Bitcoin to Bottom Out in a Few Months, Research Claims

The price of Bitcoin may go up in 2019, after bottoming out in the first quarter of the year, shows a new paper by New York-based research company Delphi Digital. The bottom might well happen in the first half of Q1 due to the recent acceleration in Bitcoin’s downward trend. They also believe that the Lightning Network’s success could prove crucial to wider Bitcoin usage.

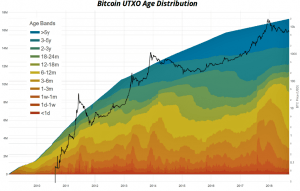

The research paper, titled “The State of Bitcoin,” found that the primary source of selling in the most recent downturn for Bitcoin came from coin owners who have been holding for 3 to 5 years, and these very same HODLers seem close to exhausting their selling efforts. This is derived from UTXO (unspent transaction output) trends, which the paper says “have shown to be an impressively reliable predictor, albeit with a limited sample history, for price bottoms, future accumulation timing, and UTXO wave amplitudes.”

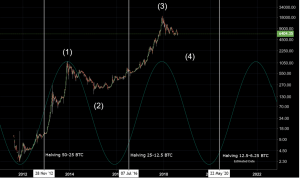

The UTXO trend and subsequent price appreciation should line up with the Bitcoin block mining reward halving that is set to happen in 2020, when the reward will decrease from 12.5 to 6.25 bitcoins, but the research team believes that this will be the last reward halving to have a very significant impact on price. Block mining reward halving occurs once every 210,000 blocks, which translates to around once every four years. Historically, there have been two halvings: in 2012 and 2016, both of which were followed by significant bull runs.

Block mining reward halving and Bitcoin price chart:

____

The short-term outlook in the paper draws a parallel to 2013: back then, when the prices peaked in late 2013 and subsequently fell, they continued to slip even after year-over-year returns turned negative. It was roughly a year before Bitcoin returned to similar price levels. The price’s rise of late 2017 mimics that of 2013, as peak valuations were followed by an extended bear market, characterized by multiple relief rallies on the way to drastically lower prices, but the bottom does not seem to be too far off.

In the long run, Bitcoin may well replace offshore accounts as the means to holding private wealth. Once Bitcoin rises in popularity for this reason, more conservative institutions (central banks, state and local pension funds, etc.) are likely to follow suit as they become more comfortable with digital assets, the paper claims. The researchers remain optimistic, however: “Barring any major disruptions to its network, however, over the long run we foresee Bitcoin serving as a staple allocation in traditional investment portfolios, central bank reserves, and as a suitable alternative for a portion of assets held in offshore accounts.”

But in order to be used as a currency, Bitcoin still has quite a way to go. “In order for Bitcoin to work as a medium of exchange, we believe it first needs to establish itself as a store of value to help reduce its volatility,” the paper states, adding that the current volatility of the asset makes it less likely for holders to spend it, as they believe it might become worth more in the future, and eliminating this possibility could be the nudge Bitcoin needs towards becoming a medium of exchange.

“If Lightning Network succeeds, it will enable Bitcoin to have nearly instant transactions and fees at potentially a fraction of a cent. This opens the door for fast micropayments where users could pay a penny to read an article or receive small tips from fans on social media. This provides unique advantages over the current web based payments infrastructure which is saddled with middle-men, delays in settlement, and high transaction fees,” according to Delphi Digital.