Coin Race: Top Winners/Losers of August; BNB and Ethereum Most Resilient as Top Coins Bleed

August is over, and fall is upon us, but the crypto market remains as difficult as ever to navigate. As we always do when a month has ended, let’s take a look in the rearview mirror to see how the crypto market has performed over the past month.

As a reminder, July was a relatively good month for crypto, with many coins turning green after heavy losses earlier in the year. The big winner for July among the major coins was ethereum (ETH), which saw strong gains as excitement around the coming Merge started to build.

In August, however, things did not go so well, with all coins in the top 10 by market capitalization seeing losses as the market downtrend resumed.

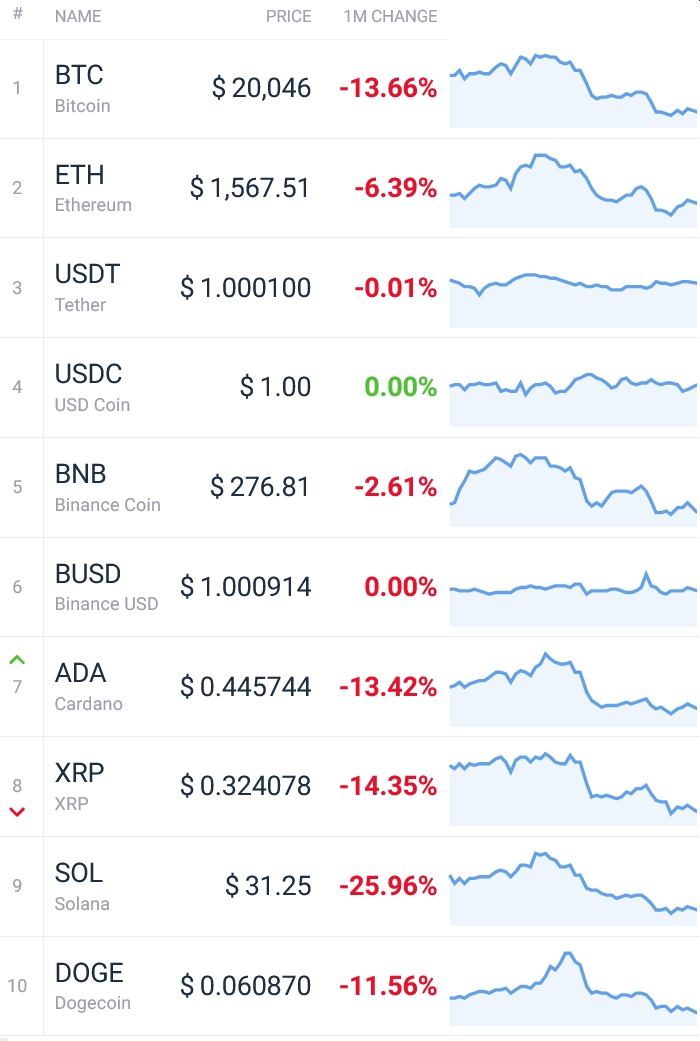

Top 10 coins in August

Among the top 10 coins by market capitalization, not a single one managed to post gains (if we exclude stablecoins). The sharply falling prices were particularly notable given that coins like bitcoin (BTC) and ETH saw gains of close to 20% and 60%, respectively, the month before.

Out of the top 10 coins, solana (SOL) stood out as the biggest loser in August, dropping close to 25% to USD 31. The token was followed by XRP, which fell by just over 14% over the same time period to USD 0.324.

On the other side of the spectrum was Binance’s exchange token BNB, which fell by almost 3% for the month to USD 277. The second-best performer was ETH, which saw a relatively modest fall of 6% to USD 1,567 as the community prepared for the highly anticipated Merge, or the network’s transition from proof-of-work (PoW) to proof-of-stake (PoS).

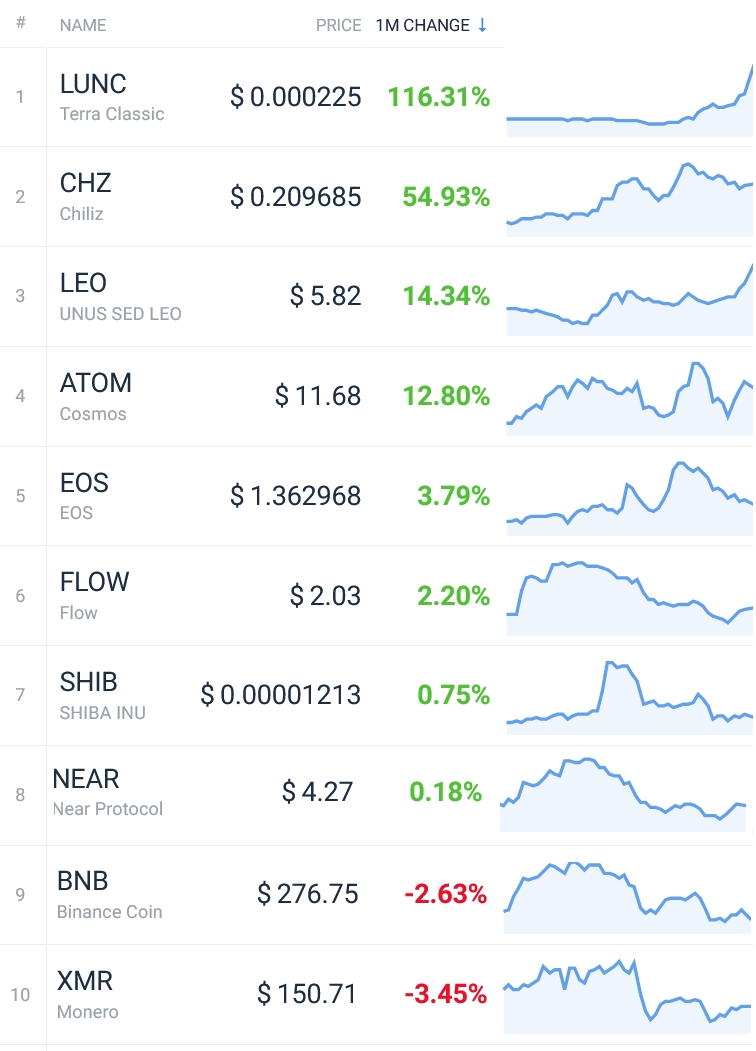

Best from the top 50 in August

Expanding our scope to the 50 largest coins by market capitalization, we can see that the best performer – terra classic (LUNC) – more than doubled in price. However, keep in mind that the doubling comes from an already low level after the collapse of the Terra ecosystem earlier this year, and that the LUNC token has been exceptionally volatile ever since.

Over the course of August, LUNC rose 116% to a price of USD 0.000225, with its market capitalization still remaining north of USD 1.5bn.

The second-best performer in this group was chiliz (CHZ), which gained close to 55% for the month to USD 0.21, followed by Bitfinex’s exchange token LEO, which rose by 14% to USD 5.8.

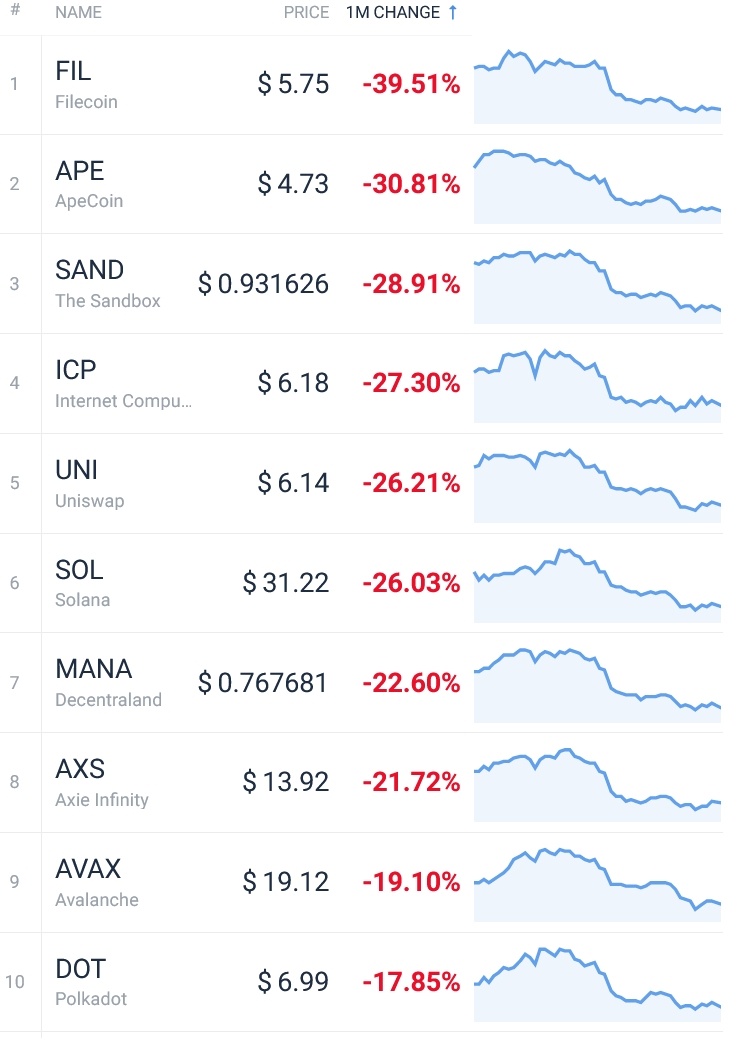

Worst from the top 50 in August

Looking now at the worst performers among the top 50 coins by market capitalization, we can see that filecoin (FIL) tops the list with a drop of nearly 40% to USD 5.75. The fall for filecoin in August comes after the same coin more than doubled in price the month before, trading at close to USD 11 as of the end of July.

Second in line comes apecoin (APE), a token issued by and for the Bored Ape Yacht Club and Mutant Ape Yacht Club NFT community. The coin fell by 31% to USD 4.7 over the course of the month.

APE was closely followed by SAND, the native token of the metaverse project known as The Sandbox. The token dropped by close to 29% for the month to USD 0.932.

Best & worst from the top 100 in August

Looking further out to cover all coins in the top 100 by market capitalization, we can see that although many of the largest coins fell in price, some also saw rather strong gains.

The top spots on the top 100 list were taken by the already-mentioned tokens LUNC and CHZ, followed by crypto lender Nexo’s native token NEXO. The token rose by just over 50% to USD 1.085 after the worst fears for a further meltdown of the centralized crypto lending industry dissipated, and the company behind it confirmed that it will continue a token buy-back scheme.

At the top of the list of the month’s worst performers was helium (HNT), a token issued for the purpose of building “decentralized wireless infrastructure.” The token fell by 43% for the month of August to USD 5.15, after it was involved in a controversy around reportedly fake partnerships earlier this summer.

Next in line came the already-mentioned FIL, followed by STEPN (GMT), which dropped by nearly 31% to USD 0.665.

_____

Learn more:

– Bitcoin Slides Below USD 20K Again, Ethereum Erases Daily Gains as Crypto Market Turns Red

– Crypto Derivatives Industry ‘Expects’ Severe Regulation, Bitcoin’s Price to Return to USD 65K – Report

– Galaxy Digital’s Novogratz Doubts Bitcoin Will Pass USD 30,000 Barrier Soon

– Hayes Asks ‘Forgiveness’ for Calling Ethereum a Shitcoin, Doubles Down on ETH

– Dogecoin is Heading to Zero, According to Industry Panel