Bitcoin Price Prediction as BTC Bounces Up from $25,800 Support Level – Where is the Next BTC Target?

As Bitcoin experienced a bounce-back from the $25,800 support level, investors are eagerly anticipating the next move for the leading cryptocurrency.

With market sentiment shifting, experts are now examining the potential price targets and forecasting Bitcoin’s trajectory in the near future.

Stay tuned to discover the latest insights on Bitcoin’s price prediction and where it may be headed next.

Bitcoin is trading at 26,829, increasing by 1.88% on Saturday. After declining for 8 consecutive sessions, BTC/USD prices finally started to recover losses mainly because of price correction.

Fidelity Investment’s Director Highlights Bitcoin’s Impressive Rally

Jurrien Timmer, the Global Macro Director of Fidelity Investments, suggests that Bitcoin is now closely aligned with gold, but he warns of a potential overvaluation around the $30,000 level.

Timmer’s analysis reveals two negative correlations: one between Bitcoin and the two-year real TIPS yield at 88%, and the other at 63% between Bitcoin and the PCE-derived real rate.

JUST IN – Fidelity Director of Global Macro: "#Bitcoin is an aspirational high-powered inflation hedge." 👀 pic.twitter.com/Fw8DKyZDsL

— Bitcoin Magazine (@BitcoinMagazine) May 12, 2023

Drawing from data since 2018, this correlation study compares Bitcoin to gold in terms of their response to actual rate factors. Timmer also highlights Bitcoin’s role as a powerful inflation hedge, akin to gold.

According to Michael Saylor, Bitcoin’s Importance Lies in Its Ownership by Individuals

According to Michael Saylor, the Executive Chairman of MicroStrategy, one of the reasons individuals acquire Bitcoin is because they consider it a moral obligation and a vital asset for society.

Saylor argues that traditional money is in a state of decline and highlights instances of financial turmoil in Africa, South America, and Asia.

Even well-established fiat currencies are facing uncertain futures, according to Saylor. He believes that banks and fiat currencies are losing public trust due to increasing inflation and a crisis of confidence.

People Own Bitcoin Because It Is Essential, Says Michael Saylor – https://t.co/nPHe0DmA9h #saylor #michaelsaylor https://t.co/sT0Y94sbUL

— Saylor News ⚡️ (@saylor_news) May 12, 2023

Saylor believes that people are embracing commodity money due to their diminishing trust in conventional fiat currencies.

He argues that commodities like gold, oil, and property are not sufficiently adaptable for everyday transactions compared to alternative options.

Therefore, Bitcoin serves as a commodity that is essential for all types of transactions and provides a solution to the world’s growing financial challenges.

These remarks from Saylor helped Bitcoin regain some of its previous losses on Saturday.

Decline in Bitcoin Liquidity on Binance

According to Aubert, an analyst from Kaiko, the liquidity of Bitcoin on Binance has significantly decreased since the beginning of February, dropping from approximately $45 million to $16 million in early May.

The discontinuation of Binance’s 10-month zero-fee campaign for 13 BTC pairings was the primary reason behind the decline in liquidity, leading market makers to exit the platform.

JUST IN:

— Whale (@WhaleChart) May 12, 2023

Bitcoin liquidity on #Binance has more than halved since february per Kaiko

Aubert further noted that the monthly trading volumes for the most popular pair, BTC-USDT, decreased from $16 billion in March to $2 billion in April.

The drying up of liquidity has been particularly noticeable after the wave of bank collapses earlier this year, affecting various businesses including Ripple, Circle, Yuga Labs, and others due to the failure of important industry on-ramps such as Silicon Valley Bank and Silvergate.

Bitcoin’s Price Dips Below $27K Amidst Meme Mania and Binance Congestion

Bitcoin, the leading cryptocurrency by market cap, experienced a decline of over 6% in the past day, falling below the $27,000 mark.

This drop occurred as investors contemplated the rising popularity of the PEPE meme coin and the temporary suspension of Bitcoin withdrawals on Binance due to congestion issues.

Bitcoin Falls Below $27.5K as Investors Weigh Meme Mania, Binance Congestion Issues

— Wen3 🚀 (@Wen3_AI) May 8, 2023

Ether’s deflationary narrative continues despite Monday’s price drop. Major crypto assets traded down on Monday.

Source: CoinDesk

After Binance restored its service the following day, the disruptions and the surging price of bitcoin raised worries about the implications of a high volume of bitcoin transactions.

The reduced availability of bitcoins for short-term trading, as more are being held for longer durations, could potentially result in increased volatility or higher trading costs due to wider spreads.

With a fixed supply of bitcoins, there are fewer coins available for public sale. In the event of increased demand for bitcoin, this could exert upward pressure on prices.

Bitcoin Price

Bitcoin is currently priced at $26,800, and from a technical standpoint, it has discovered support near the $26,300 mark, effectively pausing its decline.

With the breach of the $26,800 support level on the four-hour chart, it now becomes a potential barrier for Bitcoin, acting as a resistance level.

📊 #Bitcoin technical update: Found support at $26,300 after halting downward trend. $26,800 now potential resistance. RSI and MACD oversold, indicating bullish rebound above $26,000. Watch $27,500 and $28,400 as resistance levels. #Crypto #BTC pic.twitter.com/ee66xAhU21

— Arslan B. (@forex_arslan) May 12, 2023

The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), important technical indicators, currently show oversold conditions. This suggests that if Bitcoin maintains a level above $26,000, there is a strong possibility of a bullish recovery towards $27,800 or $27,500.

However, it’s important to note that the 50-day Exponential Moving Average (EMA) poses a significant resistance barrier around $27,500, indicating that the bearish sentiment still remains.

It is important to monitor the $26,000 level as a critical pivot point for Bitcoin.

If Bitcoin manages to stay above this level, it could potentially test the next resistance levels at $27,500 or $28,400.

On the other hand, if the downward trend continues, the next support is expected to be around the 50% Fibonacci retracement level of $25,300.

Top 15 Cryptocurrencies to Watch in 2023

The team at Cryptonews Industry Talk has compiled a selection of highly promising cryptocurrencies for 2023. These cryptocurrencies exhibit significant growth potential in both the short and long term..

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

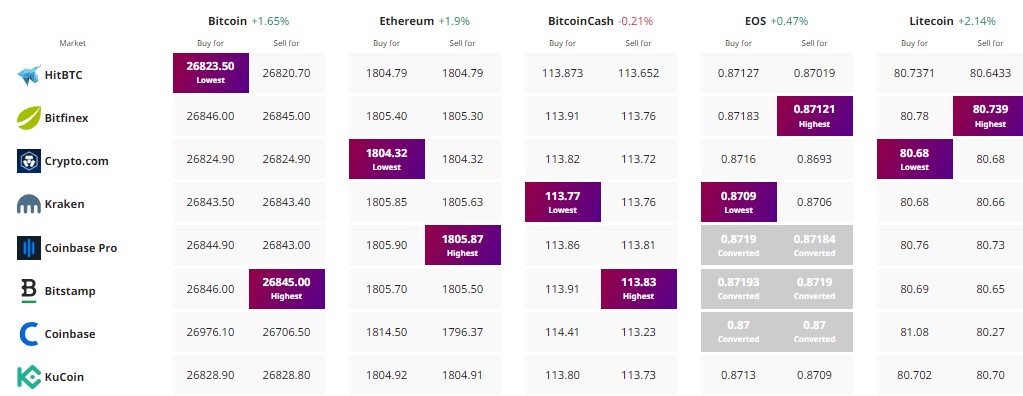

Find The Best Price to Buy/Sell Cryptocurrency