethereum (ETH) was less impressive than in February.

In a sign that ‘altseason’ may have already arrived, BTC saw the weakest performance among the top 10 coins last month, excluding stablecoins. The coin rose by just 1.95% for the month to trade at a price of USD 44,478 as the month came to an end.

ETH, on the other hand, saw relatively strong performance for the month, rising by 9.89% to a price of USD 3,241.

The performance for both of the two largest cryptocurrencies was well below what was seen in February when BTC and ETH both rose by about 15% for the month. Still, it is worth noting that most of the selling for the two coins happened during the first four days of the month, and both saw gains for the most part after that.

Best among the top 10 coins in March was the Ethereum-challenger solana (SOL), which rose by 22.33% for the month to USD 119.45. The token was followed by cardano (ADA) and the recently hot stablecoin protocol terra (LUNA) with gains of 15.64% and 10.91%, respectively.

Moving back a little further to check the overall performance for the first quarter, we see that many coins are now in the red, largely as a result of weak performance in January.

The losses seen for the quarter as a whole were particularly bad for SOL, which dropped by 31%. The quarterly fall comes as a result of a major sell-off in the first month of the year, which SOL has yet to recover from.

Meanwhile, we can also see that BTC ended in the red for the quarter with a fall of 5.9%. Bitcoin’s performance thus ended just marginally worse than XRP‘s, which performed best among the top 10 coins for the quarter with a fall of just 2.59%.

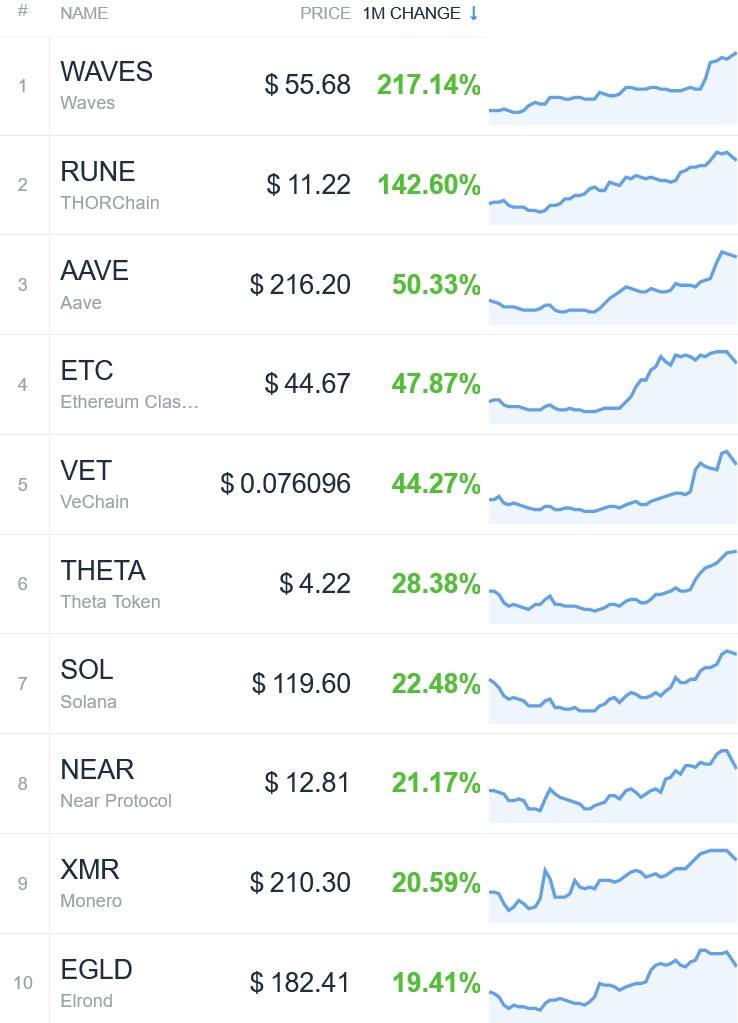

Best from the top 50 in March and Q1

Zooming out to look at the 50 largest cryptoassets by market capitalization, we can again see the ‘altseason’ thesis playing out, with many smaller altcoins outperforming both BTC and ETH.

Coming in as the best-performing token from the top 50 for the month of March was WAVES, the native token of the smart contract platform with the same name, which has gotten a reputation as the “Russian Ethereum.” The token was up a massive 217% for the month to a price of USD 55.68.

Following WAVES was the interoperability blockchain THORChain (RUNE), which rose by 142.6%, and lending and borrowing protocol Aave (AAVE), with a gain of 50.3%.

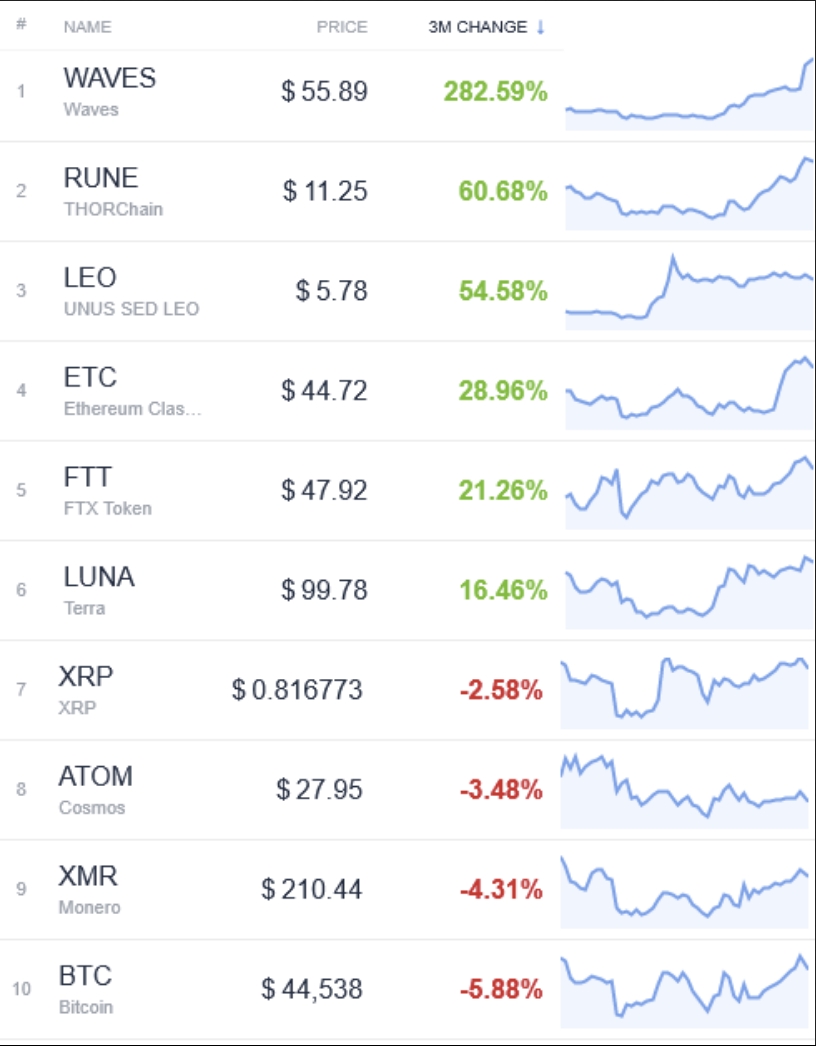

Looking at the same coins over the entire quarter, the picture looked fairly similar.

WAVES once again ranked on top with a quarterly gain of 282.59%, followed by RUNE with a rise of 60.68% over the same period.

Interestingly, BTC came in as the worst performer in this group with a loss of 5.88% for the quarter.

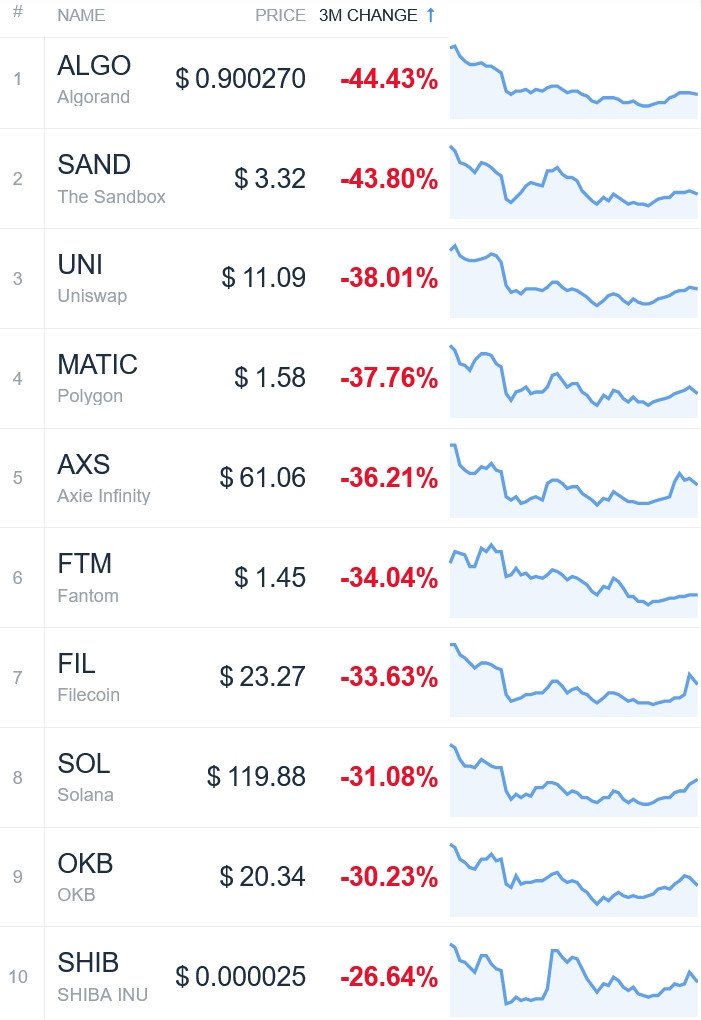

Worst from the top 50 in March and Q1

Looking now to see which coins from the top 50 were the biggest losers last month, we find that the losers saw smaller moves to the downside than the winners did to the upside, perhaps hinting at some underlying bullish momentum.

Worst in this group was smart contract platform fantom (FTM), which fell by 21.64% to a price of USD 1.45. The quarterly fall comes as a result of lower prices for the FTM token since mid-January, despite some trimming of losses in March.

The token was followed by the blockchain interoperability protocol cosmos (ATOM), which dropped by 11.13%, and metaverse platform decentraland (MANA), which fell by 10.57%.

For the quarter, things look even worse than in the monthly overview.

The worst one hit by selling pressure in the first quarter was the proof-of-stake (PoS) blockchain algorand (ALGO) with a fall of 44.4% to USD 0.9. The token was followed closely by metaverse project the sandbox (SAND), with a fall of 43.8%, and the decentralized exchange Uniswap’s UNI token with a drop of 38%.

Notably, the sharp fall for the SAND token for the quarter came after a sell-off of more than 14% in February. The losses have come after a strong performance earlier in the year as metaverse-related projects received a flurry of attention.

The token that performed best among the worst performers was the once-hot meme coin shiba inu (SHIB), which fell by 26.6% for the quarter.

Winners & losers from the top 100

Looking even further to cover all coins in the top 100 by market capitalization for the month of March, the best performer by far was the little-known altcoin STEPN (GMT). Described as a “Web3 lifestyle app with Game-Fi and Social-Fi elements,” GMT was up an impressive 1,924% for the month to a price of USD 2.56.

The massive gain posted by the GMT token was followed by the recently much-talked-about metaverse-focused platform zilliqa (ZIL) with a rise of 315.45%, and the already-mentioned WAVES token.

The worst performer for the month was once again FTM, which fell by 21.56%.

On a quarterly basis, the top 3 looked almost the same, with GMT on top with a quarterly gain of 1,005%, followed by WAVES with a gain of 283%, and ZIL with a gain of 132%.

The worst-performing token in the top 100 for the first quarter was kadena (KDA), which fell by 51% to a price of USD 6.28.

____

Learn more:

– Bitcoin Breaks Key Resistance, Crosses USD 47K as Terra Buys More BTC, Liquidations Soar

– Ethereum Moves Higher Against Bitcoin on a Wave of Positive News

– Zilliqa Token Rises Further as New NFT Gaming Partnership Announced

– Shiba Inu Unveils its Metaverse Project, But Investors Do Not Seem Excited

– The Ukraine War: How Russia’s Aggression Affected Bitcoin & Crypto and What Might Happen Next

– Crypto Market Tries to Recover With Ukraine Negotiations in Focus; Gold & Commodities Rise