Bitcoin Prices and Ethereum Prediction; The US FOMC and Fed Rate Today

Bitcoin (BTC) and Ethereum (ETH) have been cruising along the market, with their prices staying above $23,000 and $1,500 respectively. This has contributed to an overall growth of the global crypto market cap which currently stands at $1.05 trillion, showing a 0.91% increase in the last 24 hours.

Despite this, traders appear to be reluctant to make any significant offers ahead of the US Federal Reserve’s announcement. This article will focus on Bitcoin prices and Ethereum prediction, as well as the current US Federal Open Market Committee (FOMC) and Fed rate today.

Since the start of the year, Bitcoin has been on the rise. According to WatcherGuru, it has increased by 43% since the beginning of January 2023 and has remained bullish for the bulk of the month.#DeFiXSolutions #DeFi #Crypto #Cryptocurrency #BTC #Bitcoin #BitcoinPrice pic.twitter.com/e19RONjDiE

— DeFiX.Solutions (@DeFiXSolutions) February 1, 2023

Since the beginning of this year, the cryptocurrency markets have been stable and flashing green, which could be attributed to the Federal Reserve’s potential dovish stance.

A deal signed by DekaBank with Metaco to begin providing digital assets to institutions will have a significant impact on the crypto market, in addition to the upcoming Federal Reserve interest rate hike.

FOMC and Fed Fund Rate Ahead

The US dollar had weakened at the beginning of the trading session due to data suggesting that wage pressures had decreased, however, it later stabilized as investors anticipated the results of a Federal Reserve policy meeting.

Ringgit ends flat versus US dollar https://t.co/twLdtsO5Bd

— Malay Mail (@malaymail) January 31, 2023

The United States Federal Reserve is likely to increase interest rates by 0.25% on Wednesday, however, traders will be more focused on the press conference of Chairman Jerome Powell for clues regarding their long-term stance toward policy change.

Important dates & times to watch out for #volatility #Bitcoin #Crypto #Fed #FoMC #Stocks #Unemployment #PMI pic.twitter.com/24ZJ1NU6Ri

— CryptoFM_ 🟢 (@CryptoFM_) February 1, 2023

Despite this, the dollar index, which gauges the value of the dollar against six other major currencies, slipped 0.029% to 102.060. The market experienced a 0.16% dip in the last trading session, partly because of the news that US labor costs had risen at the slowest rate in a year during the fourth quarter.

Investors will be keeping a close eye on the decisions of the European Central Bank and the Bank of England this week. Both are likely to raise interest rates by 0.5% on Thursday, so investors should make sure they stay up-to-date with these economic events.

The constant depreciation of the US dollar was also seen as an important element that maintained elevated cryptocurrency prices.

German Bank to Provide Crypto Services

DekaBank, a 105-year-old bank with $428 billion in assets, has agreed to collaborate with Metaco to begin selling digital assets to institutions. According to a January 31 press release, DekaBank will use Metaco’s Harmonize, a platform for “custody and orchestration.”

DekaBank is the securities provider of Sparkassen-Finanzgruppe, the biggest financial services player in Europe.

— Blockworks (@Blockworks_) January 31, 2023

It wants to offer its institutional clients access to crypto.@caseywagnerr reportshttps://t.co/9H62d5HlUt

The custody platform is extremely important for DekaBank and therefore, its announcement had a huge impact on the cryptocurrency industry including Bitcoin. Metaco will be able to monitor all digital asset operations through this platform which is why the news was so significant.

Explaining The Recent Risk-On Wave In Crypto Markets

The global cryptocurrency market has maintained its bullish trend and gained additional bids around the $1.05 trillion mark due to the fact that $117 million, the highest amount since July of last year, was invested in crypto-based investment products between January 21 and 27.

Bitcoin, ethereum and other major cryptocurrencies have rocketed higher in the first month of 2023, adding $250 billion to the combined crypto market. https://t.co/UNuzwzoHAA

— Forbes (@Forbes) January 31, 2023

Additionally, the positive announcements regarding cryptocurrency regulations also had a significant impact on the crypto market sentiment. Moving forward, investors appear to be cautious about placing a strong bid until the Federal Reserve policy meeting has concluded.

Bitcoin Price

As of today, Bitcoin price is at $22,993.90 with a 24-hour trading volume of $22b. It has increased by 0.25% in the past 24 hours, placing its position at 1st on the CoinMarketCap rankings with a market capitalization of $443b.

On the 4-hour timeframe, Bitcoin is trading with no clear bias as the market awaits the Federal Open Market Committee and Federal Reserve rate decisions. Nevertheless, the immediate resistance for the BTC/USD pair remains at the $23,300 level, and a breakout above this level has the potential to take the BTC/USD pair toward the next resistance area of $23,920.

The leading technical indicators, such as the RSI and MACD, are in a sell zone, and the 50-day simple moving average is also suggesting a selling trend.

On the downside, an upward trendline is likely to support Bitcoin at $22,750, and a bearish breakout of this level could create more room for selling until $22,350.

Ethereum Price

Ethereum has seen a price of $1,572.48 today with a trading volume of $6.2 billion within the last 24 hours. It has experienced a 0.03% decrease in value since then and currently holds rank 2 on CoinMarketCap with a market cap of $192 billion.

Technical analysis suggests that Ethereum could experience a bullish reversal once it reaches the double-bottom support level of $1,540. Challenges remain on the upside as there is high resistance around the $1,600 mark. If it overcomes this obstacle, ETH could surge to around the $1,625 level.

If support at the $1,540 level fails, it could open up a further decline in price until the $1,500 mark.

Bitcoin Alternatives

CryptoNews Industry Talk has evaluated the top 15 cryptocurrencies for 2023. If you’re looking for a more promising investment opportunity, there are other alternatives to consider.

Every week, new altcoins and ICO projects are added to the list.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

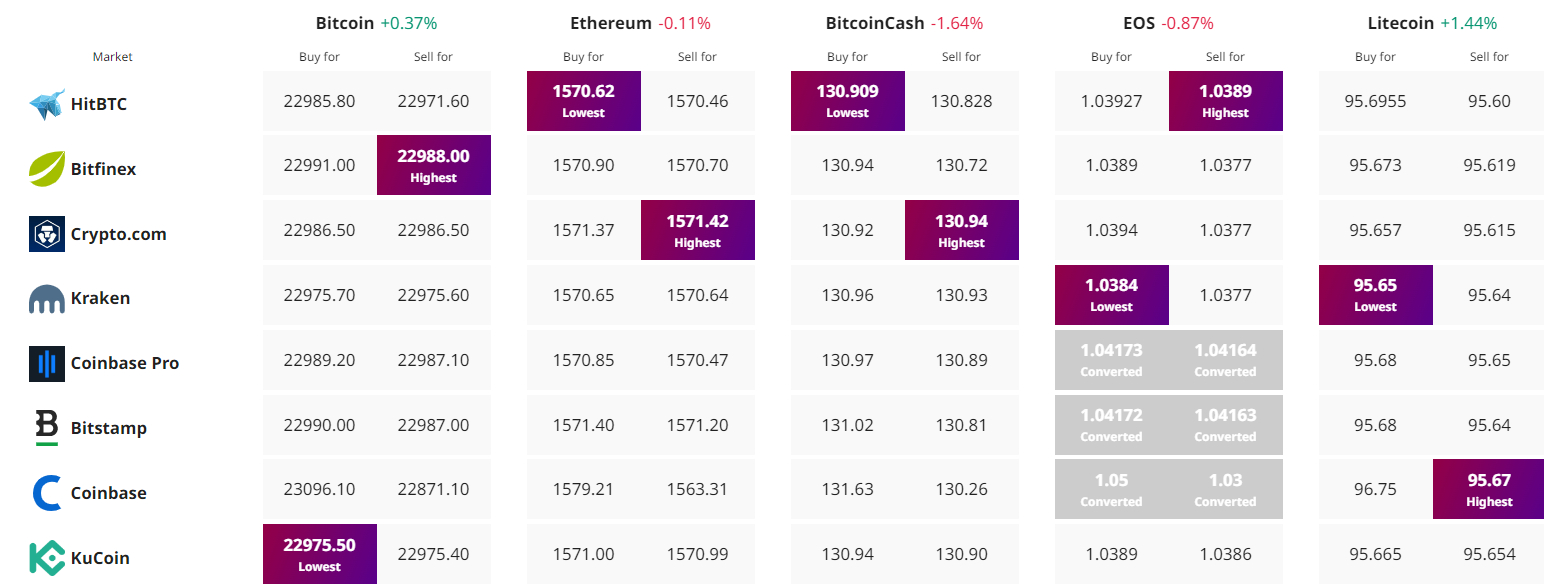

Find The Best Price to Buy/Sell Cryptocurrency