Blockchain: the Underlying Technology in the Crypto World Shows Resilience Amid Uncertainty

Disclaimer: The text below is a press release is not part of Cryptonews.com editorial content.

In recent years, the global economic outlook has become uncertain due to the COVID-19 pandemic, digital disruption, and geopolitical developments which make drastic changes in global businesses and financial markets, let alone changing people’s day-to-day lives. In the age of uncertainty, the development of digital innovations including cryptocurrencies, NFT (Non-fungible token), decentralized finance (DeFi), the Metaverse, and beyond have, surprisingly, accelerated as a majority of crypto natives and tech-savvy individuals strongly believe the backbone of the cryptocurrencies: blockchain, which is a distributed and decentralized public ledger that exists across a network.

The power of unity

Bitcoin is the first original case study of blockchain which has proven that the new technology can securely store information without the need of a centralized authority because any add-on data will be verified and replicated by a large network of hundreds of thousands of computers, that’s why decentralization, immutability, and transparency are the new technology’s main features.

In the emerging digital world, teamwork and collaboration are the keys, so the crypto craze continues in the seemingly crypto winter. No matter whether the new or old institutional investors, they are still attracted to get into the crypto market at low tides and keep their fingers crossed that the prices will bounce back in the crypto spring.

The resilience of a legend

As the old saying goes, Survival of the fittest, somehow only the most secure and reliable blockchain-based system can stand out in the crowd to weed out bad actors.

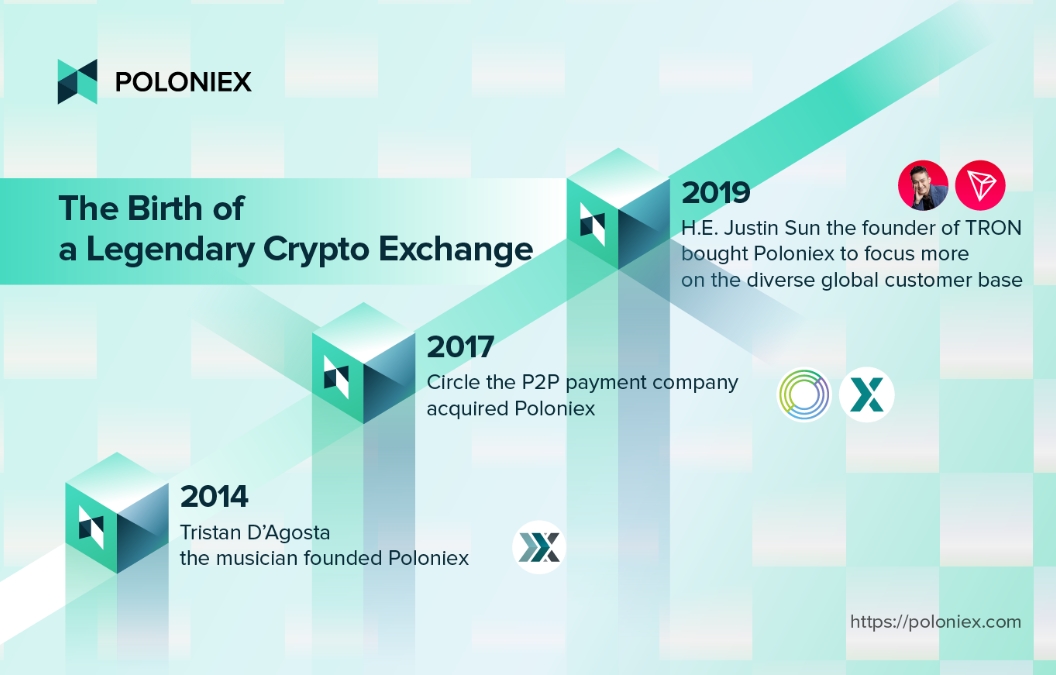

Poloniex, one of the world’s oldest and legendary crypto exchanges, is one of them, since it partnered with Polygon, the leading platform for Ethereum scaling and infrastructure development, to foster Web3 adoption after collaborating with Fantom Foundation, a decentralized application(dApp)-focused blockchain, in March 2022, to help scale its ecosystem to support smart contracts in the future as Investopedia reported.

With its eight-year history in the crypto market, the legend has continuously shown great resilience that it still reinvented, recruited new blood, and achieved profitability notwithstanding the current unpredictable environment, especially during the years-long pandemic.

As the world’s top 25 cryptocurrency exchanges according to CoinMarketCap, Poloniex has also witnessed several bullish and bearish market cycles since its establishment in 2014. After H.E. Justin Sun’s acquisition in 2019, Poloniex has focused on its diverse global customer base and successfully transformed into a truly international exchange, providing secure trading for millions of crypto investors in nearly 100 countries and regions with various languages available, including English, Chinese, Vietnamese, Turkish, and Russian, making Poloniex one of the top exchanges by market share in the Asia-Pacific (APAC) region and Commonwealth of Independent States (CIS), where are the top priorities of Poloniex’s expansion plan.

According to Poloniex’s analysis of the crypto market trends in 2022, APAC and CIS are regarded as emerging markets. As for the latter, the economic growth leads to higher crypto demand despite a mix of political views towards digital assets. In addition, the mining activities are very active in the region which creates a higher crypto acceptance level. Whereas some countries in the APAC region, such as Japan and Korea, are more mature and have seen a stable growth of crypto users. Moreover, the crypto ecosystems of these countries have mushroomed to a certain extent regardless of the tightening regulations.

If we further divide the APAC region into different component areas, we will see there is also a huge potential for futures trading in South Asia that people capitalize on the crypto craze to diversify their financial portfolios in defiance of political pressure. Meanwhile, Southeast Asia is another potential market breeding crypto whales, especially in Thailand, Vietnam, Malaysia, and Indonesia, since they are more adaptive to cryptocurrencies and other crypto derivatives.

Expand crypto footprints

To expand the aforementioned markets, Poloniex has held several global tours between May and July 2022. The first stop was in Kuala Lumpur, Malaysia while the second one was in Ho Chi Minh City, Vietnam, two of which have attracted nearly 200 crypto enthusiasts altogether to join to understand the cryptocurrency market dynamics and ongoing movements of the legendary crypto exchange, not to mention exchanging ideas with like-minded people.

Poloniex held its second Global Tour in Ho Chi Minh City, Vietnam on June 11, 2022. Source: Poloniex

As mentioned earlier, Poloniex the technology trendsetter has had a partnership with Polygon, which is a startup based in Mumbai, India and the country has nurtured a lot of companies to develop the blockchain applications and crypto innovations in recent years. Therefore, the crypto markets are still very bright in the country since the Indian authority is now formulating policy on Web3 as stated in Financial Express. Hence, Poloniex will also focus on the Indian market and expand its global tour to Bangalore to introduce a plethora of interesting programmes to the local community.

There was a panel discussion with crypto enthusiasts on Poloniex’s first Global Tour in Kuala Lumpur, Malaysia on May 8, 2022. Source: Poloniex

LATAM & MENA, the next frontiers for cryptocurrency

Poloniex’s recent global tours focus on topics ranging from the announcement of the collaboration with the APENFT marketplace; the demystifications of Web3 and the Metaverse; the optimization of the new trading system; the introduction of TRON’s USDD stablecoin; and the referral program of Poloniex Space Traveller etc.

With a great vision of the future, Poloniex’s upcoming marketing campaigns are not limited to the above countries. Instead, the crypto exchange is now shifting its focus to Latin America (LATAM) and the Middle East and North Africa (MENA) to establish local teams to serve the communities.

Consumers from Africa, Asia, and South America are more likely to own or use cryptocurrencies pursuant to the Statista Global Consumer Survey in 2021, which combined 55 different research reports to identify the countries where cryptocurrencies are most popular.

As shown in the findings, 42% of respondents in Nigeria – nearly 1 in 3 mentioned having used or owned one type of crypto or another last year, making the African country stay on top of the list. Meanwhile, Kenya is another African country on the list, as shown in the table below. Moreover, Thailand comes in second place, followed by the Philippines and Vietnam. While Argentina is the only country in Latin America that breaks the top ten.

Disclaimer: The text above is an advertorial article that is not part of Cryptonews.com editorial content.