Business Giants Invest USD 60m in Blockchain-powered Payment Firm Chai

A group of South Korean and Japanese business giants including Hanhwa Investment & Securities, SoftBank and SK have joined more established blockchain investors to complete a Series B investment round worth over USD 60m in South Korean firm Chai, the provider of a blockchain-powered payment gateway.

Chai completed a USD 15m Series A in February this year.

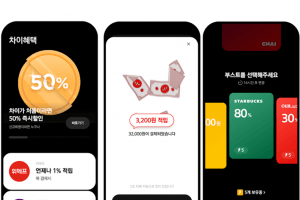

The firm is a partner of stablecoin issuer Terra, and makes use of Terra’s blockchain and stablecoin offerings to, it claims, offer lower transaction fees and provide its users with discounts.

Chai launched in South Korea last year – and claims to have over 2.5m users. A partnership deal with BC Card, one of South Korea’s biggest credit card issuers, has also boosted its profile.

Some 2,200 merchants in South Korea have partnership deals with Chai, with the latter looking to expand its reach in the wake of the coronavirus pandemic. The pandemic has seen South Koreans turn to contactless pay, with a 17% increase in contact-free payments since the start of the crisis per central bank figures.

The government has also pledged to foster contact-free payment platforms as part of a bid to reduce eliminate the damage caused by pandemics and other modern risks.

Per a press release shared with Cryptonews.com and a report from Fn News, the investment round marks a new South Korean record for a fintech firm, and was led by Hanhwa Investment & Securities, part of the Hanwha Group conglomerate, which has some USD 166bn worth of assets.

SoftBank, meanwhile, operates the Vision Fund, the reportedly world’s biggest IT-focused venture capital fund, with capital of over USD 100bn.

SK is one of South Korea’s big two mobile and internet carriers – and is another of South Korea’s so-called chaebol, or mega-companies.

Commercial bank KEB Hana’s investment arm also took part in the round, as did the venture capital firms InterVest, Aarden Partners and K2 Investment Partners – as well as blockchain accelerator Hashed.

The latter’s CEO and managing partner Simon Kim said that he was “excited to see how blockchain is fueling further advancements in fintech services,” and was “looking forward to Chai’s expansion” outside South Korea and “into the global market.”

___

Learn more:

Cash Still a Top Hedge Pick, but Digital Winning Payments War – Bank Strategist

Crypto And Blockchain Adoption Depends on Security, Trust & User Experience

Travala in Crypto Transactions Boost, Bitcoin Outstrips Credit Card Sales

Visa Makes Stablecoin Push With Circle’s USDC

Bitcoin Rewards “Farming” Is Coming