Bitcoin Price Prediction as BTC Spikes Up 2.2% – What Caused the Rally?

Bitcoin, the world’s leading cryptocurrency, has witnessed a sharp uptick in its price, surging by 2.2% in recent days. The sudden spike has reignited the discussion around Bitcoin’s future trajectory and prompted investors to reassess their positions.

In this article, we’ll examine the reasons behind the recent rally and analyze the potential implications for Bitcoin’s price in the coming days.

Kraken to Scale Back Usage of Signature Bank, According to Bloomberg Report

Crypto exchange Kraken is reportedly scaling back its usage of Signature Bank, a crypto-focused bank, for some of its critical financial operations, continuing a trend of crypto exchanges moving away from specific banks.

According to an email reviewed by Bloomberg, non-corporate Kraken clients will no longer be able to make dollar deposits or withdrawals using Signature Bank. Deposits will be phased out on March 15, followed by withdrawals on March 30. Kraken cited Signature’s revisions as the reason for the change.

🐙🏦❌ Crypto exchange Kraken is reportedly reducing its reliance on Signature Bank for major financial transactions 🤔 Bloomberg reports that Kraken is pulling back from using the crypto-focused bank. What could this mean for the industry? #Kraken #SignatureBank #cryptonews 🤔

— Arslan B. (@forex_arslan) March 1, 2023

Kraken and Signature Bank have not responded to CoinDesk’s inquiries for confirmation or additional comments. LedgerX, a crypto derivatives trading platform, also announced earlier this week that it would stop using Silvergate Bank to receive domestic wire transfers and switch to Signature Bank instead.

In December, Signature Bank announced its decision to reduce its exposure to the cryptocurrency business, though not eliminate it entirely.

Binance’s Inconsistent Claims on Lost $1.8B USDC Raise Concerns

Binance, one of the world’s largest cryptocurrency exchanges, has been under scrutiny due to inconsistent claims regarding the loss of $1.8 billion worth of USDC stablecoin. The controversy has raised concerns among investors, with many questioning the transparency and reliability of the platform.

💰🤔 Binance's inconsistent claims about losing $1.8 billion worth of USDC have left the crypto world scratching their heads 🤔🧐 Investors are questioning the transparency of the platform, and it's causing concern. What's going on? 🔍 #Binance #USDC #cryptonews #transparency 🚨

— Arslan B. (@forex_arslan) March 1, 2023

On August 17, 2022, Forbes reported that $1.78 billion in collateral allocated to support stablecoins, specifically b-USDC, which is a wrapped version of Circle’s USDC, was transferred out of Binance wallets.

I am reluctantly spending time on FUD again (4). Forbes wrote another FUD article with lots of accusatory questions, with negative spins, intentionally misconstruing facts. They referred to some old blockchain transactions that our clients have done. 1/9

— CZ 🔶 Binance (@cz_binance) February 28, 2023

According to Forbes’ analysis of the blockchain data, which Binance has not contested, $1.2 billion of this collateral was moved to trading firm Cumberland DRW, while the remaining amounts were sent to entities such as the now-defunct hedge fund Alameda Research, Tron founder Justin Sun, and crypto infrastructure and services provider Amber Group.

Economic Events to Watch on Thursday

On Thursday, March 2, there are several economic events to watch. The European Union will release its CPI Flash Estimate year-over-year, which is expected to be at 8.3% for overall CPI and 5.3% for core CPI. In the United States, the Unemployment Claims report will be released at 1:30 pm, with an expected number of 196,000 claims.

Thursday:

— Arslan B. (@forex_arslan) February 26, 2023

10am – CPI Flash Estimate y/y

10am – Core CPI Flash Estimate y/y

1:30pm – Unemployment Claims

Tentative – RBNZ Gov Orr Speaks

9pm – FOMC Member Waller Speaks#FOMC #RBNZ #CPI #UnemploymentClaims

The Reserve Bank of New Zealand Governor Orr will be speaking at an undetermined time, and FOMC Member Waller will also be speaking at 9:00 pm. These events may have an impact on the financial markets and should be closely monitored by investors.

Bitcoin Price

As of now, Bitcoin‘s price stands at $23,411 and its 24-hour trading volume is $24.9 billion. CoinMarketCap currently ranks Bitcoin first with a live market cap of $451 billion. The total quantity of BTC coins is 21,000,000, with a circulating supply of 19,305,393 BTC coins.

On the 4-hour chart, Bitcoin encountered resistance at the crucial level of $23,750, which it struggled to break. As a result, the BTC price saw a bearish correction and may drop toward the support level of $22,800. If this support level fails to hold, the next level of support could be found around $22,150.

Despite the oversold condition of the BTC/USD pair, there is a possibility of a rebound if this condition persists. This could result in Bitcoin breaking through the resistance level of $23,500 and potentially reaching a price of $24,250.

Bitcoin Alternatives

For investors who are interested in buying Bitcoin, it may be worthwhile to explore other options that offer greater growth potential in the short term. Cryptonews has conducted an in-depth analysis of the top 15 cryptocurrencies that investors should consider for 2023. Click below to learn more.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

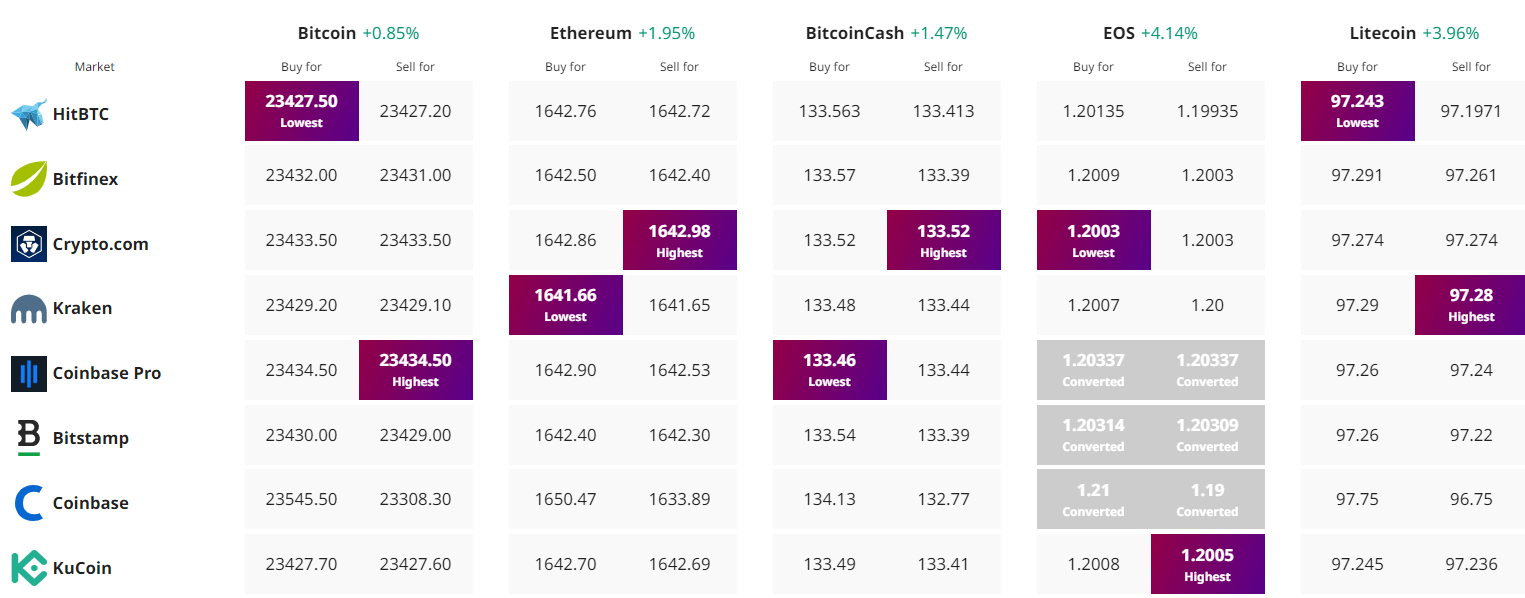

Find The Best Price to Buy/Sell Cryptocurrency