Bitcoin Shorts Hit 3-Month Low as Price Climbs

According to data from the popular crypto exchange Bitfinex, the number of short positions on bitcoin have just hit its lowest level since early August, a clear indication that the sentiment surrounding the number one cryptocurrency is becoming more positive.

At the same time, the number of long positions on the exchange has increased, overtaking the number of shorts on November 2. Prior to that, the bears have consistently been in the majority, as seen in the chart below.

Bitcoin short orders in red and bitcoin long orders in blue on Bitfinex:

Meanwhile, the ratio between short and long positions on bitcoin has dropped to 0.86, which means that there is now a net long-bias among Bitfinex users. That marks a distinct change for the market, which has been overwhelmingly short-biased over the past few months.

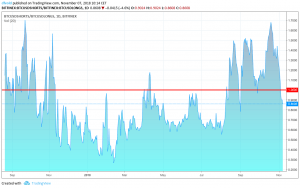

A short-to-long ratio of 1 (red line on the chart) indicates neutral market conditions, where neither bears nor bulls are in the majority.

Bitcoin short-to-long ratio on Bitfinex:

It’s worth noting that distorted market conditions where either the long side or the short side becomes “overcrowded” tends to cause temporary reversals in the market. This is for example what we have seen happening during the multiple “short-squeezes” this year, leading to sharply higher prices. Similarly, an abundance of long trades can cause pullbacks to become sharper and more violent than they would otherwise be.

At today’s levels, however, the ratio is still healthy and we are far from extreme levels. Instead, it is likely a reaction to prices gradually moving higher after having been flat for weeks.