Bitcoin’s Safe Haven Status ‘Beta Tested’ Once Again

In just one week, marked with increased political tension in the Middle East, bitcoin (BTC) moved following traditional safe haven assets such as gold on two occasions.

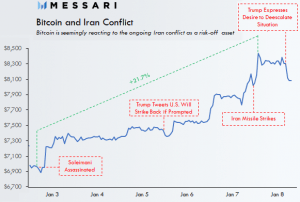

Last week, BTC’s move up coincided with the news that Iranian general Qasem Soleimani was killed by a U.S. drone strike. Back then, not many were convinced that the price increased due to the “bitcoin is a safe haven asset” narrative that is being propagated by many bitcoin enthusiasts. Meanwhile, yesterday, BTC once again moved together with gold after the U.S. President Donald Trump expressed a desire to de-escalate the situation in the Middle East. Following the news, U.S. futures and stocks climbed while gold and bitcoin dropped.

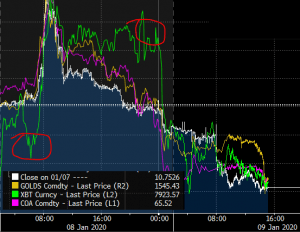

Su Zhu, CEO of Three Arrows Capital, reacted by saying that “Those [with] faith in the BTC & gold/macro correlations have been rewarded the past couple days by fading the initial wrong-way move of BTC,” explaining that “BTC originally went the opposite direction as a knee-jerk, and then followed in the same direction.”

And as pointed out by the popular Bitcoin analyst Willy Woo, the recent events could be considered a “beta test” for bitcoin as a safe haven asset. And according to Woo, the test was “successful.”

Underscoring his point, Woo also shared a chart by crypto analytics firm Messari that showed how the digital asset surged after the Iranian retaliatory attack. This surge came at the end of the 5-day long period of unfolding events, which ended with Trump’s speech on Wednesday.

Over the course of this period, bitcoin added more than 20% to its price, Messari’s chart shows.

Meanwhile, as pointed out in Coin Metrics’ latest report on Tuesday, “bitcoin and the broader cryptoasset reaction function to macroeconomic and geopolitical events is still not understood,” referring to the fact that bitcoin reacted to the original U.S. air strike several hours after the traditional financial assets moved. However, as “there were some more potential correlations following the initial event,” that occurred after the report was published, Coin Metrics will explore this topic further in their upcoming report next Tuesday.

At pixel time (12:41 PM UTC), BTC trades at c. USD 7,902 and is down by 5% in the past 24 hours, trimming its weekly gains to 10%.