BitMEX Offers ‘Quanto’ Ethereum Product in a Bid to Regain Market Share

Following a downturn in trading volumes after the coronavirus-triggered market panic in March liquidated a massive amount of trades on crypto derivatives platform BitMEX, the exchange is again looking to capture market share by offering a new product for their risk-loving clients.

The new trading product is rather unique in the crypto market as it allows traders to speculate on the ethereum (ETH) price in US dollars without ever touching neither ETH nor USD. Instead, the new ETH/USD contract, called a “quanto futures contract” has “a fixed bitcoin multiplier” that makes it possible to make or lose bitcoin (BTC) based on changes in the ETH/USD exchange rate.

The new product combines the “quanto” feature of their regular ETHUSD perpetual swap contract with expiry and settlement known from futures trading in the traditional financial markets, and expires quarterly, the exchange said. Unlike in the traditional futures market, the perpetual futures contracts normally offered on BitMEX are contracts that do not expire, but instead mimics a type of leveraged spot market.

The new product launch comes at a challenging time for BitMEX, which has been accused of everything from offering excessive leverage to retail traders, to exacerbate the bitcoin crash on “Black Thursday”, and for having an unusually large influence on price discovery in the bitcoin market.

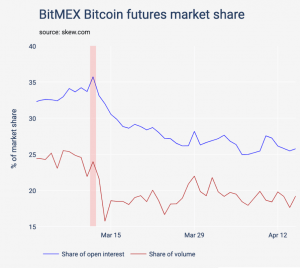

Some traders have also chosen to abandon the platform, with both trading volumes and open interest in bitcoin futures on BitMEX declining markedly after crypto’s “black Thursday” on March 12. Although it is not entirely clear why that has happened, Coin Metrics speculates that it is either because:

- BitMEX for some reason lost market share to other exchanges following the event, or

- Crypto traders in general are deleveraging and have chosen to withdraw capital from high-leverage exchanges like BitMEX.

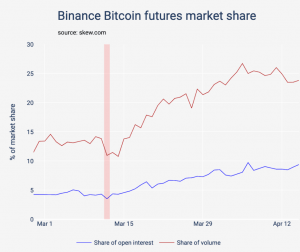

Based on the report’s findings, however, the reality appears to be a combination of the two, with evidence showing both that other exchanges such as Binance have taken market share from BitMEX, and that the overall size of the bitcoin futures market has been reduced to a lower level.

__

According to the announcement made by BitMEX, the new product is already available on the BitMEX Testnet – the platform’s demo environment where users can get used to the real platform and hone their trading skills without putting real money on the line. Starting on May 5, the product will also be available for live trading on BitMEX.com.

__

Reactions

__

__