Bitcoin Price Prediction as Key Support at $26,000 Holds, Building Potential for Hidden Bullish Divergence – Time to Buy?

As Bitcoin continues to hover around the key support level of $26,000, there is growing speculation about the potential for a hidden bullish divergence in its price.

This development has caught the attention of investors and traders who are contemplating whether it is the right time to buy Bitcoin.

With the support holding strong, the market has a sense of optimism, as the potential for an upward trend emerges.

In this Bitcoin price prediction, we will analyze the current market dynamics and explore the factors that could influence its future price action.

Impact of Rising Jobless Claims on the Bitcoin Market

According to a Thursday Labor Department report, initial jobless claims rose by 28,000 to 261,000 in the week ended June 3.

This figure includes the Memorial Day holiday, which can introduce volatility in the data.

The recent surge in Americans filing new claims for unemployment benefits has raised concerns about the labor market’s health.

📈 Jobless claims spiked by 28K to 261K in the latest week, BTC could spike amid a weaker dollar? 💼 #JoblessClaims #LaborMarket #Volatility

— Arslan B. (@forex_arslan) June 8, 2023

While jobless claims rise, impacting the labor market, the effect on Bitcoin is not straightforward.

US jobless claims jumped last week to the highest level since October 2021.

— Bloomberg TV (@BloombergTV) June 8, 2023

– Applications for US unemployment benefits rose to 261,000 in the week ended June 3

– Continuing claims fell to 1.76 million in the week ended May 27 https://t.co/2v2m6NHqod pic.twitter.com/4tfJs4CTNR

Unemployment may influence consumer spending and market sentiment, potentially affecting crypto investments.

Yet, Bitcoin has shown resilience and is seen as a hedge against financial uncertainties. Investors may turn to it as a store of value during turbulent times.

Bitcoin Price

The current price of Bitcoin is $26,637, accompanied by a 24-hour trading volume of $13.8 billion.

Over the past 24 hours, Bitcoin has experienced a slight increase of approximately 0.50%. Bitcoin holds the top ranking on CoinMarketCap with a market cap of $516.6 billion.

It has a circulating supply of 19,396,306 BTC coins, out of a maximum supply of 21,000,000 BTC coins.

Bitcoin Price Prediction; BTC Finds Support and Shows Bullish Bias

Bitcoin is showing a slight bullish bias after finding support around the $26,200 level. The formation of a doji candle followed by a hammer candle suggests a potential continuation of the bullish trend as sellingt pressure weakens.

Additionally, recent jobless claims data from the US economy indicates a potential weakness in the labor market, raising concerns about a possible interest rate hike by the US Federal Reserve.

This has led to a weakening of the US dollar and consequently benefited Bitcoin’s price, which is now exhibiting a modest bullish sentiment.

On the four-hour timeframe, Bitcoin is testing the resistance level at $26,500 and could target the next level at $27,400, supported by positive market reports.

A breakout above the $27,400 level has the potential to push Bitcoin toward the next target of $28,020 or even higher.

Key technical indicators, such as the relative strength index and moving average convergence divergence, are in the buying zone, supporting the likelihood of a continued uptrend.

The 50-day exponential moving average also confirms the potential for further upward movement.

However, in the event of a breakdown below the $26,200 level, Bitcoin may find support at $25,400.

Nevertheless, the bullish outlook remains stronger. It is important to monitor the price action around the $26,200 level for potential buying opportunities.

Top 15 Cryptocurrencies to Watch in 2023

If you are seeking to participate in the initial stages of a cryptocurrency project, it is recommended to consider presale tokens as a viable option.

Cryptonews Industry Talk has compiled an extensive selection of the most prospective coins in 2023, offering valuable insights into these projects.

This curated list is consistently refreshed on a weekly basis, introducing new altcoins and ICO ventures.

It is advisable to revisit the list regularly to stay up to date with the latest additions.

Stay informed and remain attentive to discover exciting opportunities within the cryptocurrency sphere.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

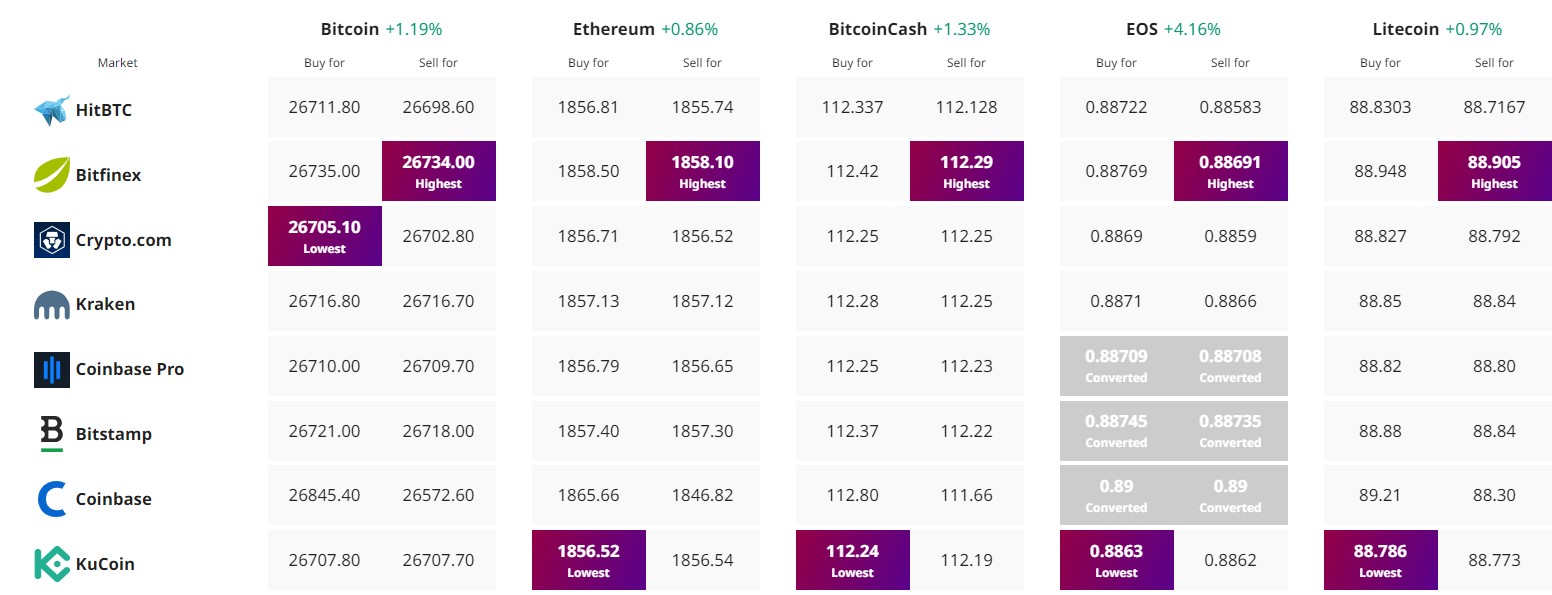

Find The Best Price to Buy/Sell Cryptocurrency