Bitcoin Realism Is More Sustainable Than Altcoins Rally – Strategist

The Cryptoverse had an opportunity this year to see a number of altcoins outperforming the world’s number one crypto, bitcoin (BTC) – but there are some words of caution out there: it still might be too early for optimism.

“This year’s enthusiasm in some altcoins is reflective of a bullish environment, but should subside as bitcoin further distinguishes itself from most of the highly speculative and oversupplied minions,” said Mike McGlone, Senior Commodity Strategist at Bloomberg Intelligence, in a recent report. In December, when BTC traded below USD 7,500, he said that “it should be just a matter of time before bitcoin finds USD 10,000,” and “bitcoin is capable of adding to its 2019 price appreciation of about 100% in 2020.”

At pixel time (13:51 UTC), BTC trades at c. USD 9,791 and is almost unchanged in a day, but is up 5% in a week and 18% in a month.

Now, McGlone said that, among cryptos, bitcoin is winning the adoption race, and added that the optimism surrounding recent rallies is more sustainable in bitcoin than the broader crypto market. The BTC 2020 outlook “remains favorable” and it’s unlikely we’ll see any significant reversal in the past 10 years’ drivers, he explained. As a matter of fact, there’s little to push BTC lower from its highest so far, the average annual price of USD 8,500.

“An unlikely force would be needed to knock the first-born crypto off its global-benchmark status and endure a price decline,” the strategist wrote.

However, bitcoin dominance, or the percentage of the total market capitalization, dropped by almost 4 percentage points, to 63.5%, this year.

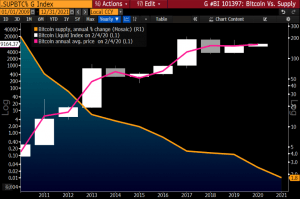

Meanwhile, contributing to BTC’s – not only price rise, but also the endurance of that rise – are gold-like positive fundamentals, rising adoption, supportive macroeconomics, decreasing supply, advent of options that represent bitcoin’s transition toward the institutional mainstream, and bitcoin’s resemblance to gold “as a quasi-currency […] vs. the more speculative, trade-orientated focus of most altcoins.”

In the last two years, “bitcoin is up about 7% vs. down 90% for the small-cap gauge,” said McGlone, and simple rules of demand vs. supply are not favorable for a sustained rise in altcoin price in such a competitive market and with a rapidly increasing supply due to few barriers to entry.

McGlone argues that the Bloomberg Galaxy Crypto Index shows a relatively declining performance of Ethereum and XRP, both of which, not only face competition but are at elevated risk, given the smaller market capitalizations and more speculative nature. (Learn more: Ethereum, XRP, and Other Altcoins Are in ‘Proving Phase,’ says Novogratz)

Furthermore, unlike BTC, the hashrate, or the computing power of the network, of most the proof-of-work altcoins is falling, which reflects BTC’s increasing adoption and dominance. While BTC’s hashrate reached a record high (currently at 110.71 EH/s), Ethereum’s is c. 40% below the 2018 peak (currently at 167,236 GH/s; 43.4% less than the peak), says the report.

Ethereum price is now at USD 220. It went up +5% in a day and 24% in a week. XRP is up 1.4% in the past 24 hours and is up 18% in a week. The one that appreciated the most in the past year is BTC with 188%, compared to ETH’s 110% and XRP’s -5%.

However, in terms of price, multiple altcoins outperformed BTC in the past year. Bitcoin cash (BCH) is up 278%, tezos (XTZ) – 491%, ethereum classic (ETC) – 203%, while chainlink (LINK), ranked 16th by market capitalization, skyrocketed 702%.

__

Learn more: Mixed Sentiment as Analysts Look For Crypto Market Direction